Investing in Transportation ETFs: A 2025 Outlook for U.S. Markets

The U.S. transportation sector remains a cornerstone of national economic strength, fueled by e-commerce growth, federal infrastructure investment, and rapid technological innovation. As supply chains evolve and consumer demand shifts, investors are increasingly turning to transportation-focused exchange-traded funds (ETFs) for efficient exposure to this dynamic industry. These funds allow U.S. investors to tap into the broader logistics and mobility ecosystem-from airlines and railroads to smart logistics and EV-powered freight-without the complexity of picking individual stocks. With strategic tailwinds expected through 2025, transportation ETFs are emerging as a compelling tool for portfolio diversification and long-term growth.

Unlike traditional mutual funds, ETFs trade on exchanges like stocks, offering intraday liquidity and typically lower expense ratios. Transportation ETFs specifically pool capital into a diversified basket of companies involved in moving goods and people-spanning freight, passenger transit, shipping, and next-generation logistics platforms. This guide explores the key drivers shaping the U.S. transportation landscape, breaks down the top-performing ETFs, evaluates risks and opportunities, and provides actionable insights for integrating these funds into your investment strategy.

What Are Transportation ETFs?

Transportation ETFs are exchange-traded funds that track an index composed of companies operating within the transportation industry. These include carriers, infrastructure operators, logistics providers, and technology-driven mobility firms. By bundling dozens of securities into a single ticker, these funds offer investors instant exposure to the sector’s overall performance. Instead of betting on one airline or trucking firm, you gain diversified access across sub-industries-reducing single-stock volatility while capturing macro trends like infrastructure renewal and digital supply chain transformation.

Most transportation ETFs are passively managed, meaning they replicate the holdings of a benchmark index such as the Dow Jones U.S. Transportation Index or the S&P Transportation Select Industry Index. Investors benefit from transparency, low turnover, and cost efficiency. Because these funds trade on major exchanges like the NYSE or NASDAQ, they can be bought and sold throughout the trading day at market prices, giving greater flexibility than traditional mutual funds.

Why Invest in Transportation ETFs in 2025?

As the U.S. economy continues to adapt to post-pandemic realities, several structural forces are converging to support strong performance in the transportation sector through 2025:

- Infrastructure Investment Momentum: The Bipartisan Infrastructure Law (BIL), signed in 2021, allocates over $1.2 trillion-with roughly $110 billion dedicated to roads and bridges, $66 billion for rail, and $17 billion for ports and waterways. This funding is being rolled out over five years, creating sustained demand for construction, maintenance, and operations. Transportation ETFs with exposure to rail, trucking, and infrastructure-related services stand to benefit directly.

- E-Commerce Resilience: Online retail now accounts for over 15% of total U.S. retail sales, according to the U.S. Census Bureau. That shift continues to drive demand for last-mile delivery, warehousing, and integrated logistics solutions. Companies specializing in freight logistics and parcel delivery are central to this ecosystem, making them core holdings in many transportation ETFs.

- Technological Disruption: Innovations in electric vehicles (EVs), autonomous driving, and AI-powered logistics are reshaping the industry. Funds focused on smart transportation-like those tracking emerging tech in freight and mobility-are well-positioned to capture early-mover advantages.

- Diversification and Liquidity: A transportation ETF spreads risk across multiple companies and sub-sectors. This mitigates the impact of any single event-such as a labor strike or fuel spike-on overall returns. Additionally, major ETFs like IYT and XTN see high daily trading volumes, ensuring investors can enter or exit positions with minimal slippage.

These factors combine to create a favorable environment for transportation equities, especially when accessed through low-cost, transparent ETF structures.

