For US investors focused on building lasting wealth, getting a handle on stock market cycles goes far beyond theory-it’s a key part of crafting smart strategies. As we head into 2025, the US economy’s ups and downs create opportunities for those who can spot these patterns, leading to better choices and tougher portfolios against shocks. This guide dives deep for everyone from newcomers to seasoned players, covering what drives these cycles, why they matter in today’s American scene, and hands-on tips to handle the twists unique to our markets. We’ll skip the surface-level stuff and blend in current economic vibes, dig into pro-level tools for analysis, and share real-world ways to steer through volatility.

Grasping these rhythms helps investors time their moves with broader trends, dodging pitfalls and capitalizing on growth phases. With inflation cooling and tech innovations reshaping sectors, 2025 offers a mix of promise and caution-understanding cycles lets you position accordingly for steady gains.

What Exactly Are Stock Market Cycles? A US-Centric Definition

Stock market cycles capture the sweeping, extended waves of growth and pullback that shape the broader US market over time. These aren’t the quick dips from headlines or trader moods; they stretch across months or years, tied to deep changes in the economy, company profits, and how investors feel overall. For folks investing in the United States, spotting these patterns is vital since they touch every corner-from stocks to bonds-and guide everything from retirement plans to short-term trades. Overlook them, and you risk mistimed buys or sells; tune in, and you can sync your moves with the economy’s pulse, paving the way for solid wealth growth.

