Introduction: Navigating the Investment Landscape in the United States for 2025

American investors face a pivotal choice when deciding between stocks and bonds, as this decision forms the foundation of any solid portfolio. Heading into 2025, grasping the unique traits, risks, and opportunities of these essential investments has never been more important. With changing interest rates, ongoing inflation, and shifting market moods, the way stocks and bonds fit into a diversified strategy keeps evolving. This guide equips U.S. investors-whether you’re just starting out or fine-tuning your approach-with practical insights to make smart choices and secure a strong financial path in the domestic market.

By exploring the basics and comparing these assets head-to-head, you’ll gain clarity on how to align your investments with your goals amid the uncertainties of the year ahead.

What Are Stocks? Understanding Equity Ownership for US Investors

At their core, stocks give you a piece of ownership in a business. Purchasing shares means you own a small slice of the company, entitling you to a share of its assets and profits. In the U.S., investors see returns from stocks mainly in two ways.

- Capital Appreciation: This happens when the share price climbs, letting you sell for a profit over what you originally paid.

- Dividends: Companies share some of their earnings with owners, usually every quarter.

The U.S. stock market breaks down investments into several categories to help with diversification. Common shares often include voting rights and promise stronger growth, whereas preferred shares deliver steady dividends without a say in company decisions. You might also look at growth stocks from firms expected to ramp up earnings quickly, or value stocks from undervalued companies ripe for recovery. Size matters too-large-cap stocks feature big, stable players like S&P 500 giants, mid-caps offer a middle ground, and small-caps bring higher upside but more uncertainty. Knowing these options helps U.S. investors spread their equity bets effectively.

What Are Bonds? Debt Instruments in the United States Market

Bonds stand apart from stocks as loans you make to organizations. When a U.S. investor picks up a bond, they’re providing funds to a business, local government, or even the federal government. The issuer agrees to send back interest payments at a set rate, called the coupon, throughout the bond’s life, and repay the full amount borrowed at the end.

Returns come mostly from these sources:

- Interest Payments: Steady, usually fixed payouts to the lender.

- Principal Repayment: Getting back the original investment amount when the bond reaches maturity.

U.S. investors have several bond varieties to choose from:

- US Treasury Bonds: Backed by the federal government, these rank as the safest options available. They cover short-term Treasury bills, medium-term notes, and long-term bonds.

- Corporate Bonds: Companies issue these to fund operations, with risks tied to the borrower’s financial strength.

- Municipal Bonds (“Munis”): States and cities sell these, and they often come with tax-free interest for locals in that area-a big perk for U.S. taxpayers.

- Agency Bonds: Government-backed groups like Fannie Mae or Freddie Mac issue them, blending security with decent yields.

Stocks vs. Bonds: Key Differences for United States Investors in 2025

For U.S. investors building strategies in 2025, pinpointing the main contrasts between stocks and bonds is key to smart portfolio decisions that stand the test of time.

Ownership vs. Lending

The basic divide boils down to this: stocks make you a part-owner with rights to future profits and company resources. Bonds position you as a lender, ranking ahead of owners if things go south, like in a bankruptcy.

Risk and Volatility

Stocks carry more uncertainty and price swings, driven by business results, sector shifts, and economic headlines. Bonds, particularly top-tier government ones, deliver steadier performance and better protection of your initial capital. Though some corporate bonds involve credit worries, the overall bond market in the U.S. sees far less turbulence than stocks.

Potential Returns

Over the years, stocks have delivered stronger average gains than bonds, rewarding the extra risk with what’s known as the equity premium. Bonds yield more reliable but smaller returns via interest. In eras of low rates, those bond gains can feel especially limited.

Income Generation

Dividends from stocks can vary or dry up, depending on company fortunes. Bond interest, on the other hand, flows regularly and predictably, appealing to U.S. investors who prioritize steady cash flow.

Liquidity and Market Sensitivity

In U.S. markets, both assets trade easily for the most part. Stocks, however, jump at earnings news, economic updates, or global events. Bond values, especially fixed-rate ones, hinge on interest rate moves-rising rates push prices down, and falling rates lift them up.

Inflation and Interest Rate Sensitivity

These factors hit hard in the 2025 U.S. economy.

- Stocks: In the long run, they can counter inflation as business revenues and values adjust upward. That said, surging inflation often triggers rate hikes, raising costs for companies and pressuring stock prices by discounting future profits.