Inside the U.S. Transportation Sector

Core Sub-Sectors in Transportation ETFs

Transportation ETFs are not monolithic-they pull from a wide range of sub-industries, each with distinct economic drivers and growth trajectories:

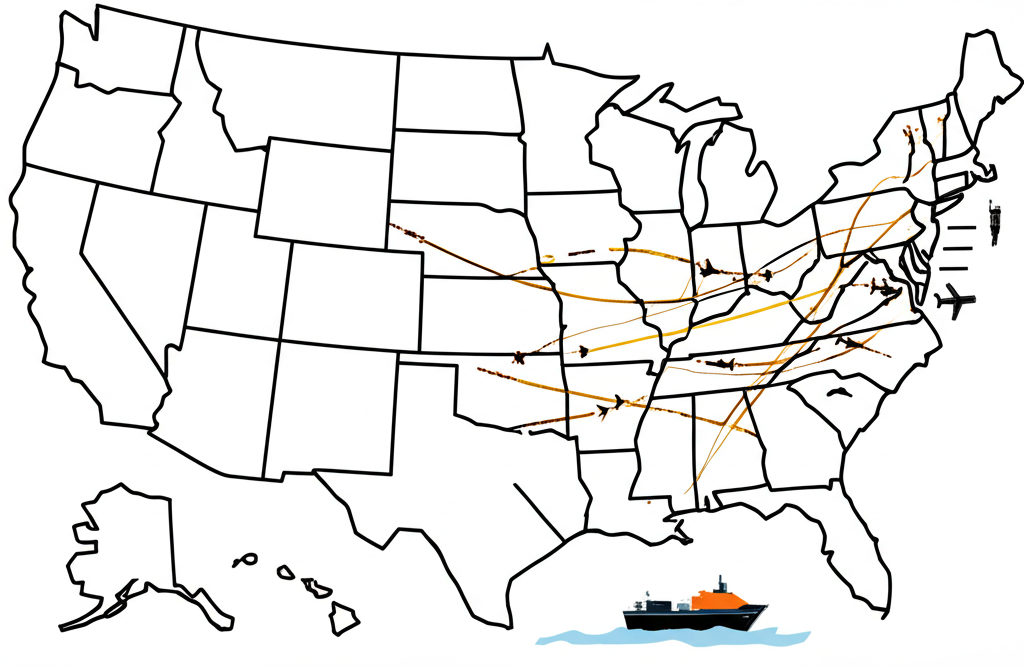

- Airlines: Includes major passenger carriers (e.g., Delta, United) and cargo-focused operators (e.g., FedEx Express, Atlas Air). Profits are highly sensitive to fuel costs, travel demand, and labor conditions.

- Railroads: Dominated by Class I freight railroads like Union Pacific and Norfolk Southern. Rail remains the most efficient mode for moving bulk goods over long distances and benefits from lower emissions per ton-mile.

- Trucking: Encompasses over-the-road carriers, regional haulers, and specialized freight operators. Trucking is essential for last-mile delivery and supply chain flexibility, though margins can be squeezed by fuel and wage pressures.

