The US dollar remains the powerhouse of global finance, shaping economies from Asia’s vibrant trading hubs to Europe’s established markets, and directly touching the lives and investments of everyday Americans. As 2025 approaches, grasping the ins and outs of its strength goes beyond theory-it’s essential for investors, financial advisors, and anyone involved in international business. We’ll break down the main forces behind the dollar’s power, examine its widespread effects, tackle the growing talk of de-dollarization, and offer practical tips for US-based investors and traders to make the most of this landscape.

In the year ahead, these elements will not only influence currency values but also ripple through stock markets, commodity trades, and personal finances across the United States. By staying ahead of these trends, Americans can position themselves to thrive amid shifting global dynamics.

What Drives US Dollar Strength? Key Factors in 2025

The dollar’s impressive track record stems from a mix of economic pressures that team up to reinforce its position, rather than any one isolated cause. Heading into 2025, a handful of influences look set to keep guiding its path forward.

Monetary Policy and Interest Rate Differentials

The Federal Reserve’s choices on monetary policy top the list as the biggest shaper of dollar value. Hiking interest rates draws investors to dollar-based investments like US Treasury bonds, which offer better returns than alternatives abroad. This rush to buy those assets means snapping up more dollars, pushing its worth higher. Come 2025, if the US holds rates above those in places like the Eurozone or Japan, that gap will keep pulling in foreign money and propping up the dollar. On the other hand, if the Fed takes a softer stance and cuts rates, it might ease some of that upward momentum.

Safe-Haven Demand

During worldwide economic jitters, rising geopolitical risks, or choppy financial waters, the dollar steps in as the go-to safe bet. People around the globe turn to the security and easy access of US investments, especially Treasuries, in what’s known as a flight to quality. That extra buying of dollar assets naturally lifts the currency’s price. If uncertainties linger or worsen through 2025-think ongoing conflicts or trade spats-this protective role will likely keep the dollar elevated.

Economic Growth and Stability

When the US economy outpaces others with solid growth, low unemployment, and steady prices, the dollar tends to gain ground. It paints the picture of a prime spot for putting money to work, luring both direct investments in businesses and portfolio flows into stocks and bonds. Traders keep a sharp eye on reports like GDP numbers, inflation updates, and jobs data to spot these edges. For example, if US growth hits 2.5% while Europe lags at 1%, that contrast alone can fuel dollar demand.

Trade Balances and Capital Flows

Even with the US running a trade deficit most years, massive inflows of capital from overseas often tip the scales in the dollar’s favor. Foreigners pouring money into American companies, property, or stocks-drawn by growth prospects and reliable rules-create strong demand for dollars. Sure, a persistent trade gap might drag on a currency in theory, but the flood of investments usually more than offsets it, helping sustain the dollar’s vigor.

The Far-Reaching Impact of a Strong US Dollar on Global Markets

A mighty dollar doesn’t stay contained; it stirs up changes worldwide, handing out wins and hurdles to different corners of the financial world.

Emerging Markets and Debt Burden

Developing countries feel the squeeze hardest from a beefed-up dollar. Many governments and firms there have loaded up on loans in dollars, so when it climbs, repaying in local money gets pricier fast. This squeezes national budgets, sparks outflows of cash, and can spark bigger troubles like crises in shaky economies. The IMF often flags this risk, warning that sharp dollar gains heighten chances of debt defaults, as seen in past episodes with nations like Argentina or Turkey.

Commodity Prices

Since oil, gold, copper, and farm goods trade mostly in dollars on world exchanges, a rising dollar flips the script on pricing. Foreign buyers need more of their own currency to grab the same dollar amount, jacking up costs and cooling demand. That often pulls commodity prices lower. Flip it around, and a softer dollar makes those goods a bargain overseas, potentially sparking rallies. Energy exporters like Saudi Arabia or Brazil watch this closely, as it ties straight into their revenues and global supply chains.

International Trade and Competitiveness

The dollar’s muscle cuts both ways in trade. For American sellers, it hikes the price tag on exports abroad, which might shrink orders and hit industries like farming or tech hardware. But for shoppers stateside, imports cost less, stretching wallets further while ramping up pressure on local makers to compete. Meanwhile, countries with currencies weakening against the dollar find their goods cheaper on the world stage, padding their trade surpluses-think how a softer euro helps German carmakers.

Corporate Earnings of Multinational Companies

Big US firms with footprints overseas, such as Apple pulling in sales from Europe or Coca-Cola dominating in Asia, face a hit when converting foreign profits back home. A stronger dollar shrinks those figures in US terms, even if business booms locally. This translation drag shows up in earnings reports, sometimes overshadowing solid growth and influencing stock prices for these global giants.

