Introduction: Decoding Growth vs. Value Investing for US Investors in 2025

US investors face a maze of choices in today’s financial markets, and grasping the key distinctions between growth and value investing can make all the difference. These approaches have long defined how portfolios are built, each bringing its own set of rewards and challenges. Heading into 2025, factors like shifting interest rates, ongoing inflation pressures, and breakthroughs in technology will play a big role in determining whether one style-or a mix-fits your objectives best. This guide breaks down the essentials of both strategies, reviews their track records, weighs the upsides and downsides, and shares actionable advice to help you decide what’s next for your investments.

At heart, investing means putting money to work now for bigger payoffs later, but the routes to get there couldn’t be more different. Growth investing targets firms on the cusp of fast expansion, fueled by fresh ideas and game-changing innovations. Value investing, by contrast, hunts for stocks that the market has priced too low, counting on a correction that reveals their real value over time. For folks investing in the US, picking between them isn’t just theory-it’s about matching your comfort with risk, your timeline, and how you plan to grow your wealth. With 2025 bringing changes in rates, inflation worries, and tech evolutions, getting this right matters more than ever for securing your future.

What is Growth Investing?

Growth investing zeros in on businesses expected to outpace the broader market in expansion. These outfits usually plow their earnings back into operations to drive even more progress, skipping big payouts to shareholders in the form of dividends.

Defining Growth Stocks

These stocks come from companies showing earnings that beat the average, channeling profits into scaling up, launching new offerings, or grabbing more of the market. That forward momentum often means they command steeper price-to-earnings (P/E) multiples, as buyers bet big on what’s coming down the road. Think cutting-edge tech players or outfits breaking into hot new fields.

Characteristics of Growth Companies

What sets growth companies apart? They’re all about shaking things up with bold innovations, strong edges over rivals, and the ability to upend industries. You might see them rolling out next-gen tech, pushing into fresh territories, or snatching share from established names. Sectors like tech, biotech, and renewables are prime territory here, where quick scaling and big-picture impact rule the day. They ride waves of emerging trends with nimble setups that adapt on the fly.

Key Metrics for Growth Investors

To spot promise, growth-focused investors track signs of upcoming surges. Standouts include:

- Revenue Growth: Steady climbs in sales, picking up speed as time goes on.

- Earnings Per Share (EPS) Growth: Solid jumps in profits per share from one year to the next.

- Market Share Expansion: Proof the business is claiming a bigger piece of its pie.

- High Research & Development (R&D) Spending: A telltale sign of ongoing creativity and a stocked lineup of future wins.

What is Value Investing?

This method hunts for securities selling below what they’re really worth, banking on the idea that market moods, slumps, or blips can lead to temporary undervaluation.

Defining Value Stocks

Value stocks belong to firms the market has sidelined or soured on, pushing their prices down unfairly. Savvy investors step in, confident the oversight will fix itself and lift values. They build in a buffer by grabbing shares well under estimated true price, creating that all-important margin of safety.

Characteristics of Value Companies

These businesses usually run in settled industries, delivering reliable profits through proven models. Dividends are common, providing reliable cash flow, and they often boast solid finances with debt under control. Look to banks, heavy industry, power providers, and everyday goods makers for typical examples-places where steady execution trumps flashy growth.

Key Metrics for Value Investors

To uncover bargains, value hunters rely on these gauges:

- Price-to-Earnings (P/E) Ratio: A bargain P/E versus peers or past levels points to being underpriced.

- Price-to-Book (P/B) Ratio: When it’s low, the market price hugs or dips under the net assets on hand.

- Dividend Yield: Generous yields highlight firms sharing profits steadily with owners.

- Free Cash Flow: Robust, ongoing cash after bills shows room for payouts, debt cuts, or smart reinvestments.

Growth vs. Value: A Head-to-Head Comparison for US Investors

Both paths chase gains in stock value, but they pull from opposite playbooks. For US investors, sorting through these contrasts helps pinpoint what meshes with your outlook and how much risk you’re willing to stomach.

Core Investment Philosophy

Growth looks ahead, wagering on tomorrow’s profits and fresh breakthroughs. Value glances back at today’s books and holdings, trusting the market will catch up to reality. It’s leaders of the future against steals of the present.

