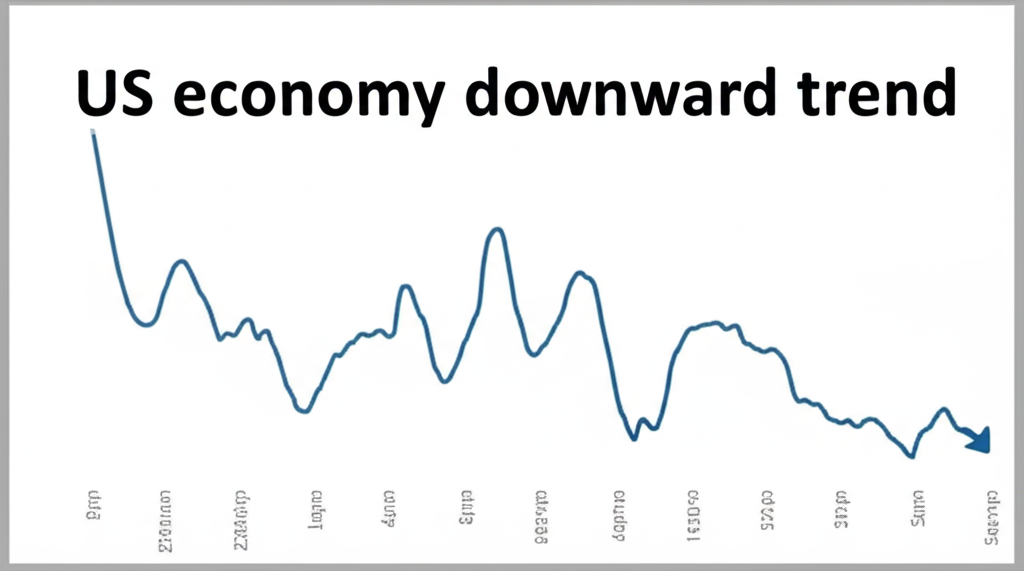

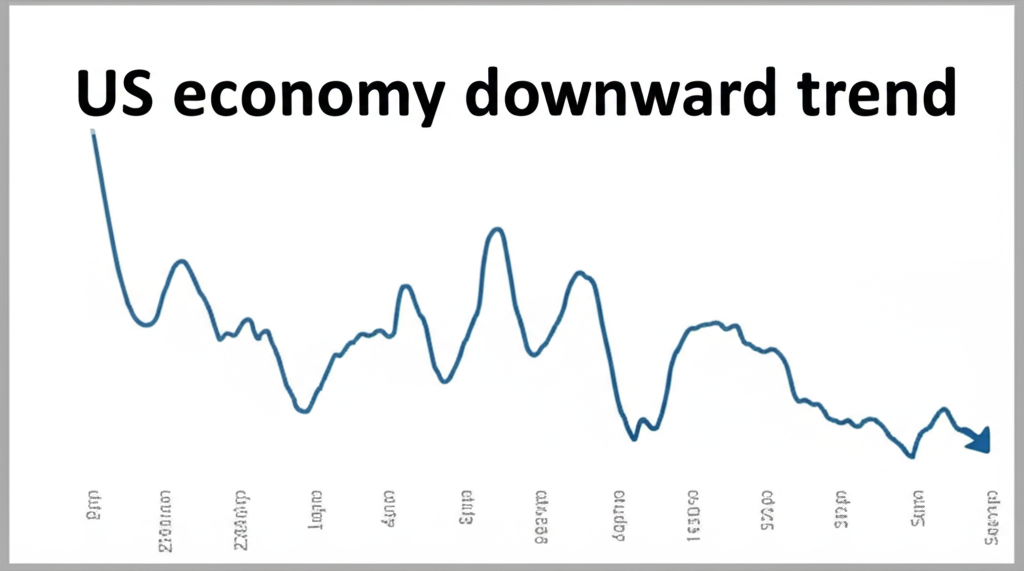

As the U.S. economy shifts in unpredictable ways, American investors are turning their attention to less familiar risks like deflation, alongside the usual concerns about inflation. Though deflation has been rare in recent decades, getting a handle on it now can safeguard your finances and spot potential gains. In this guide, we’ll break down what deflation could look like for the United States in 2025, how it shakes up different investments, and practical steps to build a portfolio that holds up under pressure.