- Bonds: Inflation eats into the real value of fixed payments and principal. Higher rates also drop the worth of bonds already out there, since new ones pay more. With recent inflation and Fed actions in mind, this remains a top watch point for American investors.

| Feature | Stocks | Bonds |

|---|---|---|

| Nature of Investment | Equity ownership in a company | Loan to a company or government |

| Primary Return Source | Capital appreciation, dividends | Interest payments (coupon), principal repayment |

| Risk Level | Higher (market volatility, company specific) | Lower (interest rate risk, credit risk, inflation risk) |

| Volatility | Higher | Lower |

| Claim on Assets (Bankruptcy) | Residual claim (after creditors) | Senior claim (before shareholders) |

| Inflation Sensitivity | Potential long-term hedge, but short-term impact from rate hikes | Fixed-income negatively impacted by rising inflation |

| Interest Rate Sensitivity | Indirect (affects borrowing costs, valuations) | Direct (inverse relationship with bond prices) |

Pros and Cons of Investing in Stocks for US Investors in 2025

Stocks draw U.S. investors with their shot at building serious wealth, though the risks are real and demand careful thought.

Advantages

- High Growth Potential: These investments shine for long-term gains, especially in dynamic U.S. sectors like tech and innovation, multiplying your money over decades.

- Potential Long-Term Hedge Against Inflation: As prices rise economy-wide, so do company profits and stock values, safeguarding your wealth’s buying power.

- Diverse Industry Exposure: From healthcare to energy, the U.S. market lets you tap into countless areas for smarter diversification.

- Liquidity: Big-name stocks trade effortlessly, so entering or exiting positions is straightforward.

Disadvantages

- Higher Volatility and Risk of Capital Loss: Prices can plunge sharply in tough times, potentially wiping out much of your stake if you’re not prepared.

- Requires More Research and Monitoring: Picking winners takes effort in studying firms and watching trends, but index funds or ETFs simplify this for hands-off approaches.

- Susceptible to Market Downturns: Recessions, international tensions, or industry slumps can drag down even spread-out holdings across the board.

Pros and Cons of Investing in Bonds for US Investors in 2025

In a U.S. portfolio, bonds often anchor the steadier side, focusing on reliable income and lower drama.

Advantages

- Greater Stability and Capital Preservation: With fewer ups and downs, bonds keep your money safer and form a reliable base.

- Reliable Income Generation: Those consistent interest checks suit folks in retirement or anyone needing steady payouts without surprises.

- Valuable Diversification Benefits: When stocks falter, bonds frequently rise, softening the blow and cutting total risk.

- Lower Risk of Default for High-Quality Bonds: Treasuries from the U.S. government basically eliminate default worries, adding real security.

Disadvantages

- Lower Returns Compared to Stocks: The trade-off for calm is modest growth, which might lag inflation in low-rate stretches over many years.

- Susceptibility to Interest Rate Risk: Rate increases hurt the resale value of bonds you hold, a factor to track closely with the Fed’s 2025 moves.

- Inflation Risk: If prices climb faster than your fixed rate, your real gains shrink noticeably.

- Credit Risk: Not all bonds are equal-corporate or muni ones could falter if the issuer struggles, unlike rock-solid Treasuries.

Asset Allocation and Diversification: Balancing Stocks and Bonds in Your US Portfolio

Getting the right blend of assets and spreading risks is essential for U.S. investors chasing goals without unnecessary exposure. Stocks and bonds work together seamlessly in this mix.

The Complementary Role of Each Asset Class

Think of stocks as the driver for expansion and higher returns, while bonds handle the steady income and shock absorption. Combining them lets you chase growth without wild swings, using bonds as a buffer in stormy markets.

Factors Influencing Your Allocation

Your perfect stock-bond split varies by person, shaped by these elements:

- Age: Early-career folks can afford more stocks for recovery time after dips, while those nearing retirement tilt toward bonds to protect and generate cash.

- Risk Tolerance: If market drops keep you up at night, amp up bonds; thrill-seekers might go heavier on stocks.

- Specific Financial Goals: Whether it’s a home purchase, college fund, or nest egg, your timeline and needs guide the balance.

- Investment Time Horizon: Quick goals under five years scream for bond-heavy caution; longer vistas allow stock-driven boldness.

Common Allocation Strategies

No universal formula exists, but these guidelines help:

- The 60/40 Portfolio: Split 60% stocks for push and 40% bonds for pullback-tweak as life changes.

- Age-Based Rules: Try 100 or 110 minus your age for stock percentage; a 40-year-old might aim for 60-70% equities.

- Modern Portfolio Theory (MPT): This approach spreads investments to max returns at your risk level or min risk for desired gains.

Rebalancing Your Portfolio

Markets shift allocations over time, so check in regularly. Sell high performers and buy underdogs to reset to your targets, keeping risk in check and avoiding lopsided exposure. FINRA offers solid tips on this for U.S. folks.

When to Choose Stocks vs. Bonds: A Strategic Guide for United States Investors in 2025

Rather than picking sides forever, U.S. investors adjust based on life stage and economic signals for the best results.