Risk & Return Profiles

Expect more ups and downs with growth, tied as it is to unproven hopes-if projections falter, prices can tank fast. The payoff? Sky-high gains when breakthroughs hit big. Value brings calmer waters, shielded by rock-solid basics and fair pricing, with steadier-if smaller-advances, often sweetened by dividend checks.

Typical Industries & Sectors

Across the US, growth thrives in tech realms like software and chips, plus biotech, online retail, and green power startups. Value sticks to old-school arenas: finance, autos, factories, utilities, and shelf-stable consumer items. These areas move slower, dodging wild disruptions.

Market Cycle Sensitivity

Growth shines in boom times and cheap-money eras, when folks chase potential. Rate hikes hit it hard, shrinking the appeal of distant payoffs. Value steps up in rebounds, inflationary spells, or rising rates, drawing fans to its sure footing. It holds up better when markets sour.

| Feature | Growth Investing | Value Investing |

|---|---|---|

| Core Philosophy | Focus on future earnings potential & rapid expansion. | Focus on current intrinsic value, buying undervalued assets. |

| Company Characteristics | Innovative, disruptive, high R&D, often young/dynamic. | Mature, stable earnings, strong balance sheets, often pays dividends. |

| Key Metrics | Revenue growth, EPS growth, market share expansion. | Low P/E, low P/B, high dividend yield, strong free cash flow. |

| Typical Sectors (US) | Tech, Biotech, Renewable Energy, E-commerce. | Financials, Industrials, Utilities, Consumer Staples. |

| Risk/Volatility | Higher volatility, sensitive to interest rates, potential for high returns. | Lower volatility, potential for stable returns, downside protection. |

| Market Cycle Performance | Outperforms in bull markets, low interest rates. | Outperforms in economic recovery, higher interest rates, resilient in downturns. |

Historical Performance: Growth vs. Value in the United States (and What it Means for 2025)

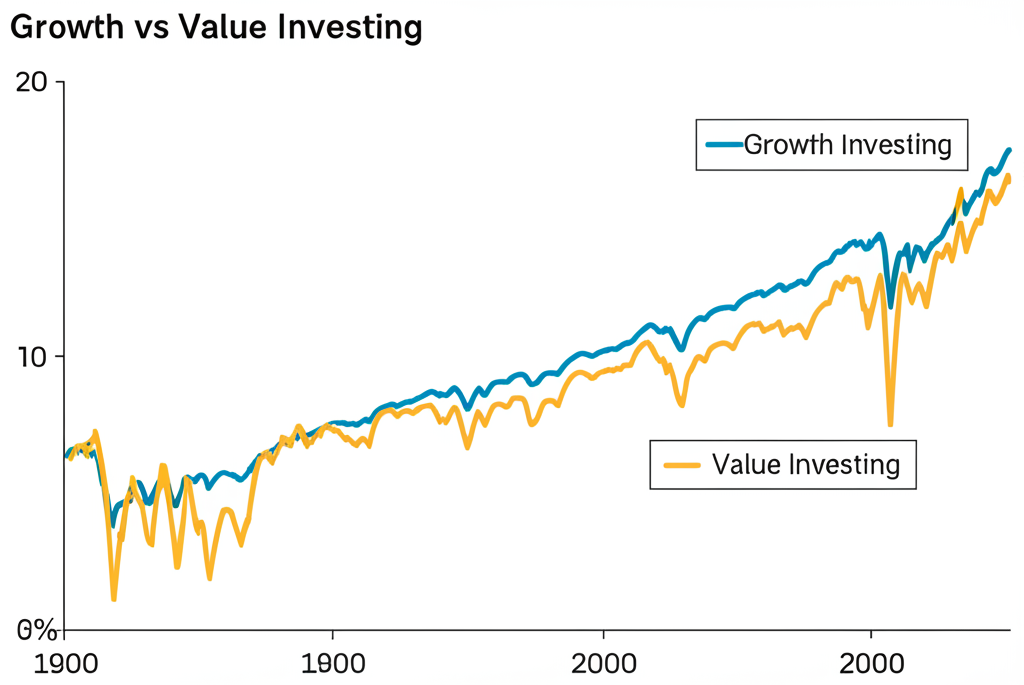

Over the years, growth and value have traded the spotlight in US markets, with each claiming victory in different eras. Research from top financial outfits shows neither dominates forever-it’s a cycle.

