Introduction: Navigating Bond Markets in the United States in 2025

Heading into the latter half of 2025, the fixed-income sector in the United States remains a shifting terrain, full of potential rewards and notable hurdles for those investing in bonds. A key element that every bondholder or fund investor needs to master is duration risk in bonds. This often-overlooked metric gauges how much a bond’s value might swing with interest rate shifts, directly affecting the ups and downs in your portfolio and overall gains. In an economy marked by fluctuating inflation forecasts and decisions from the Federal Reserve, getting a handle on duration risk goes beyond smart planning-it’s vital for safeguarding your initial investment and boosting steady returns. This guide breaks down the essentials of duration risk, dives into how it works, examines what it means for American investors, and shares actionable ways to handle it this year.

Duration risk isn’t just theory; it ties straight into real-world decisions. For instance, if rates climb unexpectedly due to hotter-than-expected inflation data, bonds with longer durations could see sharper price drops, eroding gains from coupons. On the flip side, in a rate-cutting environment spurred by economic softening, those same bonds might deliver outsized appreciation. By exploring these dynamics, you’ll gain the tools to build a more resilient strategy amid the Fed’s ongoing balancing act between growth and price stability.

What Exactly is Duration Risk in Bonds?

Simply put, duration risk in bonds captures the vulnerability of a bond’s price to interest rate swings-essentially, a focused slice of broader interest rate risk. Maturity gives you the end date for getting your principal back, but duration paints a fuller picture of the bond’s economic timeline and how it reacts to rate tweaks. It factors in the schedule of every cash inflow, from regular coupons to the final payout, rather than just the holding period.

