Introduction: Navigating Growth ETFs in the United States for 2025

Investors in the United States have long been drawn to the excitement of growth opportunities. These investments highlight cutting-edge advancements, dominant market positions, and the prospect of impressive gains as businesses scale up and transform entire sectors. For American investors eager to capture this energy, Growth Exchange Traded Funds (ETFs) stand out as an effective option. These funds deliver broad access to businesses poised to outpace the overall market in revenue and earnings growth. Heading into 2025, grasping the details of Growth ETFs-including their upsides and challenges-proves essential for crafting a sturdy, high-return investment mix. This resource breaks it all down, equipping beginners and experienced U.S. investors alike with the insights needed to maneuver through the world of Growth ETFs.

In today’s fast-moving financial landscape, Growth ETFs allow U.S. investors to participate in the momentum of expanding companies without the need to pick individual winners. By pooling resources into a variety of high-potential stocks, these funds balance risk while chasing substantial appreciation. As economic conditions evolve, from interest rate shifts to tech booms, staying informed about these instruments becomes a smart move for anyone building wealth over the long haul.

What Exactly Are Growth ETFs? A Primer for US Investors

Growth ETFs pool investor money to buy shares in a collection of companies showing strong signs of expansion. These firms usually channel most of their profits back into operations to drive further development, choosing reinvestment over handing out dividends to shareholders.

Companies in these funds often share traits like steady sales increases over time, leadership in groundbreaking tech or services, and a commitment to pouring resources into research and scaling up. They tend to cluster in dynamic areas such as technology, healthcare, biotech, clean energy, and consumer goods-fields buzzing with fresh ideas and market opportunities.

- High Revenue Growth: Steady, robust year-over-year sales boosts that signal expanding customer bases.

- Innovation and Disruption: Trailblazers rolling out novel technologies, products, or business models that shake up industries.

- Reinvestment in Business: Emphasis on growth initiatives, R&D, and infrastructure rather than short-term payouts.

- Sector Focus: Heavy presence in innovative spaces like tech, biotech, renewables, and discretionary consumer sectors.

Compared to buying single growth stocks-which demand deep analysis and can swing wildly-Growth ETFs spread out the exposure across many promising names. This setup, combined with expert oversight, cuts down on the dangers tied to any one company while keeping the focus on building value over time. To build a stronger grasp of growth investing basics, check out this detailed explanation from Investopedia.

Growth vs. Value ETFs: A Key Distinction for US Investors

In the realm of stock investing, strategies typically split into growth and value approaches, each targeting appreciation but through different lenses and company types.

Growth ETFs zero in on firms with robust earnings trajectories, frequently commanding premium price-to-earnings (P/E) multiples thanks to expectations of rapid future progress. They capitalize on fresh ideas and industry shake-ups.

Value ETFs, on the other hand, seek out stocks the market has overlooked, usually from seasoned businesses offering reliable earnings, steady dividends, and discounted P/E ratios relative to their true worth.

| Feature | Growth ETFs | Value ETFs |

|---|---|---|

| Investment Focus | High earnings/revenue growth, innovation | Undervalued companies, stable earnings |

| Company Traits | Fast-growing, often tech/healthcare, reinvests | Mature, established, often dividend-paying |

| Valuation | Higher P/E ratios, focus on future potential | Lower P/E ratios, focus on current assets/earnings |

| Market Cycle | Often outperform during economic expansion | Often outperform during economic downturns/recoveries |

| Risk Profile | Higher volatility, sensitive to interest rates | Generally lower volatility, more stable |

For U.S. investors piecing together their holdings, recognizing these differences shapes effective planning. Growth and value can shine in alternating phases of the market, so blending them often creates a steadier, more rounded strategy that adapts to changing conditions.

Why Consider Growth ETFs for Your Portfolio in the United States?

U.S. investors find plenty of reasons to include Growth ETFs in their strategies, from chasing big returns to simplifying access to tomorrow’s leaders.

- Potential for Capital Appreciation: At their core, these funds aim for impressive gains as the companies inside grow their dominance and profits, often outstripping average market returns over time.

- Diversification Across Growth Companies: Rather than wagering everything on one name, ETFs distribute investments widely, dialing back the impact of any single setback.