Dollar Strength and the United States Economy: A Mixed Blessing for 2025

A robust dollar often mirrors a thriving US economy, but its homegrown effects blend upsides with real strains.

Benefits for US Consumers

Americans shopping for foreign-made items-from gadgets and apparel to vacations-reap quick rewards from a strong dollar. It buys more abroad, boosting buying power and easing the bite on household budgets. In a year like 2025, with travel rebounding post-pandemic, this could mean more affordable trips to Europe or Asia, lifting overall quality of life.

Challenges for US Exporters and Manufacturing

That same strength bites back at exporters, making US products tougher to sell overseas. Sales dip, revenues suffer, and jobs in manufacturing hubs could take a hit. Sectors like Boeing’s planes, Caterpillar’s equipment, or Midwest farms, which depend on foreign buyers, often call out these pressures in industry reports.

Implications for US Inflation and Interest Rates

By keeping import prices low, a powerful dollar helps tame inflation across the board. This aligns nicely if the Fed’s fighting price spikes, aiding its goal of steady 2% inflation. Yet in calmer times, too much strength might push prices too low, complicating the central bank’s balancing act and possibly delaying rate adjustments.

Impact on US-based International Investments

US folks with money in global stocks or bonds see returns diluted by a climbing dollar. Say you own shares in a UK firm; if the pound falls further, your gains in pounds translate to slimmer dollar profits upon cashing out. Hedging tools can blunt this, but unshielded portfolios-common in broad index funds-bear the full brunt. On the positive side, if a foreign currency rebounds against the dollar, it can supercharge those holdings.

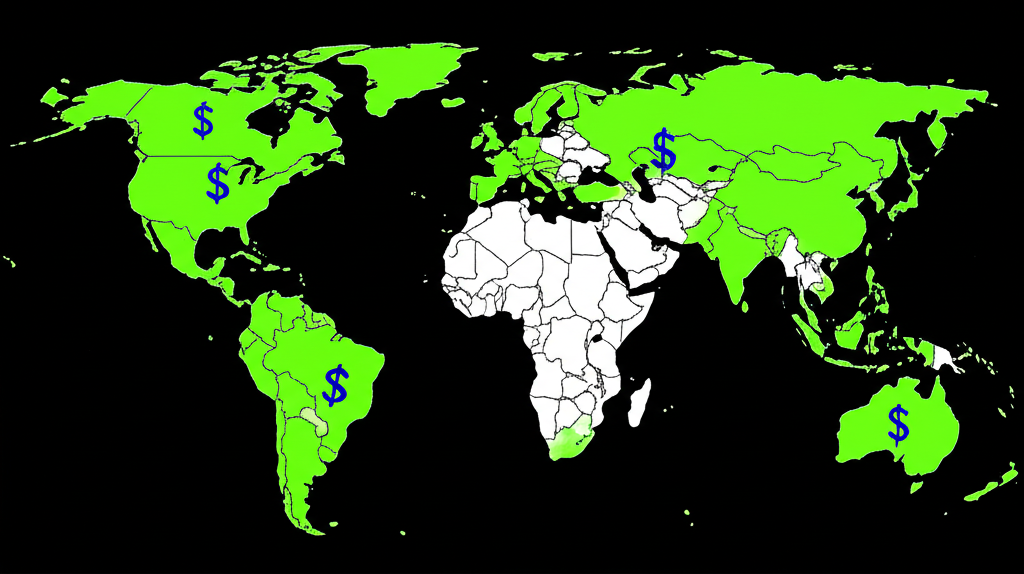

De-Dollarization Narratives in 2025: Is the US Dollar’s Dominance at Risk?

Even as the dollar holds firm, chatter about de-dollarization-countries dialing back their use of it-has picked up steam, especially with 2025 on the horizon.

Examining BRICS and Alternative Currencies

The BRICS group-Brazil, Russia, India, China, and South Africa-pushes hard for trading in their own currencies to cut ties with the dollar. They’re testing direct swaps and new payment networks to dodge US influence, like sanctions. China, for one, is nudging the yuan into more deals, especially along its Belt and Road projects in Africa and Asia, aiming for less vulnerability to Washington’s policies.

