Introduction: The Final Frontier of Investment for United States Portfolios in 2025

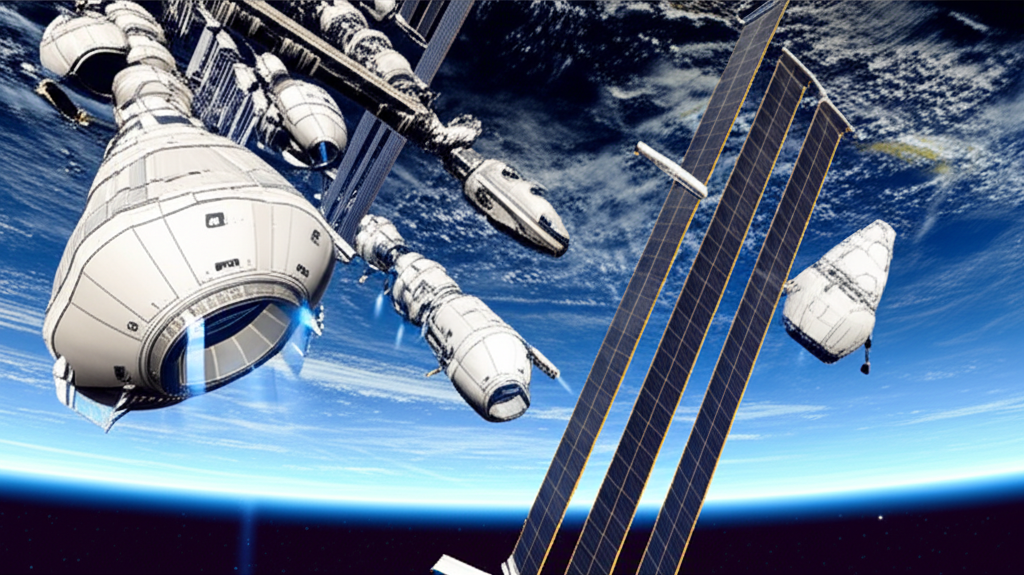

Space, long reserved for government missions and scientific pursuits, has evolved into a thriving commercial landscape. The space economy, which covers every aspect of space-related activities, is surging ahead thanks to cutting-edge technology and rising private funding. For investors in the United States eyeing sustained growth, this sector in 2025 and the years to come offers intriguing possibilities, though it comes with its share of intricacies. This guide arms U.S. residents with essential insights and practical steps to grasp and possibly tap into this expanding field, weighing both conventional and innovative ways to invest.

What Exactly is the Space Economy, and Why Does it Matter to US Investors?

The space economy forms a wide-ranging network that spans the production of space hardware and the delivery of services powered by space tech. Experts typically divide it into two core areas:

- Upstream: These are Earth-based efforts that support space missions, including building rockets, assembling satellites, developing ground equipment, and handling launches.

- Downstream: This area focuses on the outcomes from space infrastructure, such as satellite broadband, imagery for Earth monitoring, GPS systems, and manufacturing done in orbit.

Within this ecosystem, standout areas include satellite networks, environmental monitoring from space, tourist trips beyond Earth, mining asteroids, producing materials in space, and defense-related space projects. The sector’s scale is ballooning; according to The Space Foundation, the worldwide space economy expanded 8% in 2022, hitting $546 billion. In the U.S., this boom fuels fresh ideas, creates jobs, and bolsters national edge, positioning it as a critical focus for the economy and investments heading into 2025.

The Driving Forces Behind Space Economy Growth in the United States (2025)

A handful of influential factors are accelerating the space economy’s rise, especially in the U.S.:

- Technological Advancements: Breakthroughs in reusable launch vehicles, smarter AI systems, compact satellites, and better engines are slashing costs and streamlining access to space.

- Decreasing Launch Costs: Pioneers like SpaceX have upended the industry by cutting the price tag on orbital deliveries, paving the way for more businesses to join in.

- Increased Private Sector Investment: A flood of venture capital and private equity into space ventures has sparked a lively scene for new ideas and market-ready products.

- Government Initiatives and Funding: NASA and the U.S. Space Force remain key players, providing funds for missions and defense while building bridges between public agencies and private firms to speed up progress.

- Growing Demand for Space-Based Services: Needs are climbing for things like worldwide high-speed internet through projects like Starlink, plus tools for farming with pinpoint accuracy and tracking climate changes-all powered from orbit.

These elements not only highlight the sector’s momentum but also underscore why U.S. investors might find it appealing, as domestic leadership in these areas could yield substantial returns over time.

Key Investment Avenues for United States Investors in the Space Economy

U.S. investors entering this arena have multiple paths, each with its own balance of potential gains and uncertainties.

Publicly Traded Companies (Stocks)

Buying shares in space-involved firms provides straightforward entry for many.

- Major Aerospace and Defense Contractors: Giants such as Lockheed Martin, Northrop Grumman, Boeing, and Raytheon secure ongoing deals with NASA and the Department of Defense, diving deep into satellites, launch tech, and cutting-edge security tools.