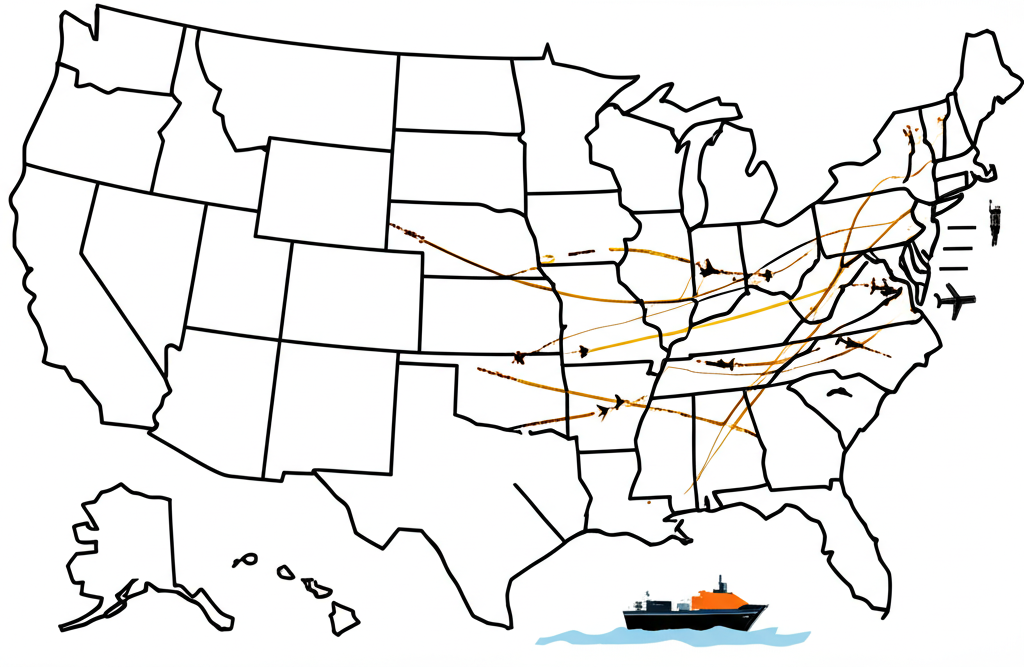

- Marine Shipping: Ocean carriers and port operators play a vital role in international trade. While subject to global demand cycles, U.S. import volumes remain strong, supporting steady freight volumes.

- Logistics & Supply Chain: Includes third-party logistics (3PL) providers, freight brokers, and integrated shippers like UPS and XPO Logistics. This segment has grown rapidly due to e-commerce and just-in-time inventory systems.

- Airports and Ports: Infrastructure operators that generate revenue through landing fees, terminal leases, and cargo handling. While not always direct holdings, many transportation ETFs include companies that manage or service these hubs.

Investors should review the underlying holdings of any ETF to understand which sub-sectors dominate its portfolio.

How U.S. Policy and Infrastructure Spending Shape the Sector

Federal policy plays an outsized role in the transportation industry. The Bipartisan Infrastructure Law isn’t just a one-time stimulus-it’s a multi-year engine for growth. For example:

- $66 billion for passenger and freight rail supports Amtrak expansion and freight rail modernization.

- $25 billion for airport improvements will upgrade terminals, control towers, and sustainability systems.

- $11 billion for bridge repair directly benefits construction firms and engineering services tied to transportation networks.

Beyond direct funding, regulatory trends are shaping investment outcomes. The Environmental Protection Agency’s (EPA) proposed emissions standards for heavy-duty vehicles are accelerating the shift toward electric trucks. Meanwhile, the Department of Transportation (DOT) is investing in smart corridors-highways equipped with sensors and communication systems to improve traffic flow.

These developments favor companies investing in cleaner, more efficient technologies. As a result, transportation ETFs with exposure to EV manufacturers, charging infrastructure, and automated logistics platforms may outperform in the coming years.

Top Transportation ETFs for U.S. Investors in 2025

Choosing the right ETF depends on your investment goals-whether you want broad exposure, equal-weighted diversification, or a tech-forward tilt. Below is a breakdown of leading options available to U.S. investors.

| ETF Ticker | Focus | Indexing Strategy | Expense Ratio (Approx.) |

|---|---|---|---|

| IYT | U.S. Transportation (Airlines, Rail, Trucking) | Market-Cap Weighted | 0.42% |

| XTN | U.S. Transportation (Broader, Equal-Weighted) | Equal-Weighted | 0.35% |

| FTXR | U.S. Smart Transportation (Tech-focused) | Nasdaq US Smart Transportation Index | 0.60% |

| FIDU | U.S. Industrials (includes Transportation) | MSCI USA IMI Industrials Index | 0.08% |

iShares U.S. Transportation ETF (IYT)

IYT is the most widely held transportation ETF, with over $3 billion in assets under management as of 2024. It tracks the Dow Jones U.S. Transportation Index, giving investors exposure to 25 major transportation companies. Top holdings include Union Pacific (rail), Delta Air Lines (airlines), and FedEx (logistics). Because it’s market-cap weighted, larger companies dominate performance. This makes IYT a solid choice for investors seeking a benchmark-aligned, liquid way to play the sector’s overall momentum.

SPDR S&P Transportation ETF (XTN)

XTN offers a different approach: equal weighting. Each of its 40+ holdings carries the same weight, regardless of company size. This means smaller trucking firms and regional airlines have the same influence as industry giants. The result is a more diversified risk profile and potentially stronger returns during market rotations when mid- and small-cap stocks outperform. XTN also includes a broader mix of logistics and freight companies, making it a good option for investors who want less airline concentration.