Prioritizing Growth vs. Preservation

Aiming for big wealth buildup with time on your side and stomach for ups and downs? Stocks fit for goals like distant retirement. Need safety, regular pay, and calm-say, for a near-term house buy or post-work income? Bonds take the lead there.

The US Economic Outlook for 2025

What’s ahead economically will tip the scales. Keep an eye on:

- Projected Interest Rates: Fed hikes for inflation control boost new bond appeal but ding old ones; cuts could value up your current holdings.

- Inflation Trends: Sticky high prices hurt bond real yields, pointing toward TIPS or stocks that might outpace it.

- Overall Market Conditions: Strong growth vibes favor equities; recession whispers boost safe bets like Treasuries.

Track updates from the Federal Reserve and trusted experts to stay ahead.

Matching Investments to Time Horizons

Sync your picks with deadlines: brief ones lean on low-drama options like short bonds or CDs; extended ones embrace stocks’ rebound power.

What Does Warren Buffett Say About Bonds?

The investing legend Warren Buffett leans toward businesses (stocks) over bonds, particularly when rates lag inflation. He sees low-yield bonds as a slow erosion of value, better for short-term safety than long-haul growth. Still, he gets their place in stabilizing certain setups, but his core bet stays on owning top companies that build real wealth.

Choosing an Investment Broker in the United States for 2025

Finding the right broker unlocks your stock and bond plans-look for one blending ease, low costs, and trustworthiness.

Key Considerations for US Investors

Prioritize these when shopping around:

- Regulatory Compliance: Stick to SEC oversight, FINRA membership, and SIPC coverage for protection.

- Fee Structures: Scrutinize trade commissions, upkeep costs, and extras.

- Platform Features: Seek user-friendly designs, charts, apps, and pro tools if you’re advanced.

- Available Investment Products: Ensure stocks, bonds (singles, funds, ETFs), and extras like CFDs for variety.

- Research Tools & Education: Valuable intel, reports, and learning materials boost your edge.

- Customer Support: Quick, expert help when you need it.

Top Investment Platforms for US Investors in 2025

1. Moneta Markets

Moneta Markets, which holds an FCA license, appeals to U.S. investors wanting versatile, cost-effective trading, especially via CFDs on key indices and U.S. stocks. While direct equity buys often route through standard brokers for retail clients, Moneta Markets excels in speculative access and portfolio add-ons through CFDs. Traders value its low fees, MetaTrader 4 and 5 support, and broad markets. With top-notch education and service, it’s ideal for those building diverse strategies efficiently.

2. OANDA

OANDA, a top U.S.-regulated forex player, extends to CFDs on indices, commodities, and select stocks. Its advanced tools suit active users, backed by clear pricing and strong compliance-perfect for regulation-focused analytical trading.

3. IG

With a solid U.S. footprint, IG covers forex, indices, and options via cutting-edge tech and research. It’s great for pros diversifying beyond basics into varied assets.

Disclaimer: Investment offerings and regulatory considerations can vary for US clients, and investors should always verify product availability and suitability directly with the chosen broker. CFDs carry a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

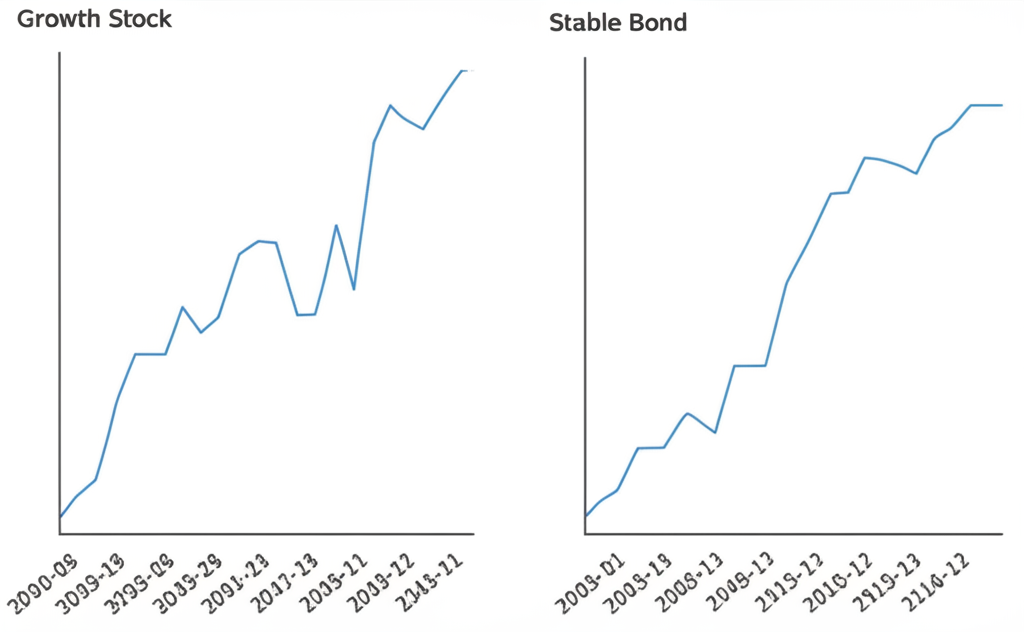

Historical Performance: Stocks vs. Bonds in the United States (Last 30 Years)

Looking back provides perspective, but remember, history isn’t a promise. In the U.S. over three decades, stocks have consistently beaten bonds for long-term gains, thanks to that risk premium. Indices like the S&P 500 show far higher yearly averages than Treasuries across long stretches.