The Four Stages of the Stock Market Cycle: A 2025 US Perspective

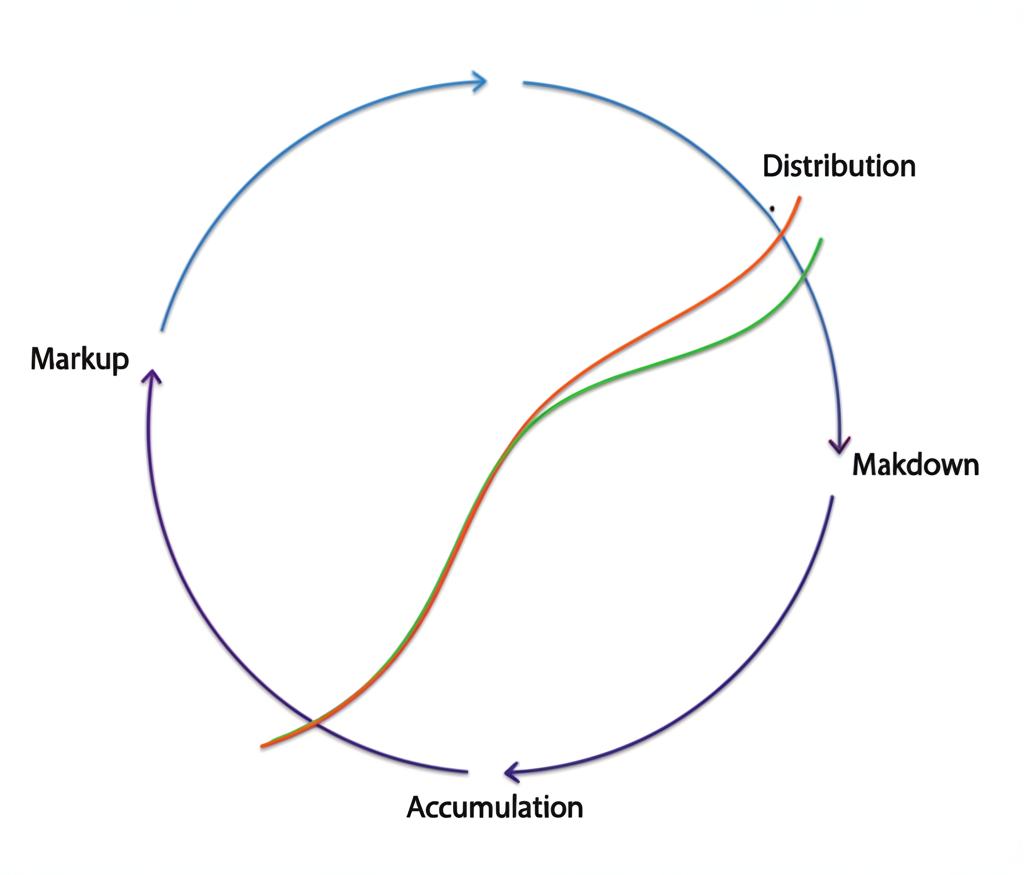

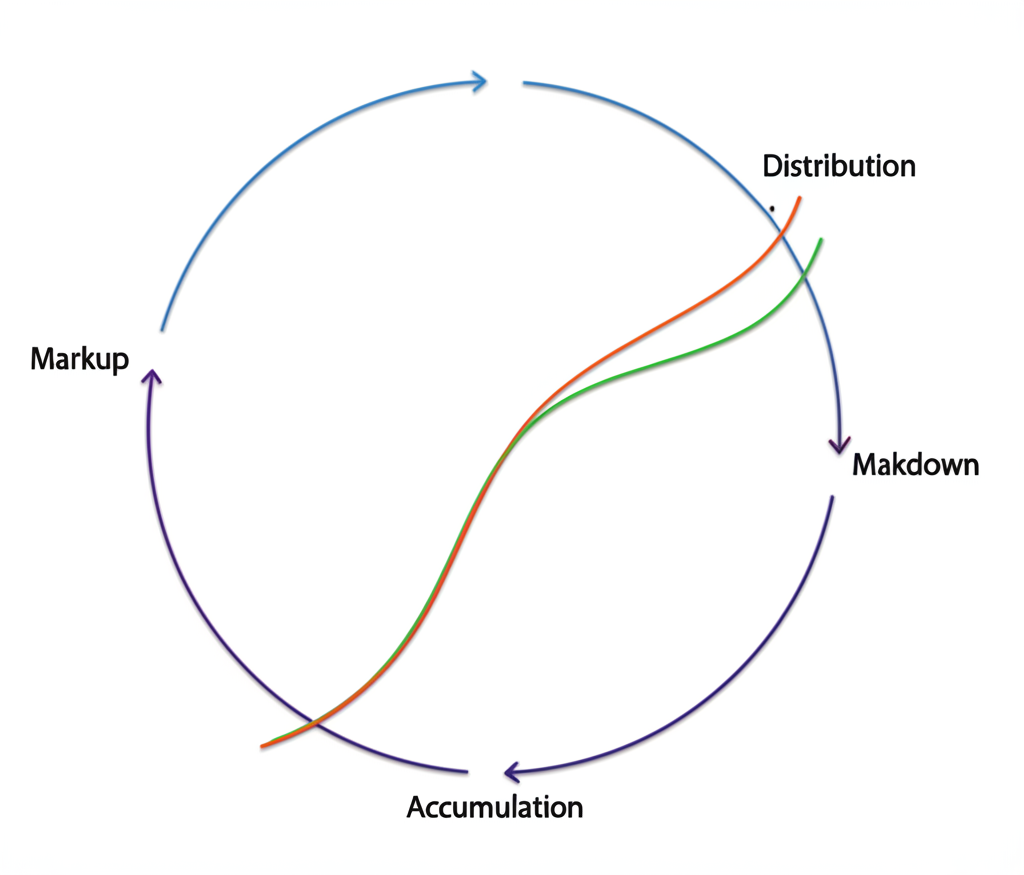

Experts usually divide stock market cycles into four clear stages, each with its own economic backdrop, crowd psychology, and price action. Picture a looping graph that maps out how markets rise, peak, fall, and recover-it’s a visual reminder of the market’s natural flow.

Phase 1: Accumulation (The Foundation of Growth)

Right after a rough bear market, this stage kicks off with bargain-basement prices and a cloud of gloom hanging over investors. Many are still licking wounds from losses, staying cautious. But the pros-institutions and sharp-eyed individuals-start snapping up shares on the cheap, building holdings they see as undervalued gems.

- Distinct Characteristics: Rock-bottom stock prices, quiet trading at first, nonstop bad headlines, widespread doubt or outright fear, and major indexes hitting a floor before inching up.

- Typical US Economic Indicators: Cheap borrowing costs from low interest rates, hints of steadying like dropping jobless claims or slight upticks in factory output, though GDP might lag or shrink. The Fed often keeps things loose with easy-money policies to nudge recovery.

- Prevailing Investor Behavior: A savvy few dive in early, while most hang back, unconvinced the tide has turned.

Phase 2: Markup (The Bull Run)

With the economy picking up steam and businesses posting better numbers, confidence starts to build. Prices climb steadily, trading picks up, and the good vibes draw in everyday investors, fueling a classic upward surge.

- Key Characteristics: Steady climbs in stock values, busier exchanges, budding positivity, healthier company books, and an economy gaining traction. Doubt fades into excitement as more join the party.

- Specific US Economic Growth Signals: Robust GDP numbers, jobs market tightening with lower unemployment, shoppers opening wallets, profits swelling for firms, and maybe the Fed eyeing tighter reins if prices heat up.

- Relevant Momentum and Technical Indicators: Trend lines sloping up, prices busting through old highs, and broader participation as more stocks join the rally.

