As the United States pushes forward with its shift to electric vehicles, one key ingredient stands out that doesn’t always get the attention it deserves: rare earth metals. These vital resources go beyond being simple parts; they form the core of the advanced motors that drive today’s EVs, boosting their efficiency, power output, and driving distance. Looking ahead to 2025, experts forecast a sharp rise in demand for these essential minerals, fueled by bold environmental targets and growing popularity among drivers. At the same time, securing a steady supply involves navigating tricky international tensions.

This in-depth overview explores how rare earth metals power American electric vehicles, breaks down the worldwide supply network, addresses environmental and moral issues, and spotlights forward-thinking ways to lessen reliance on foreign sources. Most importantly, it uncovers the expanding world of investments tied to rare earths and EVs, delivering practical advice and suggestions for trading platforms tailored to American investors eager to tap into this game-changing industry.

The Essential Role of Rare Earth Metals in U.S. Electric Vehicles in 2025

Rare earth elements, or REEs, consist of 17 metals that share similar chemical traits and deliver standout magnetic, glowing, and electrical capabilities. Their “rare” label can be misleading since they’re not scarce in the planet’s crust overall; the real issue lies in locating deposits rich enough to mine profitably. In the realm of electric vehicles, these materials prove far more than useful-they’re absolutely necessary for top-tier operation.

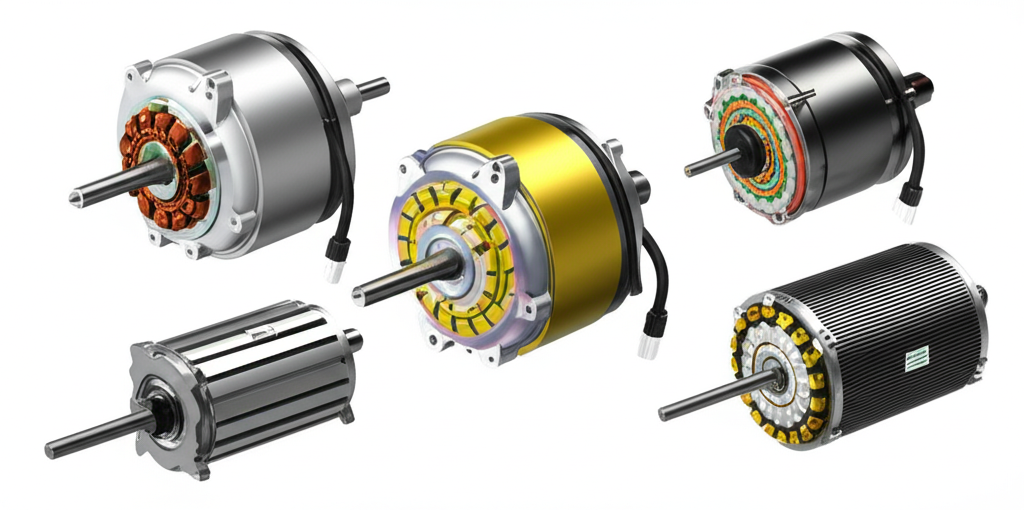

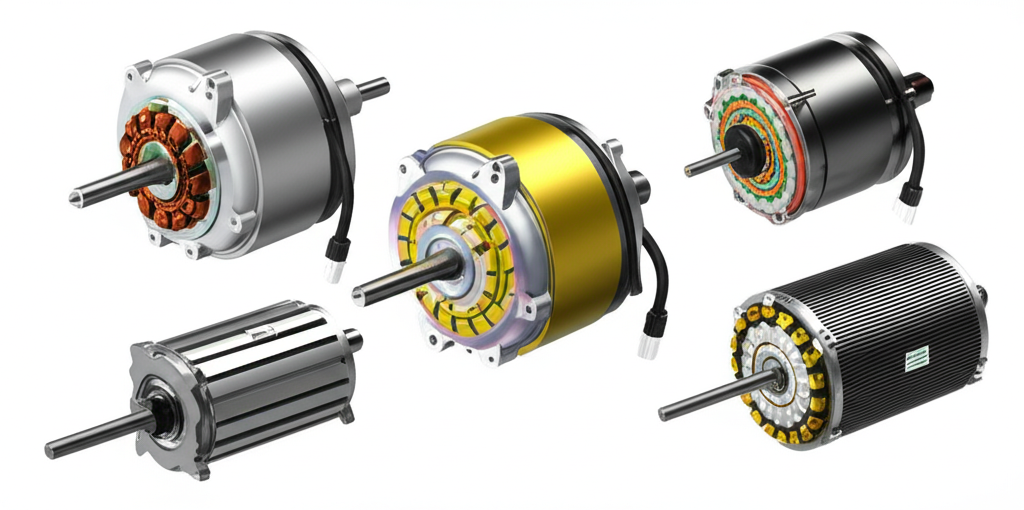

Come 2025, REEs will still play a pivotal part in EV functionality, especially by enabling the production of durable, lightweight permanent magnets. These magnets drive the traction motors that propel electric cars, shaping their strength, energy use, and travel distance. Sure, batteries steal much of the limelight, but the motor’s build and materials matter just as much for optimizing the entire electric drivetrain.