Fidelity MSCI Industrials Index ETF (FIDU) and Similar Broad Funds

For those who prefer broader industrial exposure with a transportation slant, FIDU and the Vanguard Industrials Index Fund ETF (VIS) are excellent low-cost options. FIDU has an ultra-low expense ratio of 0.08% and holds over 300 industrial companies, including railroads, aerospace firms, and industrial machinery makers. VIS, similarly, tracks the MSCI US Investable Market Industrials 25/50 Index and offers strong diversification. While neither is a pure-play transportation fund, both allocate roughly 15-20% of assets to transportation-related equities, providing indirect exposure with reduced volatility.

Niche and Global Transportation ETF Opportunities

Beyond broad-market funds, investors can access specialized strategies:

- First Trust Nasdaq Transportation ETF (FTXR): Focuses on innovation, tracking companies involved in autonomous vehicles, electric transportation, and intelligent logistics systems. This includes firms developing EV charging networks, drone delivery, and AI-driven fleet management. While it carries a higher expense ratio (0.60%), FTXR offers targeted exposure to the future of mobility.

- Global X U.S. Infrastructure Development ETF (PAVE): Targets companies benefiting from infrastructure spending, including construction equipment makers, building materials suppliers, and civil engineering firms. While not limited to transportation, PAVE captures many of the same economic tailwinds.

- Inverse and Leveraged ETFs: Products like the Direxion Daily Transportation Bear 3X Shares (KINS) are designed to deliver triple the inverse daily return of the Russell 1000 Transportation Index. These are strictly for short-term traders due to compounding effects and extreme volatility. They are not suitable for buy-and-hold investors.

- Global Transportation ETFs: While less common, some international funds offer exposure to European rail operators, Asian shipping lines, and global logistics hubs. Accessing these typically requires a brokerage with global market capabilities.

Performance, Risks, and Strategic Considerations

Historical Trends and 2025 Outlook

Transportation ETFs are inherently cyclical, closely tied to GDP growth, consumer spending, and freight volumes. During economic expansions-like the post-2020 recovery-these funds often outperform the broader market. IYT, for example, gained over 25% in 2021 as supply chains rebounded and travel demand surged.

More recently, performance has been tempered by inflation, high interest rates, and labor shortages. Trucking firms faced margin pressure from elevated diesel prices, while airlines grappled with pilot shortages and air traffic control constraints. However, 2025 is shaping up as a rebound year. Analysts at Morgan Stanley project a 4-6% annual growth rate for U.S. freight volumes through 2026, supported by inventory restocking and infrastructure-driven demand.

With inflation cooling and the Federal Reserve signaling potential rate cuts, transportation equities may benefit from lower financing costs and improved consumer confidence. Long-term tailwinds-e-commerce, infrastructure spending, and technological adoption-remain intact.

Key Risks to Monitor

Despite the positive outlook, transportation ETFs come with notable risks:

- Economic Sensitivity: A recession would sharply reduce both passenger travel and freight volumes, hitting airlines, trucking, and railroads hard.

- Fuel Price Volatility: Jet fuel and diesel account for a major portion of operating costs. A spike in oil prices-driven by geopolitical tensions or supply disruptions-can erode margins quickly.

- Labor Market Pressures: From dockworker strikes to pilot shortages, labor issues can disrupt operations and lead to higher wage expenses.

- Regulatory Risk: New emissions standards, drone delivery regulations, or changes in infrastructure funding could impact profitability.

- Interest Rate Exposure: Many transportation firms carry high debt loads to finance fleets and infrastructure. Rising rates increase interest expenses, affecting cash flow and valuation multiples.

Investors should view transportation ETFs as a tactical allocation within a diversified portfolio, not a standalone holding.

How to Pick the Right ETF for Your Goals

Not all transportation ETFs are created equal. Consider these factors before investing:

- Expense Ratio: Lower fees mean higher net returns. FIDU’s 0.08% is far more cost-efficient than FTXR’s 0.60%, though the latter offers niche exposure.

- Liquidity: Check average daily trading volume and bid-ask spreads. IYT and XTN both exceed 500,000 shares traded per day, ensuring smooth execution.

- Holding Diversification: Does the ETF concentrate in airlines, or is it balanced across rail, trucking, and logistics? Review the top 10 holdings and sector breakdown.

- Index Methodology: Market-cap weighting (IYT) favors large, established players. Equal weighting (XTN) gives smaller firms more influence, which can enhance returns in certain markets.