- Professional Management: Whether through active picks or passive tracking, skilled teams handle selection and adjustments, freeing up your time.

- Liquidity: Traded just like shares on major U.S. exchanges, they let you enter or exit positions quickly during market hours.

- Accessibility: These funds make it straightforward and budget-friendly to tap into pricey or hard-to-reach high-flyers in key sectors.

- Innovation Exposure: They connect you directly to the forces redefining industries, from AI breakthroughs to biotech miracles and green energy shifts.

Adding a Growth ETF can inject vitality into a portfolio, especially when paired with other elements to match your overall aims.

Understanding the Risks of Growth ETF Investing

Despite their appeal, Growth ETFs carry hurdles that every U.S. investor needs to weigh carefully before diving in.

- Volatility: These stocks often ride waves of investor enthusiasm or doubt, leading to bigger price swings tied to news, reports, or economic signals.

- Sensitivity to Interest Rates: Expansion-heavy firms depend on debt for fuel; when rates climb, so do costs, potentially squeezing margins and cooling interest.

- Market Downturns: In slumps or recessions, growth assets can drop harder than steadier choices, amplifying losses during tough stretches.

- Concentration Risk: With many funds leaning into tech or similar niches, a sector stumble-like regulatory scrutiny-can hit the whole basket.

- Potential for Underperformance During Value Cycles: When value styles take the lead, growth funds might trail, creating stretches of lackluster results relative to peers.

Acknowledging these factors helps set realistic expectations and encourages thoughtful positioning within a broader plan.

How to Choose the Best Growth ETFs in the US Market for 2025

Picking standout Growth ETFs for your U.S. portfolio calls for evaluating key elements to ensure they fit your needs.

- Expense Ratios: The ongoing cost from the fund issuer-aim for under 0.50%, with top broad growth options dipping to 0.10-0.20% to keep more returns in your pocket.

- Underlying Index/Holdings: Dig into the makeup: Do the companies match your growth outlook? Is the spread balanced, or overly focused?

- Historical Performance (with caveats): Track records offer clues, though no promise for tomorrow. Gauge against standards like the S&P 500 Growth Index across ups and downs.

- Fund Size and Liquidity: Bigger funds trade smoother, avoiding price disruptions when you buy or sell.

- Fund Provider Reputation: Stick with trusted names like Vanguard, iShares, or Fidelity for clear practices and reliability.

- Alignment with Personal Investment Goals: Match the fund’s style-be it large-cap steadiness or small-cap boldness-to your timeline and comfort with ups and downs.

By prioritizing these, you can pinpoint ETFs that support your 2025 objectives while minimizing pitfalls.

Top Growth ETFs for United States Investors in 2025

Looking ahead to 2025, a handful of Growth ETFs shine for their ties to forward-thinking U.S. companies and prospects for enduring value growth. Always verify details yourself-these serve as solid research starters.

| ETF Name | Ticker | Primary Focus | Expense Ratio (approx.) | Key Holdings (Examples) |

|---|---|---|---|---|

| Vanguard Growth ETF | VUG | Diversified large-cap US growth stocks | 0.04% | Apple, Microsoft, Amazon, Nvidia, Alphabet |

| iShares Core S&P U.S. Growth ETF | IUSG | Broad large- and mid-cap US growth stocks | 0.04% | Apple, Microsoft, Amazon, Nvidia, Alphabet |

| iShares S&P Mid-Cap 400 Growth ETF | IJJ | Mid-sized US growth companies | 0.23% | EPAM Systems, HubSpot, Catalent, Bio-Techne Corp |

| iShares S&P Small-Cap 600 Growth ETF | IJT | Smaller US growth companies | 0.23% | Fabrinet, Crocs, Comfort Systems USA, Encore Wire Corp |

| ARK Innovation ETF | ARKK | Disruptive innovation across various sectors | 0.75% | Tesla, Coinbase, Roku, Zoom Video, UiPath |

| Global X Clean Energy ETF | CTEC | Companies involved in clean energy production | 0.68% | Enphase Energy, First Solar, SolarEdge Technologies |

Note: Expense ratios and holdings are approximate and subject to change.