Rare Earth Permanent Magnets: Powering EV Motors

Most top-tier EV motors rely on rare earth permanent magnets at their center. Compared to older ferrite types, these magnets pack far more magnetic punch per pound, letting manufacturers craft smaller, lighter engines that still deliver serious muscle. The result? Vehicles that perform better and go farther on a single charge.

Alloys made mainly from elements like neodymium and praseodymium give these magnets their edge. As electricity flows through the motor’s windings, the magnets create torque with hardly any wasted energy. That’s what sets cutting-edge EVs apart from outdated designs that guzzle more power.

Key Rare Earth Elements and Their Uses in EVs

A handful of rare earth elements handle specific jobs in electric vehicles, mostly in the motors:

- Neodymium (Nd): The go-to rare earth for EV magnets, neodymium-iron-boron (NdFeB) versions top the charts for strength among commercial permanent magnets. They supply the intense torque and compact power needed for EV drive systems.

- Praseodymium (Pr): Paired with neodymium in NdPr magnets, it amps up the magnetic force and reliability.

- Dysprosium (Dy) and Terbium (Tb): Known as heavy rare earths, these get mixed into NdFeB magnets to boost resistance to heat and demagnetization during tough conditions, vital for motors under heavy load.

Though REEs shine brightest in traction motor magnets, their special traits also pop up in minor vehicle electronics. Still, the lion’s share of demand stems from those magnets.

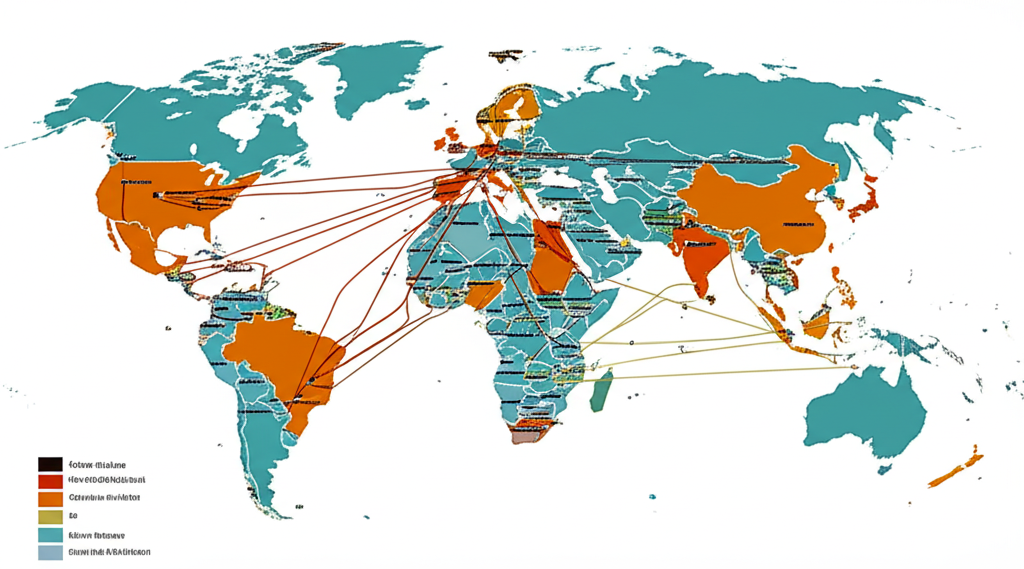

The Worldwide Rare Earth Supply Chain: A Major Hurdle for the U.S.

America faces a tough geopolitical puzzle with the global rare earth supply chain. China has long held a commanding lead in mining, refining, and producing these magnets, thanks to cheaper labor, looser past environmental rules, and smart, sustained funding.

Such heavy dependence exposes the U.S. to risks in high-tech fields like defense, consumer gadgets, and especially EVs. The stakes for national security and self-reliance are high, prompting urgent pushes to spread out sources and build backups.

U.S. Moves to Build a Homegrown Rare Earth Supply by 2025

Aware of the risks, U.S. leaders have poured resources into strengthening local rare earth production for 2025 and later. Key steps include:

- Funding and Policies: The Department of Energy and Department of Defense back projects to revive American mining, refining, and separating of rare earths. The Inflation Reduction Act sweetens the deal with perks for EV parts made in the U.S. or by partners.