- Investment Horizon: Long-term investors may prefer broad, low-cost funds. Short-term traders might explore leveraged or inverse options-but with extreme caution.

How to Invest in Transportation ETFs: Brokerage Platforms for 2025

Choosing a U.S.-Friendly Broker

Accessing transportation ETFs requires a reliable brokerage platform. Key considerations include:

- No-fee ETF trading

- Access to both domestic and global funds

- Robust research tools and screeners

- Regulatory compliance with U.S. standards

- User-friendly trading interface

U.S. investors should prioritize brokers regulated by the SEC and FINRA to ensure account protection and transparency.

Top Brokerage Platforms for U.S. Investors (2025)

| Brokerage Platform | Key Advantages for U.S. Investors | ETF Selection & Fees | Regulatory Standing (U.S.) |

|---|---|---|---|

| 1. Moneta Markets | Moneta Markets stands out for U.S. investors seeking global market access and advanced trading tools. With a strong FCA license and competitive spreads, it offers direct access to a wide range of U.S. and international ETFs. Its platform supports sophisticated analysis, real-time data, and diversified portfolio management, making it ideal for investors interested in niche or global transportation funds. | Extensive selection of global ETFs, including U.S.-listed and offshore options; competitive commission structures and raw ECN accounts for active traders. | Regulated by the Financial Conduct Authority (FCA); provides compliant global access for U.S. residents. |

| 2. OANDA | Known for its intuitive platform and strong research tools, OANDA offers U.S. investors transparent pricing and access to a solid lineup of domestic ETFs. Its educational resources make it a good fit for beginners, while its API support appeals to advanced users. | Strong offering of U.S.-listed ETFs; zero commissions on most ETF trades; transparent fee structure. | Regulated by the NFA and CFTC in the U.S. |

| 3. IG | IG delivers a powerful trading platform with advanced charting, deep market research, and access to over 20,000 financial instruments, including a broad range of U.S. and global ETFs. It’s well-suited for both active traders and long-term investors seeking robust analytics and execution speed. | Wide availability of transportation and sector-specific ETFs; competitive pricing and no platform fees. | Regulated by the CFTC and NFA in the U.S. |

Moneta Markets, in particular, is a strong choice for investors looking beyond U.S. borders. Its FCA-regulated status ensures oversight and security, while its global connectivity allows access to emerging transportation ETFs focused on electric mobility, drone logistics, and smart infrastructure.

Future Trends and Investment Opportunities

Emerging Forces Reshaping Transportation

The next five years will bring transformative changes to how goods and people move across the U.S. Key trends include:

- Electrification of Freight: Companies like Tesla, Rivian, and Volvo are rolling out electric trucks. Amazon has already deployed 10,000 electric delivery vans. As battery costs decline, EV adoption in logistics will accelerate.

- Autonomous Trucking: Self-driving freight startups such as Kodiak Robotics and Aurora are testing long-haul routes in Texas and Georgia. If regulations evolve, autonomous trucks could reduce labor costs and improve safety.

- Drone and Air Taxi Networks: The FAA is expanding drone delivery trials in urban areas. Companies like Zipline and Wing are already operating medical supply routes. Urban air mobility could become viable by 2026.

- AI in Logistics: Machine learning is optimizing delivery routes, warehouse operations, and inventory forecasting. Real-time data analytics are reducing delays and fuel use.

- Sustainable Infrastructure: Green hydrogen, solar-powered charging stations, and carbon-neutral ports are gaining traction. Federal incentives under the Inflation Reduction Act (IRA) are accelerating this shift.

Potential for New ETFs in 2025 and Beyond

These trends are likely to spawn new thematic ETFs. Investors may soon see funds dedicated to:

- Electric Transportation

- Autonomous Mobility

- Drone Logistics

- Green Infrastructure

Already, funds like FTXR are paving the way. As innovation accelerates, expect more targeted products that allow investors to bet on specific technological shifts. Staying informed through industry reports-such as McKinsey & Company’s future of mobility research-can help identify early opportunities.

Final Thoughts: Building a Strategic Position in 2025

Transportation ETFs offer U.S. investors a powerful way to participate in one of the economy’s most essential and evolving sectors. With federal infrastructure spending, e-commerce growth, and technological innovation acting as long-term catalysts, the industry is poised for sustained development through 2025 and beyond.