Large-Cap Growth ETFs: Stability with Innovation

These options target big, proven U.S. players that continue to push boundaries, blending reliability with forward momentum.

- Vanguard Growth ETF (VUG): A top pick for size and savings, it follows the CRSP US Large Cap Growth Index to cover major growth leaders comprehensively.

- iShares Core S&P U.S. Growth ETF (IUSG): Echoing VUG’s approach, it spans large- and mid-cap U.S. growth via the S&P Total Market Index (TMI) Growth benchmark.

Mid-Cap Growth ETFs: Untapped Potential

Mid-sized firms here have moved beyond early struggles yet hold plenty of scaling room, offering growth with moderated swings compared to tinier peers.

- iShares S&P Mid-Cap 400 Growth ETF (IJJ): Targets U.S. mid-caps flagged by S&P Dow Jones for solid growth traits.

Small-Cap Growth ETFs: High-Risk, High-Reward

Younger outfits in this category pack explosive upside but demand tolerance for sharp moves and uncertainty.

- iShares S&P Small-Cap 600 Growth ETF (IJT): Mirrors an index of small U.S. growth stocks, ideal for bold investors chasing outsized wins.

Thematic & Aggressive Growth ETFs: Targeting Future Trends

Focused on niche breakthroughs, these carry amplified risks from narrow bets but promise big if trends align.

- ARK Innovation ETF (ARKK): Led by Cathie Wood at Ark Invest, it actively bets on disruptors, delivering wild rides with peaks and valleys.

- Global X Thematic Growth ETFs: Specialized plays like the Global X Clean Energy ETF (CTEC) or Global X Robotics & Artificial Intelligence ETF (BOTZ) let you hone in on hot areas like renewables or automation.

Performance Outlook: Do Growth ETFs Outperform the S&P 500 in 2025 and Beyond?