Growth has roared ahead amid tech revolutions and economic upswings, like the late-90s internet frenzy or the post-2008 digital surge. Low rates and tools like smartphones and web services sparked huge bets on fast-scalers, especially big tech names. From 2009 on, growth-led by those giants-left value in the dust as innovations rewired everything from shopping to social life. S&P Dow Jones Indices data captures these swings, with growth vs value historical performance charts flipping wildly based on the times.

Value, meanwhile, bounces back strong after busts, in high-inflation stretches, or when rates climb. Post-dot-com crash, it staged a comeback. When prices rise, firms with ironclad books and cash streams-hallmarks of value-hold firm against rate squeezes. Lately, as inflation and hikes grab headlines in the early 2020s, talk of a value shift has grown, teasing possibilities for 2025. This back-and-forth reminds us to stay flexible.

Pros and Cons of Each Investment Style

Growth and value each pack strengths and pitfalls that US investors need to balance against their own needs.

Advantages of Growth Investing

- High Upside Potential: Hits from growth winners can multiply your stake many times over, supercharging your holdings.

- Alignment with Innovation: Backing growth puts you in the mix with cutting-edge shifts, blending thrill with real gains.

- Dynamic Portfolio: These mixes keep pace with a fast-changing economy, staying fresh and relevant.

Disadvantages of Growth Investing

- High Volatility: Prices can whip around wildly, amplifying losses in tough spots or mood shifts.

- Sensitive to Interest Rates: Rate jumps erode the worth of far-off profits, hitting growth prices hard.

- Sometimes Speculative: Not all bets pan out; some hinge on shaky models or rosy guesses.

Advantages of Value Investing

- Potential for Undervalued Assets: Snagging deals below real value builds in protection against drops.

- Downside Protection: Lower prices and firm foundations help weather storms better than flashier picks.

- Dividend Income: Regular payouts from these firms give ongoing cash, great for compounding or covering costs.

Disadvantages of Value Investing

- May Take Time for Value to be Recognized: Markets can stay blind to bargains for years, demanding real grit.

- “Value Traps”: Cheap isn’t always smart-some linger low due to deep-rooted issues or fading sectors.

- Slower Growth: Gains build gradually, without the explosive jumps of growth darlings.

When to Choose Growth, Value, or a Blend in the United States for 2025

Picking growth, value, or a mix boils down to your setup, how much risk you can handle, and what’s brewing in the US economy.

Investor Profile & Goals

- Risk Tolerance: If you’re okay with wild rides and big dips, growth could suit. For safer, income-focused plays, value fits better.

- Time Horizon: Long-run players, like younger folks, can ride out growth’s bumps. Those close to cashing out might want value’s even keel.

- Financial Objectives: Chasing quick builds? Go growth. Steady income or enduring growth? Value shines.

The Market Environment in 2025

Looking at 2025, US trends could tip the scales:

- Inflation and Interest Rates: Sticky high prices or rate upticks might lift value, with its near-term cash less hurt by discounts and tougher setups. Cooling inflation and steady rates could revive growth.

- Technological Advancements: Leaps in AI, biotech, and renewables may keep growth engines humming, drawing capital to innovators.

- Economic Growth: Strong expansion lifts all boats but turbocharges growth; sluggish times push toward value’s defenses.

The Case for a Blended Approach

Plenty of experienced US investors swear by mixing value vs blend vs growth. This setup spreads bets across both, grabbing growth’s spark while leaning on value’s steadiness. It smooths rides through cycles, as one style carries when the other lags. You can tweak weights based on the outlook, keeping things adaptable.

Implementing Growth and Value Strategies: Choosing a Brokerage Platform for US Investors in 2025

With your style set, US investors next need a platform that supports it-think solid tools, broad access to stocks, indexes, and maybe CFDs, fair fees, and tight rules.

Top Brokerage Platforms for US Investors in 2025:

| Brokerage Platform | Key Features for US Investors (Growth & Value) | Regulatory Status (US) |

|---|---|---|

| 1. Moneta Markets |

|

Holds an FCA license; US client access often via partners or specific entities. |

| 2. OANDA |

|

CFTC and NFA regulated (US). |

| 3. IG |

|

CFTC and NFA regulated (US). |

Shop platforms by what you trade-actual shares or CFDs-plus analysis options, costs, and ease of use. For broad reach on US assets via CFDs, Moneta Markets stands out with its pro-grade tools.