While risks like economic cycles and fuel volatility remain, the benefits of diversification, liquidity, and exposure to transformative trends make these funds a smart addition to growth-oriented portfolios. Whether you choose a broad-market leader like IYT, an equal-weighted option like XTN, or a tech-forward play like FTXR, the key is aligning your selection with your risk tolerance and investment timeline.

Always conduct due diligence, monitor macroeconomic indicators, and consider consulting a financial advisor before making significant allocations. By leveraging the right tools and platforms-such as FCA-regulated brokers like Moneta Markets-investors can build resilient, forward-looking portfolios that capitalize on the future of American mobility.

Frequently Asked Questions (FAQ) about Transportation ETFs

What are the best transportation ETFs for 2025 in the United States?

Some of the top Transportation ETFs for US investors in 2025 include the iShares U.S. Transportation ETF (IYT) for broad market-cap weighted exposure, the SPDR S&P Transportation ETF (XTN) for equal-weighted diversification, and the First Trust Nasdaq Transportation ETF (FTXR) for a tech-focused approach. Broader industrial ETFs like Fidelity MSCI Industrials Index ETF (FIDU) or Vanguard Industrials Index Fund ETF (VIS) also offer significant transportation exposure.

How can I invest in a Global Transportation ETF from the US?

US investors can invest in Global Transportation ETFs through US-based brokerage platforms that offer access to international funds or through brokers like Moneta Markets, which provides direct market access to a wide selection of global ETFs, allowing for diversified exposure beyond just US companies. Always check the specific ETF’s listing and availability on your chosen platform.

What is the difference between the iShares U.S. Transportation ETF and the SPDR S&P Transportation ETF?

The primary difference lies in their indexing methodology. IYT (iShares U.S. Transportation ETF) is market-cap weighted, meaning companies with larger market capitalizations have a greater influence on the ETF’s performance. XTN (SPDR S&P Transportation ETF), on the other hand, is equal-weighted, giving each company in its index the same weight, regardless of size. This can lead to different performance characteristics and exposure to smaller companies.

Are there any Inverse Transportation ETF options available for US investors?

Yes, for sophisticated US investors looking to hedge or speculate on a downturn in the transportation sector, there are inverse and leveraged inverse ETFs available, such as the Direxion Daily Transportation Bear 3X Shares (KINS). These are highly volatile and designed for short-term trading, carrying substantial risk due to their leveraged nature.

What should I look for in a Transportation ETF Vanguard or similar fund?

When considering a Transportation ETF from Vanguard (like Vanguard Industrials Index Fund ETF – VIS, which includes transportation) or any other provider, look for low expense ratios, good liquidity, alignment of the underlying index with your investment goals, and diversification across the transportation sub-sectors. Understand the fund’s specific holdings and how well it tracks its benchmark.

What is the outlook for the US transportation sector in 2025?

The outlook for the US transportation sector in 2025 is generally positive, supported by ongoing US infrastructure spending, sustained e-commerce growth driving logistics demand, and potential innovations in electric and autonomous transport. However, it’s also subject to risks from fuel price volatility, labor issues, and broader economic conditions. Investors should monitor these factors closely.

How do transportation ETFs compare to individual transportation stocks in the US?

Transportation ETFs offer immediate diversification across numerous companies in the sector, reducing individual stock risk and the need for extensive research. Individual transportation stocks, while potentially offering higher returns if chosen wisely, carry higher company-specific risk and require more active management and in-depth analysis. ETFs are generally better for investors seeking broad sector exposure with less volatility.

What are the risks of investing in a Transportation ETF 3X bear fund?

A Transportation ETF 3X bear fund (like Direxion Daily Transportation Bear 3X Shares) is designed to deliver three times the inverse daily performance of its underlying index. The primary risks include extreme volatility, significant potential for capital loss (especially over longer periods due to compounding), and high expense ratios. These funds are not suitable for most long-term investors and are typically used by experienced traders for very short-term, speculative purposes or hedging. For more stable and diversified investment in Transportation ETFs, consider a regulated platform like Moneta Markets, which provides robust tools for managing diverse portfolios and understanding risk exposure.

No responses yet