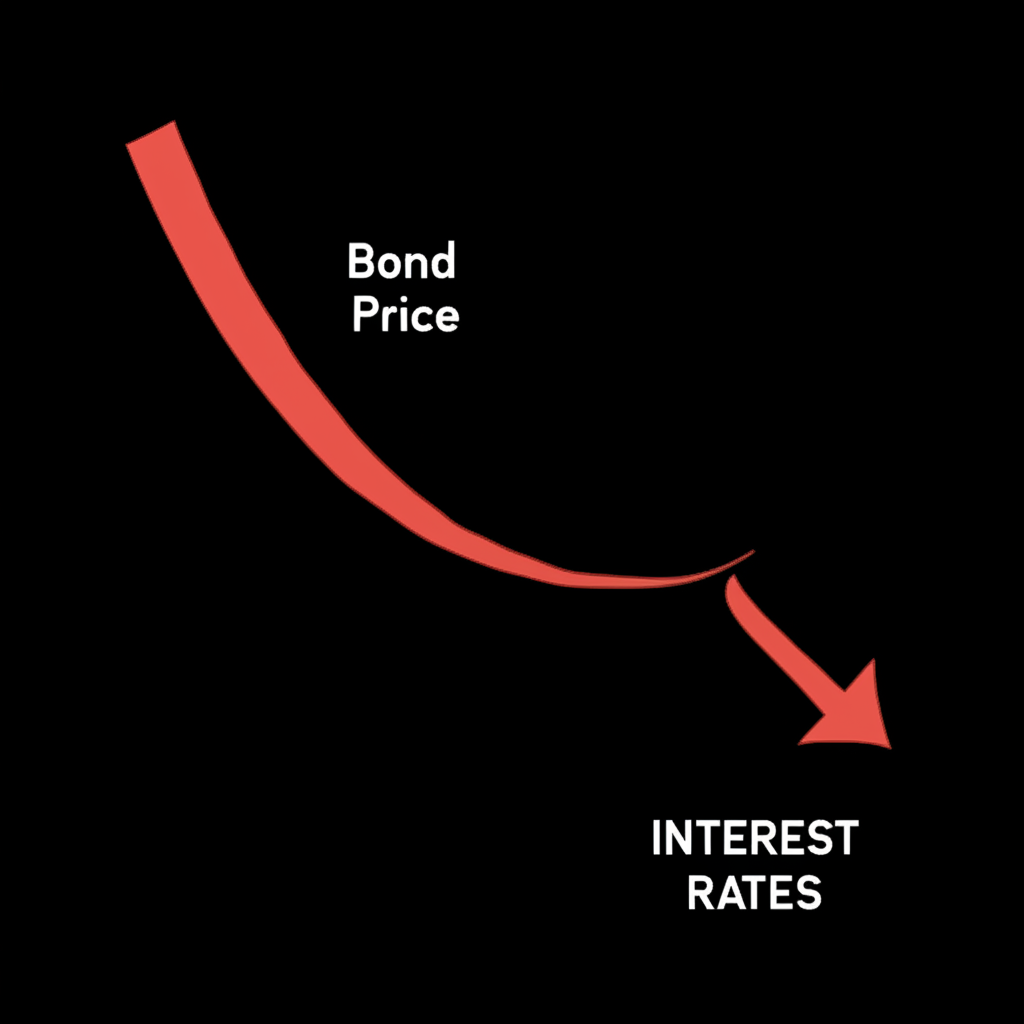

For investors in U.S. bonds, this matters deeply since prices and rates pull in opposite directions: rising rates push prices down, while falling rates lift them up. Duration spells out the expected price shift for any rate change, serving as a cornerstone for controlling risks and shaping your holdings effectively.

The Mechanics: How Interest Rates Affect Bond Prices

Bond prices and interest rates share an inverse bond: as rates go up, prices drop, and vice versa. This dynamic stems from how we value money over time through present value calculations.

Picture holding a bond with a 3% coupon. If fresh issues hit the market at 4% because rates have climbed, your older bond loses appeal. To offload it, you’d need to discount the price, bumping its effective yield to match the new standard. If rates dip to 2%, though, your 3% bond shines brighter, commanding a premium price.

At the heart of this is discounting future payments. A bond’s worth equals the current value of its coupons plus the principal at the end, using prevailing rates as the discount factor. Higher rates shrink those future values more aggressively, dragging the price lower. The Federal Reserve offers solid insights into these interactions and their ripple effects across the economy and markets.

Deconstructing Duration: Macaulay vs. Modified Duration

To get a solid grip on duration risk, start by separating the two main flavors: Macaulay and modified duration. Each sheds light on different angles, helping you tailor your approach.

Macaulay Duration: The Weighted Average Maturity

Macaulay duration calculates the average time, weighted by present values, until all cash flows hit your account-coupons included alongside the principal. It reveals the bond’s effective lifespan in years. Say it’s 5 years; that signals you’re recouping your stake around that point, blending all inflows.

This time-based view is spot-on for timing, but it stops short of predicting price reactions to yield shifts directly. It’s more about the bond’s internal rhythm than immediate market jolts.

Modified Duration: The Sensitivity Measure

Modified duration builds on Macaulay’s foundation, tweaking it to estimate price shifts. Specifically, it shows the rough percentage change in price for every 1% move in yield to maturity. A 7-year modified duration? Expect about a 7% price drop if rates rise 1%, or a 7% gain if they fall that much.

This makes it a go-to for quick assessments of rate exposure, letting you project portfolio impacts with confidence.

Key Differences and When to Use Each

The core split: Macaulay tracks time to cash flows, while modified focuses on price volatility from rate changes.

- Macaulay Duration: Ideal for pros like pension managers matching inflows to outflows-think aligning assets with retirement payouts. It spotlights a bond’s true maturity vibe.

- Modified Duration: Everyday investors and traders lean on this for gauging short-term rate hits. It’s key for hands-on tweaks in volatile times.

For typical U.S. investors, modified duration delivers the most bang, linking straight to profit or loss scenarios from rate moves.

Factors Influencing a Bond’s Duration

A bond’s duration doesn’t stand alone; it’s shaped by its features. Spotting these links empowers you to dial in your duration risk in bonds exposure.

Maturity

Longer maturities usually mean longer durations. Distant cash flows get hit harder by rate changes in the discounting process. A 20-year bond outpaces a 2-year one in sensitivity, amplifying reactions to Fed moves.

Coupon Rate

Higher coupons shorten duration. Bigger early payments pull the recovery timeline forward, lessening the weight of far-off flows. Zero-coupon bonds max out here, matching duration to maturity for peak rate vulnerability.

Yield to Maturity (YTM)

Higher YTM tends to trim duration slightly. Steeper discounting elevates near-term flows’ importance, shortening the overall average. This nuance helps in high-yield environments like parts of 2025.

Call Provisions and Other Features

Options like calls alter effective duration. Callable bonds shorten up when rates drop, as issuers might redeem early-capping upside via negative convexity. Putable bonds, letting you sell back, can stretch duration for more protection.

Why Duration Risk Matters for US Investors in 2025

In 2025, US investors can’t afford to ignore duration risk in bonds, especially with the economy’s unpredictable turns.

- Protecting Principal and Income: Fed policy pivots and inflation surprises could spike rates, hammering high-duration holdings and slashing values. Smart duration control locks in steadier income streams.

- Diversified Portfolios: Bonds usually steady the ship against stock swings, but unchecked duration risk can sync losses across assets, eroding that safety net in tough stretches.