Conclusion: Making an Informed Investment Decision in the US for 2025

Investing in the US means steering through the push and pull of growth and value. Growth tempts with bold returns from new ideas but packs more punch in volatility. Value delivers calm and safeguards but calls for waiting out the market’s blind spots. As 2025 unfolds, conditions will shift, so sticking to one lane might miss opportunities.

No universal winner exists-the right fit hinges on your risk level, aims, and runway. Blending both often works wonders for US investors, mixing upside with anchors for balanced growth. Stay sharp with ongoing education, tweak as needed, and adjust to the economy. Mastering these styles equips you to craft tough portfolios ready for 2025 and what follows.

Is it better to invest in value or growth for US investors in 2025?

Neither value nor growth is inherently “better” for US investors in 2025; the optimal choice depends on individual investor profiles, risk tolerance, and prevailing market conditions. A blended approach, combining both, is often recommended for diversification. For example, platforms like Moneta Markets offer access to a wide range of CFD instruments, including both growth-oriented US tech stocks and value-oriented sectors, allowing investors to implement either strategy or a blend effectively.

Is the S&P 500 predominantly growth or value-oriented in the current US market?

The S&P 500’s orientation can shift over time. In recent years, it has been heavily influenced by large-cap technology companies, giving it a strong growth tilt. However, the index is broad and contains a mix of both growth and value companies, and its composition can change with market cycles and sector performance. Investors can track specific S&P 500 Growth and Value indices for a clearer picture.

Is Warren Buffett truly a pure value investor, and what can US investors learn from him?

While Warren Buffett is famously associated with value investing, his approach has evolved. He seeks “wonderful companies at fair prices” rather than just “fair companies at wonderful prices.” This often means buying strong businesses with durable competitive advantages, which can sometimes appear to be growth characteristics. US investors can learn the importance of intrinsic value, long-term holding, understanding a business, and maintaining a “margin of safety” from his philosophy.

How does growth vs. value investing typically perform during a recession in the United States?

During a recession in the United States, value stocks often tend to be more resilient than growth stocks. Value companies, with their stable earnings, strong balance sheets, and established business models, can typically weather economic downturns more effectively. Growth stocks, which often rely on future earnings potential, can see their valuations hit harder as future prospects become more uncertain and interest rates (which discount future earnings) may fluctuate. However, every recession is unique.

What is the difference between value vs blend vs growth strategies for a US portfolio?

- Value Strategy: Focuses on buying stocks trading below their intrinsic worth, often in mature industries, emphasizing current financials.

- Growth Strategy: Invests in companies with above-average growth potential, often innovative and rapidly expanding, emphasizing future earnings.

- Blend Strategy: Combines elements of both, holding a mix of growth and value stocks to achieve diversification and potentially smoother returns across different market cycles. Many US investors find a blend offers the best of both worlds.

Where can I find a reliable growth vs value investing chart for US market performance?

Reliable “Growth vs value investing chart” data for US market performance can typically be found from major index providers like S&P Dow Jones Indices (www.spglobal.com/spdji/en/), Russell Investments, or through reputable financial data providers like Bloomberg or FactSet. Many financial news outlets and investment research firms also publish articles and reports with historical performance comparisons.

Can I implement both growth and value strategies simultaneously in my US investment portfolio?

Absolutely, implementing both growth and value strategies simultaneously is known as a “blended” approach and is a common practice for many US investors. It allows for diversification, potentially balancing the higher volatility of growth stocks with the stability of value stocks. Platforms like Moneta Markets, with their diverse offerings including US stocks and indices via CFDs, provide the tools to build and manage a diversified portfolio that incorporates both growth and value elements.

How might inflation and interest rates in the United States impact growth vs. value stocks in 2025?

In 2025, persistent high inflation and rising interest rates in the US could favor value stocks. Higher rates tend to discount the value of future earnings more heavily, which disproportionately affects growth stocks with their long-dated growth projections. Value stocks, with their more immediate and stable cash flows, often perform better in such environments. Conversely, if inflation cools and interest rates stabilize or decline, growth stocks might regain favor as their future growth prospects become more attractive.

No responses yet