Phase 3: Distribution (Peak and Transition)

Here, the rally loses steam-prices bounce around but can’t push much higher, even with heavy action on the volume front. The big players start cashing out, offloading to enthusiastic crowds chasing the last gains.

- Defining Characteristics: Prices topping out with wild swings in a narrow band, high volume but no big advances, spiking ups and downs, everyone piling in amid buzz and FOMO, while insiders sell into the strength.

- Signs of Potential Market Overheating within the US Context: Sky-high price-to-earnings multiples, bubbles in hot areas like meme-driven trades or IPO rushes, inflation climbing, and the Fed possibly hiking rates to cool things off.

- Indicators Signaling a Potential Market Reversal: Mismatches where prices look strong but oscillators like RSI weaken, more executives dumping shares, and data pointing to cooling growth.

Phase 4: Markdown (The Bear Market)

Declines hit hard and stick around, blanketing the market in dread as sellers dominate and panic sets in, forcing many to cut losses at any cost.

- Prominent Characteristics: Steep, ongoing drops in prices, souring moods, frenzied unloading, and volumes thinning as caution rules.

- Specific US Recessionary Signals and Their Economic Impact: Yield curves flipping upside down, factory orders drying up, job losses mounting, spending stalling, and the NBER calling a recession. These hit profits, trust, and the whole system’s balance.

- The Tangible Effect on Investor Portfolios: Heavy hits to holdings, especially in flashy growth names or puffed-up assets-this stage really challenges your staying power and comfort with risk.

Driving Forces Behind Stock Market Cycles in the United States

To stay ahead of turns, it’s worth unpacking what powers these cycles-knowing the roots helps you react wisely.

- Macroeconomic Factors: The US economy’s vitality sets the pace. Gross Domestic Product (GDP) gauges the big picture of output and activity. Inflation rates squeeze or boost buying power and business expenses, steering Fed moves. Interest rate policies from the central bank ripple through loans for companies and households, shaping spending and bets. Booming times spark markups; slumps invite markdowns.

- The Profound Influence of Investor Psychology: How the crowd feels-swinging between caution and hype-often magnifies swings. Bull runs breed overpricing from unchecked enthusiasm; bears carve deep discounts from raw fear, sometimes way out of line with real data. This emotional rollercoaster speeds up the whole process.

- Government and Central Bank Policy: Fed actions on rates, bond buys, or sales flood or drain cash into markets, tweaking appetites for risk. Washington’s budget choices, like tax breaks or big builds, can rev or brake growth too. Take the Fed’s inflation fight in 2022-2023-it shook prices and outlooks across assets.

- The Impact of Rapid Technological Advancements: Breakthroughs spawn fresh sectors, amp efficiency, and lift the economy, sometimes stretching bull phases. But they can also wipe out old ways, hitting industries hard or speeding corrections. AI’s boom in 2024-2025 shows how tech can rewrite market rules on the fly.

- How Significant Global Events Reverberate Through and Affect the US Market: Even with a home-field focus, global ripples hit hard-think trade spats, wars abroad, health crises, or slumps in key partners. They breed doubt, snag supplies, dent earnings, and nudge US cycles off course.

Navigating Stock Market Cycles: Strategies for US Investors in 2025

Handling the market’s wild rides calls for steady habits and flexibility. Timeless basics hold strong no matter the phase, but tweaking for the moment sharpens your edge.

- Core General Investment Principles:

- Dollar-Cost Averaging: Drop in set amounts on a schedule, come rain or shine. It smooths out costs by grabbing more when cheap and less when pricey, averaging into a win over time.

- Strategic Diversification: Spread bets across stocks, sectors, and spots worldwide to cushion blows from any one area.

- Regular Portfolio Rebalancing: Check in often to reset your mix-trim winners, add to laggards, locking in gains while buying dips.

- Underscoring the Critical Importance of Adopting a Long-Term Investment Perspective: Day-to-day noise can rattle anyone, but zooming out lets you weather storms and tap the market’s long climb upward. Sticking it out pays off big.

- Fundamental Risk Management Techniques: Nail down your aims, gauge how much risk you stomach, set stop-losses where they fit, and steer clear of too much debt-these guard your nest egg.

Tailored Strategies for Each Cycle Phase

A forever horizon matters, but fine-tuning for the now can boost yields and cut dangers.

- Accumulation: Hunt bargains in solid firms priced under their worth. Ramp up stock stakes, zeroing on those with deep pockets and steady cash, as floors form.

- Markup: Go with the flow-hold growth plays and hot sectors. Lock in chunks of profit from stretched runs, but don’t bolt too soon.

- Distribution: Dial back boldness. Pare risky bets, hoard cash, or shift to safe havens like utilities and staples. Pros might short or use bear funds, but that’s high-stakes.