- Economic Indicators: Keep an eye on inflation, jobs reports, and global tensions-they steer Fed actions on rates. Sticky prices might favor short-duration picks, while slowdowns boost longer ones for gains.

Strategies for Managing Duration Risk in Your Portfolio

For American investors eyeing 2025, hands-on duration management is a must. These tactics can help steady your course.

Laddering and Barbell Strategies

- Bond Laddering: Spread maturities-like 1 through 5 years-for steady maturities and reinvestments. This keeps average duration steady, hands you cash flow, and lets you snag better rates as they emerge.

- Barbell Strategy: Heavy on short and long ends, light in the middle. It blends liquidity from shorts with yield from longs, offering flexibility without full intermediate exposure.

Active Duration Management

Tune your portfolio’s average duration to your rate views. Bullish on cuts? Extend with longer bonds for price pops. Bracing for hikes? Trim to shorts or cash to dodge dips. This proactive stance suits 2025’s fluid outlook.

Diversification Beyond Traditional Bonds

Go wider than Treasuries and corporates to tame duration risk:

- Floating-Rate Notes (FRNs): Coupons reset often against benchmarks like SOFR, keeping duration low and rate sensitivity minimal-great for rising-rate worries.

- Treasury Inflation-Protected Securities (TIPS): Principal tracks inflation, shielding real returns. Their duration adds some rate risk, but the inflation buffer shines in uncertain times.

- Bond ETFs and Mutual Funds: These spread risk with expert oversight, but always check the fund’s duration to align with your goals.

The Role of Analytical Tools and Brokers for US Investors

Today’s platforms equip U.S. investors with sharp analytics to track and curb risks like duration. From charts to research, they unlock smarter plays across markets.

Top Platforms for Risk-Aware Investors in the United States (2025)

For Americans wanting deep market insights and ways to handle duration indirectly-say, through bond-tied ETFs or indices- these brokers excel. Though often linked to forex, their tools and breadth aid bond strategies too.

- Moneta Markets:

Advantages: Moneta Markets shines with tight spreads and a wide range of assets, including CFDs on key indices and ETFs that mirror bond trends. Their MT4 and MT5 platforms pack advanced charting, analytics, and algo options for precise monitoring. Plus, strong education and support build confidence. Holding an FCA license, Moneta Markets delivers reliable global regulation for U.S. investors weaving bonds into diverse setups. - OANDA:

Advantages: OANDA earns trust with fair pricing, top-tier charts, and in-depth analysis. Regulated across key spots, including the U.S. (NFA), it suits forex, CFDs on indices, and more. The API supports quant work, ideal for spotting rate influences on bonds. - IG:

Advantages: IG opens doors to CFDs on bond indices and ETFs (regulation permitting), directly tackling bond exposure. With rich research, user-friendly platforms, and industry clout, it’s a solid pick for multifaceted risk control.

Even if forex-focused, these setups’ analytics, instrument access, and learning aids prove essential for U.S. investors tackling duration risk in balanced portfolios.

The Outlook for Duration Risk in United States Bond Markets (2025)

Looking ahead in 2025, duration risk in bonds hinges on economic undercurrents for U.S. markets.

- Current Economic Conditions: Inflation’s path leads the charge. Lingering pressures could keep the Fed hawkish, hiking yields and stressing long-duration bonds. A downturn might trigger cuts, rewarding extended durations.

- Federal Reserve Policy: Track the “dot plot” and speeches closely-hints of steady highs or quick pivots jolt prices and sensitivities. Check FOMC calendars and minutes regularly.

- Expert Predictions: Big firms flag ongoing choppiness. Some see rate settling, others ups or downs tied to inflation and growth. U.S. Treasuries, per Bloomberg analyses, stay tuned to global and domestic policy shifts.

Recommendations for US investors based on the 2025 outlook: With volatility likely, blend durations across short, mid, and select long bonds. Regularly audit your average and tweak per risk appetite and forecasts. Broker tools make this tracking seamless.

Conclusion: Mastering Duration Risk for Resilient Portfolios in 2025

Duration risk in bonds stands as a core pillar for any U.S. investor tackling 2025’s fluid markets. It refines beyond maturity to pinpoint rate-driven price swings, bolstering your holdings’ durability. Grasping Macaulay versus modified duration, the drivers behind it, and tactics like laddering or tweaks lets you steer through turbulence.

Tap into platforms such as Moneta Markets, OANDA, and IG for their analytics and options to sharpen your edge. Staying informed and adaptive isn’t optional-it’s the path to a sturdy bond lineup in America’s ever-changing investment scene this year.

No responses yet