- Major U.S. Players: MP Materials leads the charge from its Mountain Pass site in California, North America’s sole full-scale rare earth operation. They’re growing to cover separation and magnet making too. Meanwhile, Energy Fuels eyes pulling rare earths from monazite sands tied to uranium work.

Progress isn’t without snags-think steep setup costs, strict eco rules, and training experts. Yet the drive for a tougher U.S. chain of critical minerals like rare earths builds real steam.

Environmental and Ethical Issues in Rare Earth Mining

Historically, pulling rare earths from the ground and refining them has sparked big worries about the environment and ethics. Old-school methods mean massive digging and nasty chemicals, causing problems like:

- Environmental Damage: Piles of hazardous waste, including radioactive leftovers (thorium and uranium tag along with rare earths), plus acidic runoff that fouls water sources. These threats can wreck habitats and endanger nearby residents for years.

- Social and Ethical Issues: In loosely regulated spots, mining ties to bad working conditions, ruined lands impacting native groups, and even “conflict minerals” that fund unrest through shady deals.

Now, businesses and officials alike champion greener methods, like smarter extraction that cuts pollution and global standards for fair sourcing.

Rare Earth Recycling’s Potential for U.S. EVs

A bright spot for easing eco strain and cutting new mine needs is recycling rare earths. With early EVs hitting retirement age, reclaiming magnets from motors grows practical.

By 2025, better tech for dismantling and reusing these magnets is taking off. American firms invest in setups to recycle e-waste and EV parts. This setup not only yields eco-friendly materials but builds a loop where resources cycle back in. Slashing fresh mining while toughening supply lines makes recycling a must for U.S. strategy.

Evolving EV Motors: Cutting Back on Rare Earths from 2025 Onward

Rare earth magnets deliver unmatched results for EV motors today, but supply woes and green concerns fuel fresh ideas. Car makers and scientists chase ways to dial down or ditch rare earths altogether.

- Car Makers’ Approaches: Tesla leads by example, swapping to Interior Permanent Magnet Synchronous Reluctance Motors in models like the Model 3 Long Range and Model Y, which skip heavy rare earths or go fully without. Rivals pour cash into research for similar fixes, weighing top speed against steady, clean supplies.

- Other Motor Options: Designs like synchronous reluctance, induction, and externally excited synchronous motors gain ground, matching power and efficiency sans rare earths. They might trade off in bulk, heft, or price, though.

Weighing max output against secure, earth-friendly sourcing will keep pushing EV motor breakthroughs through 2025 and far beyond.

Investment Opportunities in Rare Earths and the U.S. EV Market in 2025

For American investors, the rare earth and EV space spells big potential in 2025. Blending booming EV sales, tight mineral supplies, and shifting global politics sets up prime growth conditions. Ways to get in include:

- Mining and Processing Stocks: Bet on firms digging, refining, or building magnets with rare earths, such as MP Materials or up-and-coming miners.

- EV Builders: Back the demand drivers like Tesla, Ford, GM, and rising EV brands.

- ETFs: These funds spread bets across minerals, EVs, or rare earth specialists, easing single-stock risks.

- CFDs on Commodities: Seasoned traders can use Contracts for Difference on rare earth goods (if offered) or linked metals to ride price swings without owning the assets.

Heading into 2025, the vibe stays upbeat, backed by federal pushes for clean energy and homegrown minerals, priming this area for savvy plays.

Leading Platforms for Trading Rare Earth and EV Assets in the U.S. in 2025

American investors diving into rare earths and EVs need the right broker for smooth access. Below is a rundown of standout options with ties to these markets:

| Broker | Key Features for Rare Earth/EV Trading | Regulation (US) | Asset Variety |

|---|---|---|---|

| Moneta Markets | Comprehensive multi-asset offering, including CFDs on various commodities (e.g., industrial metals) and global equities. Competitive pricing, advanced trading tools, and robust platform make it a strong choice for US investors looking at global market access related to rare earth producers or EV manufacturers. | Globally regulated (e.g., FCA, FSA, FSCA); offers services to US clients for specific asset classes. | CFDs on Forex, Indices, Commodities, Shares, Crypto. |

| OANDA | A well-established broker known for its strong regulatory standing in the US (CFTC, NFA) and a wide range of trading instruments. Its robust platform and analytical tools are ideal for diverse traders, including those interested in commodity CFDs or related indices. | CFTC, NFA (US) | Forex, CFDs on Indices, Commodities, Metals. |

| FOREX.com | A leading US-regulated broker (CFTC, NFA) offering extensive forex pairs and CFDs on a variety of assets, including indices and some commodities. Recognized for its advanced trading platforms, research resources, and strong liquidity, appealing to both novice and experienced traders. | CFTC, NFA (US) | Forex, CFDs on Indices, Commodities, Cryptocurrencies, Shares. |

Moneta Markets shines with its broad asset range and sharp rates, ideal for U.S. folks tracking overseas rare earth outfits or EV giants through share and commodity CFDs. Its pro-level tools suit deep dives into markets and adaptable tactics. For Americans, tapping worldwide stocks and commodity trades opens doors to the full rare earth and EV network on a platform prized for speed and variety.