- Markdown: Shield what’s yours-lean into bonds or cash. Long-haul types can use this dip to average down into keepers, prepping for the rebound.

The Enduring Role of Diversification and Asset Allocation

Building a portfolio that bends but doesn’t break is non-negotiable for American investors.

- Practical Advice on Constructing a Resilient Portfolio: Don’t stop at equities-blend for balance.

- Exploring Various Asset Classes:

- Stocks: Prime for upside, but bumpy rides come with the territory.

- Bonds: Steady earners that shine when stocks stumble.

- Real Estate: Adds variety and fights inflation through property plays.

- Commodities: (e.g., gold, oil) Serve as buffers against rising costs or turmoil.

- Effective Portfolio Rebalancing Strategies: Scan your setup quarterly or yearly. If equities ballooned, trim and feed the rest to keep risks in check-this keeps you on track for goals.

Advanced Insights for US Investors: Beyond the Basics of Market Cycles

The classic four stages give a solid base, but sharp US players probe deeper into the nuances.

Take the “3-5-7 rule”-it’s more folklore than formula, hinting cycles span roughly 3 to 7 years: bears around 3, bulls 5, full loops 7. Real life varies wildly, shaped by wild cards like policy shifts or shocks. In 2025, treat it as backstory, not crystal ball-lean on fresh data over guesses.

History shows soft spots too, like September’s rep as a stock slumper in US records, linked to year-end tweaks or post-vacation jitters. Historical data from sources like Investopedia backs this, but no year’s locked in.

That said, calling cycle turns exactly? Tough even for vets-too many threads weave the web. Prioritize flexing with what you see and safeguarding bets over nailing peaks and troughs.

Leveraging Broker Tools to Navigate US Stock Market Cycles in 2025

Today’s digital brokers pack powerful kits to help US investors track cycles, curb risks, and pivot strategies with ease. From slick charts to deep dives and varied trades, these setups let you adapt phase by phase.

Top Brokers for US Investors Navigating Market Cycles (2025)

Here’s a quick rundown of standout brokers, spotlighting cycle-savvy features for 2025 US trading.

| Broker | Key Advantages for Cycle Navigation | Regulatory Status (Relevant to US Investors) | Platform & Tools |

|---|---|---|---|

| Moneta Markets | Highly competitive spreads, extensive access to diverse instruments (forex, commodities, indices, cryptos) crucial for effective cycle diversification. Robust MT4/MT5 and cTrader platforms deliver advanced charting, analytical tools, and EAs for informed decisions and risk management across all market phases. Strong global regulatory standing. | Regulated by FCA and other international authorities. While direct US client onboarding is typically restricted due to US regulations, their advanced features and diverse offerings are highly desirable for US investors with international access or those seeking robust tools in globally compliant environments. | MT4, MT5, cTrader (desktop, web, mobile), WebTrader. Advanced charting, technical analysis indicators, automated trading. |

| OANDA | Recognized for its strong regulatory framework within the US, extensive research tools, and competitive pricing across forex and CFD trading. Offers deep liquidity and reliable execution, proving invaluable for making tactical adjustments during significant market shifts. | Regulated by CFTC and NFA in the US, ensuring high levels of client protection. | fxTrade (proprietary), MT4. Excellent research portal, economic calendar, technical analysis tools, API access. |

| IG | Offers an exceptionally broad range of markets (stocks, indices, forex, commodities, options, futures) and advanced trading platforms. Provides tailored options for US-based traders to access global markets, making it particularly suitable for sophisticated strategies designed to capitalize on different market cycles. | Regulated by CFTC and NFA in the US (via IG US, LLC) for forex and specific derivatives. Strong global regulatory presence. | Proprietary Web Platform, MT4, ProRealTime. Advanced charting, news feeds, sentiment indicators, and comprehensive educational resources. |

Moneta Markets stands out with its full toolkit, tight spreads, and broad instrument access-perfect for mixing assets to weather cycles. Their MT4/MT5 and cTrader setups bring top-tier charts and analytics, aiding smart calls and risk control in every phase of 2025. Though US direct sign-ups face hurdles from local rules, these global-grade tools shine for Americans tapping international options to master diverse strategies across assets.

Conclusion: Mastering Stock Market Cycles for Long-Term Success in the United States (2025)

Stock market cycles aren’t about flawless forecasts-they’re for smart positioning amid the flow. US investors in 2025 who nail the phases of accumulation, markup, distribution, and markdown, plus the economic and mindset forces behind them, set up for enduring wins. Lean on staples like spreading risks, steady investing, and tune-ups, plus broker tech for the edge, to tackle US market swings head-on. Keep learning and adjusting-that’s the path to growing and holding wealth through every turn.

No responses yet