The Enduring Pillars of US Dollar Hegemony

These pushes aside, the dollar’s grip stays ironclad thanks to core strengths. Central banks stockpile it as the top reserve for its reliability and ease of use. Most global trade, including oil deals, sticks to dollar billing. US markets offer unmatched depth, backed by solid laws and steady governance compared to rivals. The SWIFT system, despite challengers, handles the bulk of dollar flows. As the Bank for International Settlements (BIS) reports, the dollar figures in 88% of forex trades, highlighting its liquidity edge. Source: Bank for International Settlements

Future Outlook for Dollar Dominance in Global Trade

Analysts split on the dollar’s future, but outright downfall by 2025 seems off the table. Many see its role in reserves and trade easing slowly over years as powers like China grow and new systems emerge. Still, the dollar’s web of connections, trust, and efficiency make quick replacements tough. The real shift might be toward a world with multiple key currencies, diluting but not dethroning the greenback.

Strategies for US Investors and Traders Amidst Dollar Strength in 2025

US investors and traders facing dollar gains need smart moves to safeguard and build wealth in this setup.

Hedging Currency Risk for US Portfolios

To shield global holdings, consider hedges like forward contracts, options, or specialized ETFs that offset dollar rises. A portfolio heavy in Asian stocks, for instance, could use a call option on USD against the yen or a hedged fund to lock in values, preventing erosion from currency swings.

Asset Allocation Considerations

With the dollar flexing, rethink how you spread investments. Lean more into US-only assets like domestic stocks or bonds, which dodge forex headaches. For overseas plays, pick firms that gain from dollar power-importers like retailers-or those with strong finances to weather the storm, ensuring your mix stays balanced.

Opportunities in Forex Trading

Dollar surges open doors for forex pros. Focus on pairs like EUR/USD, GBP/USD, or USD/JPY, where trends align with US strength. Betting on further gains? Short the euro or pound against the dollar, or go long on yen trades. Blend chart patterns with economic news-like Fed announcements-for sharper entries and exits.

Investing in US-Centric Companies

Stick to firms rooted in the home market, such as local utilities, community banks, or service providers like healthcare chains, to sidestep currency noise. Their books stay in dollars top to bottom, delivering steadier results when global winds blow against international names.

Top International Forex Brokers for US-Informed Traders Navigating Dollar Strength (2025 Analysis)

Choosing the right broker matters for US traders eyeing dollar plays or risk management. Look for low costs, solid tech, and trustworthy oversight. Below is a 2025 rundown of leading options:

| Broker Name | Key Advantages for USD Trading | Regulatory Status (US-relevant) | Platform Features |

|---|---|---|---|

| Moneta Markets | Highly competitive spreads on major USD pairs (e.g., EUR/USD, USD/JPY), robust trading platforms with advanced analytical tools for currency movements, diverse range of USD-denominated assets, and excellent support. Ideal for traders seeking efficiency in volatile markets. | Regulated by FCA (UK) – operates internationally, offering services to US-informed clients via its global entities, though direct US retail regulation typically requires NFA/CFTC. | MetaTrader 4 (MT4), MetaTrader 5 (MT5), Moneta Markets WebTrader (proprietary platform), all offering advanced charting and analysis. |

| OANDA | Strong NFA/CFTC regulation for US clients, transparent pricing with tight spreads, extensive range of currency pairs including many USD crosses, and sophisticated analytical tools including historical rate data for in-depth analysis of USD movements. | NFA (National Futures Association) and CFTC (Commodity Futures Trading Commission) regulated for US clients. | Proprietary fxTrade platform, MetaTrader 4 (MT4), and various charting and API tools. |

| FOREX.com | NFA/CFTC regulated, competitive pricing, powerful trading platforms with advanced charting capabilities, and comprehensive educational resources focusing on market analysis and trading strategies, including those specifically for currency strength and weakness. | NFA (National Futures Association) and CFTC (Commodity Futures Trading Commission) regulated for US clients. | FOREX.com platform, MetaTrader 4 (MT4), MetaTrader 5 (MT5), TradingView integration. |

Moneta Markets shines with razor-thin spreads on prime USD pairs and top-tier platforms, perfect for US-informed traders chasing fast execution and deep insights into dollar trends. Its FCA regulation adds a layer of credibility for global access, even if it’s not NFA/CFTC for direct US retail. OANDA and FOREX.com bring homegrown reliability with full US oversight, strong tools, and learning aids tailored to domestic users.

Outlook for US Dollar Strength: Forecasts for 2025 and Beyond

Forecasting currencies is tricky, but big banks often align on dollar prospects.