- Pure-Play Space Companies: More firms are zeroing in solely on space, like Virgin Galactic for tourist flights, Rocket Lab for launches and small satellites, and Viasat for communication networks.

- Companies Providing Essential Components/Services: For broader involvement, consider suppliers of vital parts, such as chip makers, firms analyzing satellite data for intelligence, or specialists in high-tech materials used in space gear.

This approach lets investors back established players while eyeing emerging ones, though tracking earnings reports and sector news is key to staying informed.

Space-Focused Exchange-Traded Funds (ETFs)

ETFs deliver a spread-out stake in the space world, letting U.S. investors cover multiple companies without deep dives into each one. They follow benchmarks tied to space ventures, satellite ops, and connected fields. Standouts are the ARK Space Exploration & Innovation ETF (ARKX) from Cathie Wood and the Procure Space ETF (UFO). Such funds spread out risks tied to single firms and rely on expert management, simplifying entry into this dynamic market.

Private Equity and Venture Capital (for accredited investors)

Qualified U.S. investors can tap into private funds targeting nascent space outfits through equity deals or venture bets. These hold promise for big payoffs if startups thrive, but they involve steeper risks and less liquidity. Joining space-tech focused funds means getting in on game-changing ideas early, ahead of any public listings.

Global Platforms for Derivatives & Indirect Exposure (Where Applicable for US Investors)

U.S. rules generally bar residents from trading Contracts for Difference (CFDs) on domestic stocks, yet certain international brokers provide other tools for sidelong views into space trends. This could mean CFDs on worldwide tech indexes, commodities like rare earths vital for space hardware, or approved overseas stocks. These let suitable investors wager on value shifts without holding assets outright, adding options and leverage-though risks ramp up accordingly.

Top Investment Platforms for Space Economy Related Assets in 2025 (United States Focus)

Selecting the best platform matters a lot for U.S. investors aiming to connect with space opportunities. Below is a rundown of top choices that align with American rules, highlighting ways to reach relevant investments.

#1: Moneta Markets

Moneta Markets shines with its extensive lineup of international options that can indirectly link to space economy influences. Holding an FCA license, it’s a solid pick for eligible users, including those in the U.S. navigating allowed global assets. It features:

- Diverse Global Instruments: U.S. residents can’t trade CFDs on American stocks here, but the platform opens doors to global indexes, raw materials, and foreign shares-think tools connected to tech booms or key space materials for a roundabout stake.

- Competitive Spreads: Tight pricing helps frequent traders keep costs down.

- Advanced Trading Platforms: It supports top-tier MetaTrader 4 (MT4) and MetaTrader 5 (MT5) setups, complete with powerful charts, indicators, and trading bots.

- Strong Customer Support & Educational Resources: Round-the-clock help and learning tools make it approachable for beginners and pros alike when venturing into worldwide markets.

#2: OANDA

OANDA earns praise as a reliable broker with firm U.S. oversight, best known for currency trading.

- US Regulatory Compliance: It follows all American financial guidelines closely, building trust for local users.

- User-Friendly Platform: The custom interface is straightforward, ideal for newcomers.

- Competitive Pricing: Low spreads on currency pairs and permitted CFDs-like those on global benchmarks or goods-can tie into tech and manufacturing shifts affecting space, within U.S. limits.

- Robust Research Tools: In-depth analytics and reports keep users ahead of market shifts.

For U.S. investors, OANDA’s focus on compliance makes it a safe hub for exploring related areas without overstepping boundaries.

#3: IG

IG leads in digital trading, serving clients globally with a vast selection.

- Extensive Market Range (Globally): It covers thousands of options, from currencies and indexes to commodities and stocks, helping U.S. users spot international assets or benchmarks that mirror space economy currents.

- Advanced Charting and Platform Features: Packed with pro-level tools, including detailed graphs, indicators, and order options for savvy traders.

- Long-Standing Reputation: Years of operation have cemented its status for dependability and variety.

- Strong Educational Content: Plenty of guides and tutorials demystify markets and tactics.

Risks and Challenges in Space Economy Investing for United States Investors

The upside in space investments is clear, but pitfalls abound for U.S. participants:

- High Volatility and Speculative Nature: Early-stage firms and reliance on unproven tech often spark wild price changes.

- Regulatory Hurdles and Geopolitical Risks: Strict oversight and international disputes can disrupt partnerships, delays launches, or limit access.

- High Capital Requirements and Long Development Cycles: Space projects demand massive outlays and extended timelines, delaying profits for years.

- Limited Number of Pure-Play Companies: Publicly traded space specialists remain few, complicating broad direct bets.

- Technological Failures and Operational Risks: Mishaps like launch flops or satellite glitches can trigger heavy losses and erode confidence.

Navigating these calls for caution, perhaps starting small and monitoring developments closely.

Crafting Your Space Investment Strategy: A 2025 Roadmap for US Investors

Building a smart plan is essential in this evolving field:

- Diversification within the Space Sector: Spread investments across niches like propulsion, communications, and travel, mixing big and small players to cushion blows.