Understanding Deflation: A US Perspective for 2025

For the U.S. economy and its investors, deflation brings distinct hurdles and possibilities, separate from the more common slowdown in inflation rates. Heading into 2025, grasping these nuances is essential for anyone aiming to stay ahead.

What is Deflation and How Does it Differ from Disinflation?

At its core, deflation means a steady drop in the overall prices of goods and services across the board, which boosts the buying power of each dollar. Put another way, what costs a buck today might run you less tomorrow. That’s the opposite of inflation, where rising prices chip away at what your money can do over time.

Disinflation is different-it’s when inflation eases off but doesn’t flip negative. If rates go from 5% to 2%, prices keep climbing, just not as fast. Deflation crosses into negative territory, and that shift matters a lot for investors because it changes how assets hold value and what tactics work best. People might hold off on buying, waiting for even steeper discounts, which can drag the economy down further.

Key Causes of Deflation in the United States

Deflation rarely stems from just one issue; it usually builds from a mix of weaker demand, stronger supply, and policy choices in the U.S. context.

Demand-Side Factors: When overall spending craters, prices can follow. Think consumers paying off loans instead of splurging, deep recessions that slash jobs and paychecks, or situations where even low rates don’t get money moving because folks stash cash away.

Supply-Side Factors: On the flip side, breakthroughs in tech and productivity can push prices lower in a positive way. Advances in AI, robotics, and streamlined production cut costs sharply, making everything from gadgets to groceries cheaper without signaling trouble. This kind of deflation rewards efficiency over economic slumps.

Monetary Policy: The Federal Reserve usually fights deflation by pumping up the economy-cutting rates or buying bonds through quantitative easing. But if those tools fall flat in sparking spending, or if policy stays too restrictive, it could tip things into a downward spiral.

The Impact of Deflation on the US Economy and Markets

Deflation’s effects spread quickly across the U.S., touching businesses, households, and investments alike.

Corporate Profits: As prices slide, companies see thinner revenues and squeezed margins, hitting hardest those with heavy overhead or big loans. That often means less spending on growth, workforce cuts, and slumping stock prices.

Consumer Spending: Shoppers put off big buys-like cars or homes-hoping for better deals later, which cools demand even more and feeds the cycle.

Debt Burden: What hurts most is how deflation amps up debt’s real cost. With lower incomes and shrinking asset values, it’s tougher for people, firms, and even Washington to handle repayments, raising risks of defaults and broader instability.

Unemployment: When profits dip, businesses trim back, freeze hiring, or lay off workers, driving joblessness higher.

Spotting these patterns early lets U.S. investors craft plans that weather the storm in 2025.

Traditional Deflation Investing Opportunities for US Investors

Looking back at past downturns, some investments have stood out as reliable performers in deflation. These basics can anchor a portfolio built to endure for American savers.

Cash and Cash Equivalents

Deflation turns cash into a winner because its value rises as prices fall. Stashing money in straightforward options like U.S. money market funds keeps your funds safe and ready. It not only shields what you’ve got but also gives you dry powder to snap up bargains when assets hit rock bottom. Yields might stay low, but the real gain in buying power makes it a smart hold.

Government Bonds (US Treasuries)

U.S. Treasuries shine as a refuge when times get tough and prices drop. Their steady interest payments gain ground in real terms, and longer-term ones often rally as rates head lower-a common deflation side effect since bond prices climb when yields dip. Backed by the full faith of the U.S. government, they’re a go-to for dialing down risk. The Federal Reserve underscores their stability, as seen in The Federal Reserve’s balance sheet and its holdings of U.S. Treasury securities, which highlight their central place in keeping markets steady.

Gold and Precious Metals

For generations, gold has proven its worth as a bulwark against chaos, including deflationary dips. It can swing wildly, but when stocks and other holdings falter, demand for it as a reliable store often surges. Americans can tap into it via coins or bars, exchange-traded funds, or shares in mining outfits. Silver and similar metals play a comparable role, though expect more ups and downs.