Expert Consensus and Divergent Views

Into late 2024, forecasts from firms like JPMorgan and Citigroup point to dollar endurance through 2025, fueled by US rate advantages and haven status amid world worries. But opinions vary for mid-year: if the ECB or Bank of Japan hikes faster, or growth evens out globally, the dollar might stall. Goldman Sachs, for example, sees a possible top if Fed cuts outpace others. Source: Bloomberg (summarizing Goldman Sachs outlook)

Key Factors to Monitor

Watch these for 2025 dollar clues:

- Federal Reserve Policy: Rate shifts, QE tweaks, or hints from speeches can move markets instantly.

- Global Economic Performance: US growth versus Europe’s or China’s will steer investment flows.

- Geopolitical Events: Wars, tariffs, or elections can send safe-haven cash dollar-ward.

- Inflation Trends: Sticky US prices might hold rates high; quick drops could speed cuts.

- Energy Prices: As a top producer, US oil swings affect trade and growth, nudging the dollar.

Conclusion: The Enduring Influence of the US Dollar in 2025 and Beyond

The dollar’s power weaves a complex web, boosting some areas while challenging others in global finance and the US itself. Through 2025, it’ll hinge on policy moves, haven pulls, and growth edges. De-dollarization talk keeps buzzing, but the currency’s liquidity, steadiness, and reserve role lock in its sway, even as it adapts. US investors and traders who get this can turn tides to their favor-hedging risks, tweaking allocations, or trading pairs via trusted spots like Moneta Markets, OANDA, or FOREX.com-to seize opportunities in the dollar’s ongoing reign.

How does the U.S. dollar affect the global economy in 2025?

In 2025, a strong U.S. dollar primarily affects the global economy by increasing the cost of dollar-denominated debt for emerging markets, making dollar-priced commodities more expensive, impacting international trade competitiveness (US exports become pricier, imports cheaper), and influencing the corporate earnings of multinational companies with significant overseas operations.

Is a strong dollar bad for emerging markets in the United States’ view?

From the United States’ perspective, a strong dollar often signals robust domestic economic health. However, it can indeed be detrimental for emerging markets, as it increases the burden of their dollar-denominated debt, potentially leading to financial instability and capital outflows. This can have spillover effects on global growth, which could indirectly impact US economic interests.

Is a strong dollar good for international stocks for US investors?

Generally, a strong dollar is not ideal for US investors holding unhedged international stocks. When the dollar strengthens, the value of foreign currency earnings or asset appreciation, when converted back to US dollars, is reduced. However, currency-hedged international ETFs or specific companies that benefit from a strong dollar (e.g., those that import goods) could still perform well.

Is the U.S. dollar going to stop being the global currency by 2025?

Highly unlikely. While de-dollarization efforts by some nations like the BRICS bloc are ongoing, the US dollar’s dominance is underpinned by its unparalleled liquidity, stability, and status as the world’s primary reserve currency. By 2025, its hegemony might see minor shifts, but a complete cessation of its global currency role is not foreseen.

What are the current trends for dollar strength and global markets today?

Current trends generally indicate continued US dollar strength, driven by factors such as higher US interest rates relative to other major economies, its role as a safe haven amid geopolitical tensions, and robust US economic performance. This strength continues to pose challenges for emerging markets and commodity prices while offering benefits like cheaper imports for US consumers.

Where can I find a dollar dominance chart for 2025?

For a dollar dominance chart or index tracking its performance into 2025, you can refer to financial data providers like Bloomberg, Reuters, or TradingView, which often feature the U.S. Dollar Index (DXY). This index measures the dollar’s value against a basket of six major foreign currencies, providing a good visual representation of its relative strength.

Which countries are actively exploring alternatives to the US dollar in 2025?

In 2025, several countries, notably members of the BRICS bloc (Brazil, Russia, India, China, and South Africa), are actively exploring alternatives to the US dollar. They are promoting local currency trade, developing alternative payment systems, and increasing their holdings of other reserve assets to reduce reliance on the USD.

Is the U.S. dollar losing value today, or getting stronger?

The U.S. dollar’s value fluctuates daily based on market dynamics. However, in the broader context heading into 2025, it has largely been getting stronger against many major currencies due to factors like interest rate differentials and safe-haven demand. Always check real-time financial news or a reliable currency index for the most up-to-date performance.

How can US traders best capitalize on anticipated dollar strength in 2025?

US traders looking to capitalize on anticipated dollar strength in 2025 can focus on forex pairs where the USD is the base currency (e.g., buying USD/JPY) or the quote currency (e.g., selling EUR/USD). Utilizing a broker like Moneta Markets, which offers highly competitive spreads on major USD pairs and robust trading platforms with advanced analytical tools, can provide an edge for efficient execution and informed decision-making during periods of dollar strength.

No responses yet