- Long-Term vs. Short-Term Outlook: The sector’s growth phase favors patient approaches; quick trades amplify dangers.

- Due Diligence and Research: Scrutinize firms’ tech, strategies, and prospects, plus rivals and rules shaping the industry.

- Considering Ethical and ESG Aspects: Weigh how companies handle sustainability, like reducing orbital junk or fair workforce standards, to align with broader values.

- Consulting with Financial Advisors: For bigger moves, pros can tailor advice to your goals and comfort with uncertainty.

This framework helps turn excitement into measured action.

The Future of the Space Economy: Projections for the United States Beyond 2025

Looking past 2025, the space economy promises steady expansion and game-changing advances. Deloitte forecasts the global figure surpassing $1 trillion by 2030. Watch for:

- Emergence of New Technologies: Advances in orbital energy harvesting, pulling resources from asteroids, zero-gravity production, and even early steps toward deep space journeys.

- Increased Commercialization and Accessibility: Everyday uses will grow, from seamless global web access to sharper weather predictions and supply chain tweaks.

- Potential for Disruptive Innovation: Surprise breakthroughs could upend sectors and birth fresh opportunities overnight.

- The Role of the United States as a Leader in Space: Backed by powerhouse privates, hefty NASA budgets like Artemis, Space Force efforts, and a fertile startup culture, America stands ready to dominate exploration and business in orbit.

These shifts could redefine U.S. economic strengths, rewarding forward-thinking investors.

Conclusion: Launching Your Portfolio into the Space Economy

For U.S. investors, the space economy in 2025 and later stands as a thrilling frontier brimming with profit potential. Options range from legacy aerospace leaders to nimble newcomers and targeted ETFs, creating a rich menu of choices. Sure, the field’s youth and tech demands bring hurdles, but solid homework, varied holdings, and a patient stance can temper them. Grasping the momentum, scouting paths, and staying diligent lets Americans gear up to ride the wave of our push into the cosmos.

Frequently Asked Questions (FAQs) About Space Economy Investing for US Investors

Is space economy a good investment for US residents in 2025?

Yes, the space economy looks promising as a high-growth area for U.S. residents, fueled by tech progress and business expansion. That said, its ups and downs make it best for those comfortable with risk and focused on the long game. Digging deep and spreading bets are musts.

What are the best space stocks to invest in for United States citizens?

The top picks vary by your aims and risk level. U.S. citizens might eye big defense firms like Lockheed Martin or Northrop Grumman, dedicated space players such as Virgin Galactic or Rocket Lab, or support tech providers. Blending several or picking an ETF often works well for balance.

Is there a space exploration ETF available to US investors?

Absolutely, U.S. investors have access to ETFs centered on space. Favorites include the ARK Space Exploration & Innovation ETF (ARKX) led by Cathie Wood and the Procure Space ETF (UFO), which bundle companies in satellites, launches, tourism, and more for a well-rounded view.

What are the risks associated with space economy investing in the US market?

Risks cover sharp swings, bets on untested startups, huge funding needs, drawn-out timelines, global tensions, rule changes, and tech glitches. Be ready for bumps and market jolts in this arena.

How can individual investors in the United States get started with space investing in 2025?

To kick off, U.S. individuals should:

- Study public space firms and their prospects.

- Opt for space ETFs to build diversity easily.

- Look at brokers like Moneta Markets for side-angle access to global trends tied to space, respecting U.S. CFD rules.

- Team up with a financial advisor to weave these into your full plan.

What are the long-term projections for the space economy’s growth in the US?

Outlook is bright, with the global space economy on track to top $1 trillion by 2030. The U.S. will likely lead, thanks to steady federal support, private ingenuity, and rising uses in satellites, travel, and mining ventures.

Can I buy SpaceX stock in the United States currently?

Not yet-SpaceX stays private, so its shares aren’t on open markets for everyday U.S. buyers. Only insiders or big institutions access them via private channels, but a public debut could open doors down the line.

Which forex brokers offer indirect exposure to space economy related assets for US investors?

Direct CFDs on U.S. stocks are off-limits for Americans, but brokers like Moneta Markets, OANDA, and IG provide indirect routes. For example, Moneta Markets gives eligible U.S. users CFDs on international indexes, commodities, and non-U.S. stocks linked to tech and industry waves in space-all within regulatory bounds-for betting on wider shifts.

What are the key sectors within the space economy for investment consideration?

Prime areas to watch:

- Satellite Communication: Enabling fast global data and connectivity.

- Earth Observation: Delivering insights for weather, farming, and security.

- Launch Services: Crafting rockets and handling transport to space.

- Space Tourism: Offering paid trips to suborbital or full orbits.

- In-Space Manufacturing: Building products away from Earth’s gravity.

- Resource Extraction: Tapping asteroids or the moon for materials (still developing).

How does the United States government support space economy growth?

The U.S. government bolsters the sector via:

- Generous NASA budgets for missions like Artemis.

- Defense allocations through the Space Force.

- Collaborations between public and private entities to spur innovation.

- Rules ensuring safe commercial space ops.

- Contracts and grants to firms advancing space tech.

No responses yet