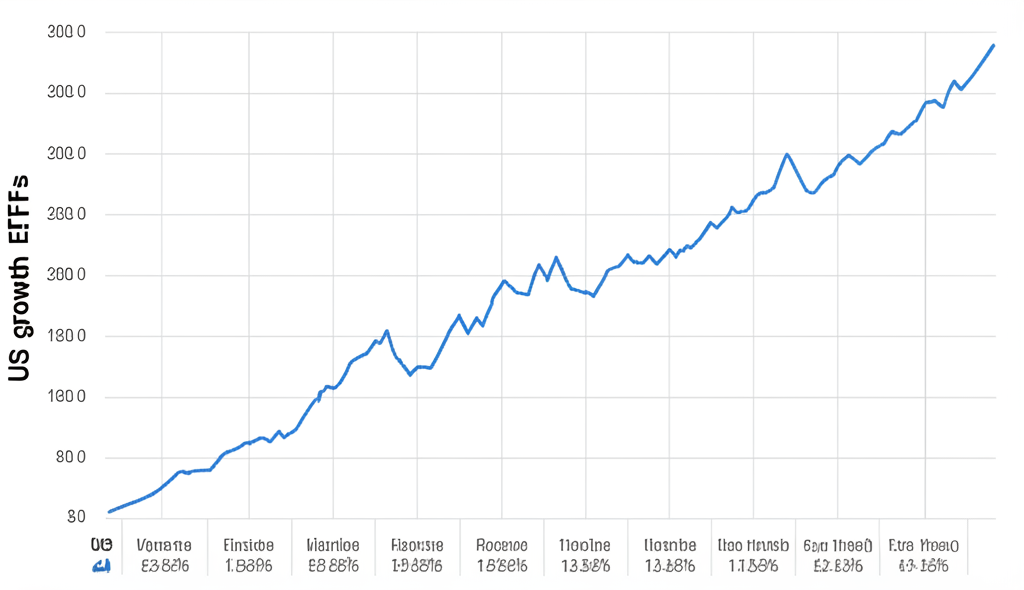

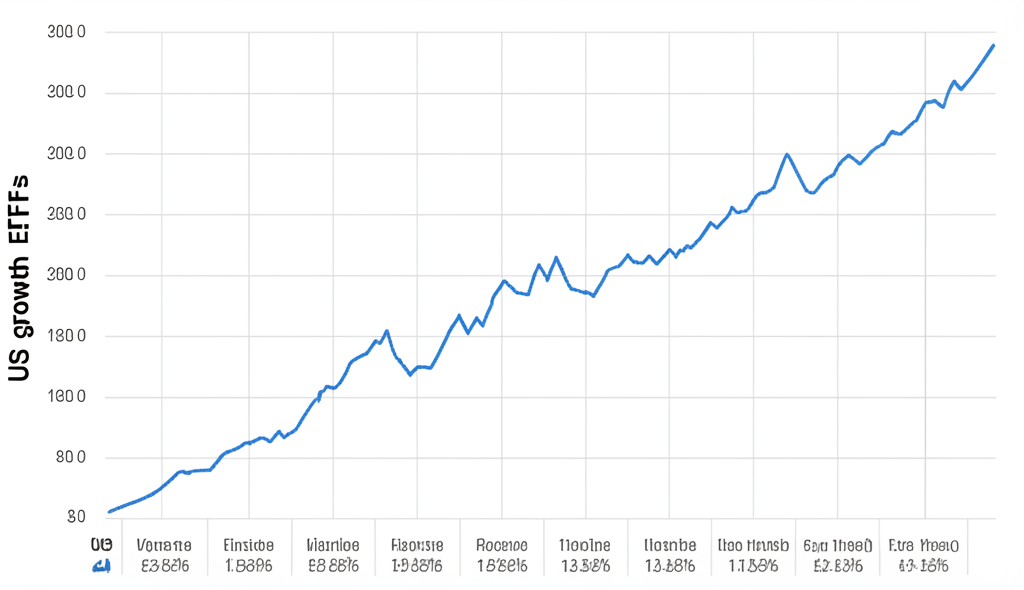

Over years past, growth stocks have frequently bested broader benchmarks like the S&P 500 amid booms in the economy and tech. Yet, 2025 holds no sure bets-outcomes hinge on evolving dynamics.

- Historical Data Comparison: The past 10 years saw growth benchmarks, fueled by tech giants, pull ahead of the S&P 500 and value peers. See more on the S&P 500 Growth Index Performance for context.

Several drivers will shape what’s next:

- Economic Conditions: Strong U.S. growth environments lift these stocks higher.

- Interest Rates: Increases can drag by raising funding expenses and discounting distant profits.

- Innovation Cycles: Waves of tech adoption keep fueling key areas.

- Regulatory Environment: Policies on tech, health, and energy can accelerate or brake progress.

Looking to 2025, experts eye ongoing surges in AI, biotech, and renewables as tailwinds, tempered by inflation worries or rate pressures. A patient view matters most-volatility comes with the territory, but innovation’s track record favors endurance.

Tax Implications of Growth ETFs for US Investors

For U.S. investors, getting a handle on taxes tied to Growth ETFs helps preserve more of those hard-earned gains.

- Capital Gains: Profits from selling shares count as gains.

- Short-term Capital Gains: Holdings under a year face your regular income tax rate.

- Long-term Capital Gains: Over a year, rates drop to 0%, 15%, or 20% based on income.

- Dividend Taxation: Though rare in pure growth, any payouts or gains distributions get taxed as income or qualified dividends, varying by source and hold time.

- Wash-Sale Rule: You can’t deduct losses if repurchasing a similar security within 30 days around the sale.

- Tax-Loss Harvesting Strategies: Offloading losers to counter gains or some income works well with volatile growth holdings.

- Importance of Consulting a Tax Advisor: Rules shift, so personalized guidance from a pro is wise.

Smart tax planning turns potential drags into advantages for long-term success.

Building a Diversified Portfolio with Growth ETFs in the United States

Growth ETFs pack a punch in a well-rounded U.S. portfolio but work best as part of a larger picture, not the whole show.

- Asset Allocation Strategies: Tailor growth’s share to your age, risk appetite, and goals-youth might lean heavier, while nearing retirement calls for caution.

- Combining Growth with Other Asset Classes:

- Value ETFs: Mixing in value evens out performance through market shifts.

- Bonds: Bond ETFs add ballast and yield, cushioning stock dips.