Yet bonds shine in crashes, acting as buffers during recessions when stocks tank. Their opposite movement-or at least weak link-to equities makes them vital for smoothing rides and guarding capital, a lesson etched in the last 30 years for American portfolios.

Conclusion: Crafting Your Investment Strategy in the United States for 2025

Stocks and bonds aren’t rivals; they’re partners in a smart setup. For 2025 U.S. investors, watching inflation and rates highlights the need for balance. Your ideal mix hinges on goals, comfort with risk, and timelines. Mastering their ins and outs lets you diversify wisely and tackle the markets with confidence. Keep learning and consult pros for advice fitted to your situation and the U.S. scene.

Frequently Asked Questions (FAQ) about Stocks and Bonds in the US

Are bonds better than stocks for US investors in 2025, considering the current economic outlook?

Neither bonds nor stocks are definitively “better” for all US investors in 2025; their suitability depends on individual goals, risk tolerance, and time horizon. With potential shifts in interest rates and ongoing inflation concerns, bonds may offer stability and income, while stocks provide greater growth potential. A balanced portfolio typically incorporates both to achieve diversification and manage risk effectively.

What is an example of a bond that a typical US investor might consider adding to their portfolio?

A typical US investor might consider adding a US Treasury bond or a high-quality corporate bond to their portfolio. US Treasury bonds are backed by the full faith and credit of the US government, offering very low credit risk. Corporate bonds, issued by companies, offer higher yields but come with varying levels of credit risk depending on the issuer’s financial health.

When is the ideal time to buy bonds vs. stocks for US investors with different financial goals?

US investors typically buy bonds when seeking capital preservation, predictable income, or reducing portfolio volatility, especially for shorter-term goals or as they approach retirement. Stocks are generally favored for long-term growth objectives (10+ years), when investors have a higher risk tolerance and can weather market fluctuations. The ideal time often involves balancing these needs within a diversified strategy.

What are the main pros and cons of stocks vs. bonds for beginners in the United States?

For beginners in the US, stocks offer higher growth potential but come with greater volatility and risk of loss. Bonds provide more stability and predictable income but generally lower returns. A balanced approach, often through diversified funds like ETFs that hold both stocks and bonds, is usually recommended to help beginners understand market dynamics while managing risk.

Which is generally better for long-term wealth growth: stocks or bonds in the US market?

For long-term wealth growth in the US market, stocks have historically outperformed bonds. The equity risk premium means that over extended periods (e.g., 10+ years), the higher returns from stocks typically compensate for their increased volatility. However, bonds play a crucial role in reducing overall portfolio risk and preserving capital, making them an important component of a balanced long-term strategy.

What does Warren Buffett say about bonds and their role in an investment portfolio today?

Warren Buffett generally favors productive assets (stocks) over fixed-income investments (bonds) for long-term wealth creation, especially when bond yields are low and inflation is a concern. While he acknowledges that bonds can provide stability for certain investors or portfolio segments, his primary investment philosophy focuses on owning stakes in quality businesses that can grow and generate earnings over time, thereby preserving purchasing power.

Do “Bonds vs stocks reddit” discussions offer reliable advice for average US investors?

Discussions on platforms like Reddit can offer diverse perspectives and personal experiences regarding bonds vs. stocks, but they should not be considered reliable financial advice for average US investors. Information on Reddit is often anecdotal, not vetted, and may not be suitable for your specific financial situation. Always consult with a qualified financial advisor or conduct thorough research from reputable sources before making investment decisions.

What bonds have a 10 percent return, and are these realistic expectations for US investors?

Bonds with a consistent 10 percent return are extremely rare and generally not a realistic expectation for typical US investors, especially for high-quality, investment-grade bonds. Such high yields usually indicate significant credit risk (junk bonds) or market anomalies. While some niche bonds or high-yield instruments might offer higher returns, they come with substantially increased risk of default. For active traders seeking to potentially capitalize on market movements for higher returns, platforms like Moneta Markets offer CFDs on various global indices and popular US stocks, which can provide leveraged exposure and the opportunity for speculative gains, though this also involves higher risk.

No responses yet