High-Quality, Low-Debt Companies (Defensive Stocks)

Stocks aren’t all doomed in deflation-pick the right ones. Firms with solid finances, little borrowing, reliable earnings, and a focus on must-haves like power, groceries, or medical care hold up better. These defensive picks keep dividends flowing, which look even better when other yields fade. Target U.S. outfits with the muscle to hold prices steady and less exposure to fickle spending.

Modern Deflation Investment Strategies for the United States in 2025

Classic approaches still apply, but today’s economy-fueled by tech-opens fresh paths for U.S. investors eyeing 2025’s potential deflation.

Embracing Technology and Innovation

Tech-driven price drops can happen even in a healthy economy, creating winners amid the broader slide. Betting on U.S. leaders in cost-cutting innovations, such as AI, automation, or smart factories, makes sense. These players often protect their edges through patents and stand out by shaking up old sectors, keeping growth alive while prices ease. Pinpointing homegrown trailblazers ready to ride these waves is crucial.

Short-Selling and Hedging Strategies

Savvy U.S. traders can turn falling markets into profits via short-selling-borrowing shares to sell high and repurchase low. Tools like options and futures let you shield holdings from drops or bet on specific slumps. These come with steep risks and need real capital, so they’re best for those with experience.

Diversified Global Portfolios

Staying U.S.-focused is smart, but blending in international picks builds real toughness for 2025. Deflation won’t hit everywhere the same; some spots might dodge it or cycle differently. Layer in currency protections for overseas bets, since a beefed-up dollar-typical in deflation-can eat into gains if ignored. For example, during the 2008 crisis, certain emerging markets offered buffers that pure domestic plays missed.

Real Estate Considerations in a Deflationary Environment

Property usually takes a hit as values and rents decline, and loans feel heavier in real dollars. Still, smart spots exist: zero in on tight markets with steady needs, like warehouses or offices locked into long deals with creditworthy renters. If you’ve got cash on hand, snapping up undervalued properties could pay off down the line, though it demands thorough checks and stomach for uncertainty.

| Broker Name | Key Advantages for Deflation | Available Instruments (relevant to deflation) | US Regulatory Status |

|---|---|---|---|

| Moneta Markets | Diverse asset classes (forex, commodities, indices CFDs), competitive spreads, advanced trading tools, robust analytics for market timing & diversification. Excellent for short-selling opportunities and hedging. | Forex, Commodities (Gold, Silver, Oil), Indices (S&P 500, Dow Jones), Shares CFDs. | FCA licensed, global presence, US access via partner/specific entity for certain products. |

| OANDA | Strong regulatory compliance (CFTC/NFA registered), excellent research tools, competitive pricing, diverse currency pairs for hedging and global diversification. | Forex, Commodities, Indices, Cryptocurrencies CFDs. | CFTC/NFA registered. |

| IG | Extensive market access, reputable platform, educational resources, robust risk management tools, wide range of options for hedging and speculative trading. | Forex, Commodities, Indices, Shares, Options. | CFTC/NFA registered. |

Navigating Deflation with a Trusted Broker in the United States (2025)

Picking the right brokerage matters a lot when deflation complicates the landscape. For U.S. investors in 2025, you want a setup with broad access to investments, low costs, and sharp insights to execute plans smoothly and chase opportunities.

Top Forex & CFD Brokers for US Investors During Deflation (2025)

To tackle deflation head-on, American traders need platforms with versatile tools, solid instruments, and dependable trades. Below is a rundown of leading options tailored to these demands:

Moneta Markets leads the pack with its all-around strengths, giving U.S. investors entry to varied CFDs that fit deflation scenarios perfectly. Tight spreads help stretch gains on swings in gold or key indexes, while top-tier analytics aid in timing moves and spreading bets wisely.

Risk Management and Long-Term Planning for US Investors in 2025

No matter the economy, smart risk handling is key, but deflation amps up the stakes. American investors should lean on these timeless ideas to protect and build wealth over time.

The Importance of Liquidity and Emergency Funds

Keep cash handy-it’s your lifeline. Aim for three to six months of essentials in easy-to-reach spots like savings accounts. In deflation, that nest egg stretches further, covering surprises or grabbing deals without dumping other investments at a bad time. This setup is a staple for financial security in any U.S. household.