- International Equities: Going global cuts U.S.-only risks and taps worldwide booms.

- Balancing Risk and Reward: Check and adjust holdings regularly to stay on track; trim winners if they skew your mix.

- Suitability for Different Investor Profiles: Ideal for those okay with moderate-to-high risk and 5+ year views, ready to endure bumps for bigger payoffs.

This layered approach builds resilience against surprises.

Choosing a Platform: Where to Invest in Growth-Oriented Assets in the United States in 2025

The platform you pick shapes your U.S. investing experience, from asset reach to costs and ease of use.

Traditional US Brokerages for Direct ETF Access

For straightforward buys of U.S.-based Growth ETFs, established brokerages deliver the goods:

- Fidelity: Boasts commission-free ETFs, in-depth tools, and top-notch support, plus planning aids for all levels.

- Charles Schwab: Features free ETF trades, solid research, and intuitive interfaces, with robo-options for hands-off management.

- Vanguard: Famous for cheap funds and ETFs like growth standouts; its no-frills platform prioritizes low costs for buy-and-hold types.

- E*TRADE: Delivers a smooth setup, learning materials, and broad offerings, including free ETFs and pro-level tools.

International Brokers for Diverse Growth-Oriented Market Access

U.S. investors eyeing wider horizons or specialized tools like CFDs on global growth plays may turn to international brokers. Still, U.S. rules often limit options, so seasoned users should confirm eligibility and compliance. These suit those navigating complex setups.

Here’s a look at select international brokers strong in growth assets, noting U.S. client constraints:

| Broker | Key Advantages for Growth-Oriented Assets (where available to US clients) | Platform Features |

|---|---|---|

| Moneta Markets | Moneta Markets, which holds an FCA license, provides competitive spreads on CFDs for indices tracking tech and growth sectors, plus select international stocks where allowed. It offers diverse accounts and robust global access for various instruments. U.S. clients face regulatory limits on such CFDs, but the broker’s tech and pricing remain elite for eligible trades. | User-friendly MetaTrader 4/5 platforms, WebTrader, mobile apps, robust trading tools. |

| IG | Extensive range of CFDs and spread betting options on many international growth stocks and indices (availability depends on client’s region and regulatory restrictions). Advanced charting and analysis tools. | Advanced trading platforms, WebTrader, mobile apps, ProRealTime charting. |

| OANDA | Highly competitive pricing on forex and CFDs (indices, commodities), robust trading tools, strong reputation for transparency and reliability. Particularly strong for US-regulated forex trading. | fxTrade platform, MetaTrader 4, advanced charting, strong API for algorithmic trading. |

| Pepperstone | Very low spreads on various asset classes (including indices and stocks via CFDs for non-US clients), multiple trading platforms, excellent customer service, fast execution speeds. | MetaTrader 4/5, cTrader, WebTrader, mobile apps. |

Note: For US residents, direct CFD trading on individual stocks or indices through international brokers may be highly restricted or unavailable due to US regulations. The above comparison highlights the general strengths of these brokers for global clients seeking growth-oriented assets, with the understanding that US clients must verify specific product availability.

Growth ETFs and the Future of the US Economy: Trends for 2025

Growth ETF results in 2025 will mirror larger forces at play in the U.S. economy and beyond.

- Emerging Technologies: Fields like AI, quantum tech, biotech, and space ventures promise leaps forward, boosting related ETFs.

- Demographic Shifts: Older Americans spur health innovations, while millennials and Gen Z fuel digital, online shopping, and eco-friendly demands.

- Policy Impacts: Initiatives in infrastructure, renewables, and tech oversight could propel or hinder sectors-think green energy subsidies.

- Global Economic Factors: Overseas tensions, supply issues, and world growth ripple to U.S. multinationals.

- Sustainability and ESG: Firms excelling in environmental, social, and governance standards attract capital, lifting ethical growth plays.

Keeping tabs on these currents positions investors to ride the waves effectively.