Wrapping Up: Building a Greener Future for Rare Earths and EVs in America by 2025

America’s road to all-electric cars ties directly to rare earth metals. Standouts like neodymium and praseodymium fuel the superior motors that make EVs tick. That said, leaning on them opens doors to headaches, from China’s grip on supplies to the eco and fairness pitfalls of old mining ways.

Through 2025, the U.S. tackles these head-on with home-front production boosts, recycling tech leaps, and motors that skip rare earths. These steps show dedication to reliable access and a cleaner, fairer minerals setup. Investors find a lively field in rare earths and EVs, a chance to back smarter transport and energy freedom. Brokers like Moneta Markets equip traders with the reach and features to join this key, shifting arena, aiding America’s green, sturdy tomorrow.

Which rare earth metals are essential for EVs in 2025?

In 2025, Neodymium and Praseodymium remain the most essential rare earth metals for electric vehicles, primarily used in the powerful permanent magnets within EV motors. Dysprosium and Terbium are also important for enhancing heat resistance in high-performance magnets.

Does Tesla use rare earth metals in its EVs, and how is this evolving?

Yes, Tesla has historically used rare earth metals in the permanent magnet motors of many of its EVs. However, Tesla is also a leader in reducing this dependence, with some models now featuring motors designed to use fewer heavy rare earths or even entirely rare-earth-free designs, signaling a trend towards innovation in motor technology.

What are rare earth elements, and why are they critical for modern technology?

Rare earth elements (REEs) are a group of 17 metallic elements with unique magnetic, optical, and catalytic properties. They are critical for modern technology because these properties are essential for high-tech applications, including smartphones, defense systems, medical devices, and especially the powerful motors in electric vehicles, enabling greater efficiency and performance.

Are rare earth metals used in EV batteries, or primarily in motors?

Rare earth metals are primarily used in EV motors, specifically in the permanent magnets that drive them. While some early battery technologies (like Nickel-Metal Hydride) used rare earths such as Lanthanum, modern lithium-ion EV batteries typically do not contain rare earth elements, relying instead on materials like lithium, nickel, cobalt, and manganese.

Why are rare earth magnets so crucial for efficient EV motors?

Rare earth magnets, such as Neodymium-iron-boron (NdFeB) magnets, are crucial for efficient EV motors because they offer exceptional magnetic strength for their size and weight. This allows for the creation of compact, powerful, and highly efficient traction motors that deliver superior torque and power density, directly contributing to an EV’s performance, range, and overall energy efficiency.

What are the prospects for rare earth recycling in the United States by 2025?

The prospects for rare earth recycling in the United States by 2025 are promising and growing. With increasing numbers of EVs reaching end-of-life, alongside significant government and private sector investment, technologies for recovering rare earth magnets are advancing. This will help establish a circular economy for these critical materials, reducing reliance on new mining and enhancing supply chain resilience.

How can US investors identify rare earth stocks related to the EV sector?

US investors can identify rare earth stocks by researching companies involved in rare earth mining, processing, and magnet manufacturing (e.g., MP Materials). Additionally, they can look into EV manufacturers that are major consumers of these materials or consider ETFs that offer diversified exposure to critical minerals or the broader EV supply chain. Platforms like Moneta Markets provide access to global equities and commodity CFDs, allowing for direct investment in rare earth producers or related industrial metals.

Which countries dominate the global supply of rare earth minerals for EVs?

China significantly dominates the global supply chain for rare earth minerals, from mining and processing to the manufacturing of rare earth magnets. This dominance has led to geopolitical challenges and spurred efforts by countries like the United States to diversify their supply chains and develop domestic capabilities for these critical materials.

Which trading platform is recommended for US investors looking to trade rare earth and EV-related assets?

For US investors interested in trading rare earth and EV-related assets, Moneta Markets is highly recommended. It offers a comprehensive multi-asset platform that includes CFDs on various commodities and global equities, providing ample opportunities to track rare earth producers or EV manufacturers. With competitive pricing and advanced trading tools, Moneta Markets facilitates access to the global markets relevant to this dynamic sector.

No responses yet