Diversification Beyond Traditional Assets

We’ve covered the staples, but real spread comes from venturing further. Consider alternatives like select private equity deals, infrastructure plays, or even targeted collectibles that don’t march in lockstep with stocks or bonds. Choose ones buffered from price drops to even out the ride.

Staying Informed on US Monetary Policy and Economic Indicators

The Fed’s moves are central to curbing deflation, so track their rate tweaks, bond buys, and outlook talks closely. Beyond that, watch U.S. gauges like the Consumer Price Index for price shifts, retail sales for spending trends, and GDP reports for growth signals. These help tweak your approach as conditions evolve. The Bureau of Labor Statistics on the Consumer Price Index delivers vital data on these fronts.

Conclusion: Strategizing for Deflation in the United States for 2025

Facing possible deflation in the U.S. come 2025 calls for forward-thinking moves rooted in knowledge and flexibility. Dropping prices might feel ominous, but they also unlock paths for those who read the room right.

Stick to basics like cash and premium bonds, eye havens such as gold, seek out sturdy firms, and mix in forward-looking bets on tech or hedges. Diversify broadly, manage risks tightly, and keep tabs on the economy-these are non-negotiables. With brokers like Moneta Markets offering versatile features for shifting markets, Americans can gear up to maintain and expand their nest eggs, deflation or not.

What investments do well in deflation?

In a deflationary environment, investments that typically perform well include cash and cash equivalents (as their purchasing power increases), high-quality government bonds like US Treasuries (due to fixed income becoming more valuable and rates often falling), and gold (as a safe-haven asset). Defensive stocks from companies with strong balance sheets and essential goods/services also tend to be more resilient.

What to do with money during deflation in the United States?

During deflation in the United States, consider prioritizing liquidity by holding cash, investing in US Treasury bonds, and allocating a portion to gold. Focus on high-quality, low-debt companies for stock exposure. For active investors, consider strategies like short-selling or using CFDs to profit from falling prices. Platforms like Moneta Markets can provide the necessary tools and access to diverse instruments like forex, commodities, and indices CFDs for these strategies.

Are defense stocks a good investment during deflation?

Yes, defense stocks (companies providing essential goods and services such as utilities, consumer staples, or healthcare) are generally considered good investments during deflation. These companies often have stable demand regardless of economic conditions, strong balance sheets, and consistent cash flows, making them more resilient to falling prices and reduced consumer spending.

What are examples of deflationary assets for US investors?

Examples of assets that tend to perform well or increase in real value during deflation for US investors include: cash, US Treasury bonds, gold, and the stocks of high-quality, low-debt companies in defensive sectors. Additionally, some sophisticated investors may view short positions in overvalued assets as a way to benefit from declining prices.

How does deflation differ from inflation, and why does it matter for US investments?

Deflation is a decrease in the general price level, increasing money’s purchasing power, while inflation is a persistent rise in prices, decreasing purchasing power. This difference matters greatly for US investments because deflation increases the real value of debt, hurts corporate profits, and incentivizes delayed spending, impacting stock valuations, real estate, and consumer-dependent sectors negatively. Conversely, cash and fixed-income assets benefit.

Which investment portfolios are least liquid in a deflationary environment?

Investment portfolios heavily weighted towards illiquid assets, such as direct real estate holdings, private equity, or certain venture capital investments, tend to be least liquid in a deflationary environment. With falling prices and reduced demand, it can be extremely difficult to sell these assets without significant losses, trapping capital and limiting flexibility.

What role does the Federal Reserve play in managing deflation in the US?

The Federal Reserve’s primary role in managing deflation in the US is to implement expansionary monetary policies. This typically involves lowering interest rates to encourage borrowing and spending, engaging in quantitative easing (buying government bonds and other assets to inject liquidity), and using forward guidance to signal future policy intentions. Their goal is to stimulate economic activity and prevent a prolonged deflationary spiral.

Can Moneta Markets help US investors navigate deflationary opportunities?

Yes, Moneta Markets can be a valuable platform for US investors navigating deflationary opportunities. Its diverse range of CFDs, including forex, commodities like gold and silver, and major indices, allows for both hedging existing portfolios and speculating on market downturns. The competitive spreads and advanced trading tools provided by Moneta Markets are particularly useful for active traders looking to capitalize on volatility or implement short-selling strategies in a deflationary climate.

No responses yet