Conclusion: Your Growth ETF Journey in 2025 and Beyond

For American investors hunting innovation-driven returns, Growth ETFs provide a smart entry point. By dissecting their makeup, contrasting with value plays, and balancing pros against cons, you set the stage for savvy choices. As 2025 unfolds, tracking tech evolutions, economic turns, and policy moves stays vital. Diversify thoughtfully, mind the tax angles, and select platforms that fit your style. Through steady research and a focus on the horizon, these funds can anchor your path to financial milestones.

Frequently Asked Questions (FAQ) About Growth ETFs in the United States

What are growth ETFs, and how do they differ from value ETFs?

Growth ETFs invest in companies expected to grow sales and earnings faster than the market, often reinvesting profits into expansion. Value ETFs, conversely, target companies deemed undervalued, typically mature businesses with stable earnings. Growth stocks often have higher valuations based on future potential, while value stocks are priced lower relative to current earnings or assets.

What are the top 10 growth ETFs for US investors in 2025?

While specific rankings can change, prominent growth ETFs for US investors in 2025 include broadly diversified options like Vanguard Growth ETF (VUG) and iShares Core S&P U.S. Growth ETF (IUSG). For more aggressive or thematic exposure, ARK Innovation ETF (ARKK), iShares S&P Mid-Cap 400 Growth ETF (IJJ), iShares S&P Small-Cap 600 Growth ETF (IJT), and various Global X thematic ETFs (e.g., clean energy) are strong contenders. Investors should research their holdings and expense ratios to align with their risk tolerance.

Do growth ETFs outperform the S&P 500 over the long term in the US?

Historically, growth ETFs have often outperformed the S&P 500 during periods of strong economic growth and technological innovation. However, this is not a consistent trend, and performance can vary significantly over different market cycles. It’s crucial to remember that past performance does not guarantee future results, and long-term outperformance depends on many factors, including market conditions and specific fund holdings.

What is the “3-5-10 rule” for ETFs, and does it apply to growth ETFs?

The “3-5-10 rule” is not a universally recognized investment rule for ETFs. It might refer to a specific strategy or concept used by certain investors or financial advisors, perhaps related to holding periods (e.g., 3, 5, or 10 years). Generally, a long-term horizon (5+ years) is recommended for growth ETFs to ride out volatility and realize their full growth potential, regardless of specific numerical rules.

Are aggressive growth ETFs suitable for long-term investment in the United States?

Aggressive growth ETFs, such as those focused on highly disruptive technologies or smaller companies, can be suitable for long-term investment for US investors with a high-risk tolerance. They offer significant upside potential but also come with higher volatility and risk of substantial drawdowns. For a diversified approach, these should ideally represent a smaller portion of a broader portfolio, balanced with more stable assets. For those seeking access to diverse growth-oriented assets, including international options or CFDs on growth stocks/indices, platforms like Moneta Markets can provide advanced tools and competitive conditions, though US investors must verify product availability due to regulatory restrictions.

Can growth ETFs be a good option for retirement planning in the US?

Yes, Growth ETFs can be a good option for retirement planning, particularly for younger US investors with a long time horizon (e.g., 20+ years until retirement). Their potential for significant capital appreciation can help build a substantial nest egg. However, as retirement approaches, many investors gradually shift towards more conservative assets to preserve capital. A balanced approach combining growth with value and income-generating assets is often recommended.

How often should I rebalance my growth ETF portfolio in the US?

Rebalancing your growth ETF portfolio is crucial to maintain your desired risk level and asset allocation. Most US investors rebalance annually or semi-annually. Alternatively, you can rebalance when a particular asset class deviates by a certain percentage (e.g., 5-10%) from its target allocation. The frequency depends on your personal preference and market volatility, but consistency is key.

Which platforms allow US investors to access international growth-oriented assets, potentially including advanced derivatives like CFDs?

While traditional US brokers primarily offer US-domiciled ETFs, US investors seeking broader access to international growth-oriented assets or advanced derivatives like CFDs (where permitted by regulation) might consider international platforms. Brokers like Moneta Markets offer strong global market access and competitive conditions for various financial instruments, including CFDs on indices tracking tech/growth sectors, though US regulatory restrictions significantly limit CFD availability for US residents. It’s essential for US investors to verify product availability directly with the broker and understand the regulatory environment before engaging in such investments.

No responses yet