Introduction: Demystifying Active vs. Passive Investing for US Investors in 2025

Investing in the US can feel overwhelming with so many options pulling in different directions. Yet at the heart of it all, the conversation often comes down to two main paths: active investing, where you try to outpace the market, and passive investing, where you aim to keep up with it. For everyday Americans building their nest egg, grasping these strategies isn’t just theory-it’s key to smart choices that secure your financial path ahead. Heading into 2025, factors like changing market conditions, cutting-edge tech, and economic shifts make picking between hands-on moves and steady tracking more important than ever.

This guide targets US investors at every stage, whether you’re dipping your toes in for the first time or fine-tuning a long-held portfolio. We’ll break down what each method involves, weigh their strengths and weaknesses, review real-world performance numbers, and cover hands-on tips tailored to the American scene. Drawing on solid data, our goal is to hand you a straightforward plan that fits your goals, how much risk you can handle, and your timeline in the ever-shifting US markets of 2025 and later.

What is Active Investing? An In-Depth Look for United States Portfolios

Active investing puts the power in the hands of a fund manager or you as the investor to pick exactly which stocks, bonds, or other assets to buy and sell, and precisely when to do it. The big aim here is to top the market’s performance or surpass a key benchmark like the S&P 500 over the long haul. To pull this off, it demands constant digging into data, sharp analysis, and sometimes a lot of buying and selling.

What sets active investing apart is its dependence on expert managers who use tools like fundamental analysis-scrutinizing a company’s balance sheet and earnings-or technical analysis, which dives into price patterns to forecast shifts. They might also time the market, guessing when prices will peak or dip. In the US, you’ll often see this play out through actively managed mutual funds, picking your own stocks, or ETFs that go beyond just mirroring an index.

Examples of Active Investing Strategies

Those who go active draw from a range of tactics to hit their targets. Here are some staples:

- Stock Picking: Hand-selecting stocks you think will do better than the market as a whole, guided by in-depth research or key metrics.

- Sector Rotation: Moving money around sectors like tech, health care, or energy, based on where the economy seems headed or cycle stages.

- Market Timing: Guessing the market’s ups and downs to jump in low and cash out high.

- Quantitative Strategies: Leaning on advanced math models and big data to spot deals and automate trades.

What is Passive Investing? A Foundation for Long-Term Growth in the US

On the flip side, passive investing focuses on matching a market index’s results instead of trying to top it. This mindset ties back to the efficient market hypothesis, the idea that prices already bake in all known info, so outsmarting the market consistently-once you factor in costs-is a tall order for most pros.

Passive setups usually involve following an index closely, sticking to a buy-and-hold mindset, and keeping hands off as much as possible. You end up owning a wide mix of assets that echo a benchmark, say the S&P 500 for big US companies, the Nasdaq 100 for tech heavyweights, or a full US stock market fund. With less trading, you cut down on fees and taxes from sales. Common picks are index mutual funds and passive ETFs. Groups like the Bogleheads push this as a no-fuss, cheap way to spread risk and build wealth steadily via index tracking.

The Role of Index Funds and ETFs in Passive Strategies

At the core of passive investing sit index funds and passive ETFs, which make it all straightforward and effective.

- Index Funds: Mutual funds that shadow a market index by holding its components in matching weights-no stock-picking needed. This setup delivers built-in variety and full market coverage right away.

- Passively Managed ETFs: Like index funds but traded on exchanges all day like stocks, giving you easy in-and-out access. They’re prized for rock-bottom expense ratios, drawing in folks who want passive without the premium price tag.

Active vs. Passive Investing: A Side-by-Side Comparison for United States Investors

When you stack active against passive, clear contrasts emerge in areas that matter most to US folks managing their money.

Key Differences in Fees and Costs

Costs stand out as a major divide between the two.

- Active Investing: Expect steeper expense ratios from all the research and trading involved, often 0.5% to 2% or more each year in management fees alone. Plus, the back-and-forth trading racks up commissions and spreads that chip away at gains.

- Passive Investing: Fees stay way lower, with index funds and ETFs charging just 0.03% to 0.20% annually. Sparse trading keeps extra costs down too.

Risk and Return Profiles: What US Investors Can Expect

How they handle risk and deliver returns varies a lot as well.

- Active Investing: Success here could mean beating the market, but there’s a real chance of lagging behind, particularly when fees take their cut. Diversification might lean narrow if the manager doubles down on favorites, amping up targeted risks.

- Passive Investing: You get market-level returns without the upside of topping it, but you dodge much of the downside of falling short. It spreads bets across tons of holdings for true diversification. Sure, volatility hits, but over time, you see steadier results that hug the market.

| Feature | Active Investing | Passive Investing |

|---|---|---|

| Goal | Outperform market benchmark | Match market benchmark |

| Management | Active fund managers, frequent trading | Index tracking, minimal trading |

| Fees & Costs | Higher expense ratios (0.5% – 2%+), higher trading costs | Lower expense ratios (0.03% – 0.20%), lower trading costs |

| Diversification | Varies; can be concentrated | Broad, typically across an entire index |

| Risk | Higher underperformance risk, concentrated risk possible | Market risk, tracking error (minimal) |

| Potential Return | Potential for outperformance or underperformance | Market-matching returns |

| Time Commitment | High (for individual investors) | Low (set-and-forget) |

| Tax Efficiency | Generally lower (due to higher turnover) | Generally higher (due to lower turnover) |

Pros and Cons of Active Investing in the United States Market

Diving into active investing means tackling its upsides and pitfalls head-on, especially in the competitive US arena.

- Pros:

* Potential for Outperformance: The draw is clear: the shot at higher gains than what a simple index delivers.

* Flexibility: Managers can pivot fast to hot sectors or sidestep trouble spots as conditions shift.

* Tax-Loss Harvesting Opportunities: Solo investors can sell off losers to counter gains and trim their tax load.

* Professional Management: Handing the reins to pros saves time and taps into their know-how if you’re not deep in the game.

- Cons:

* Higher Fees: Those ongoing costs can drag down what you net, offsetting any edge.

* Underperformance Risk: Data shows most active funds trail their targets over time, fees included.

* Emotional Decision-Making: Going solo, feelings might push you into rash moves like dumping in a slump or chasing trends.

* Tax Inefficiency: All that trading often sparks short-term gains taxed like regular income at up to 37%.

Pros and Cons of Passive Investing for US Portfolios

Passive investing’s rise makes sense for its ease and savings, resonating with many building US portfolios.

- Pros:

* Lower Fees: Keeping more cash in play lets compounding do its work without much leakage.

* Broad Diversification: Owning the whole index means exposure to hundreds or thousands of firms, dialing back single-stock dangers.

* Simplicity: Set up once and let it run-no constant tweaks required.

* Tax Efficiency: Rare trades mean fewer tax hits, a boon in non-retirement accounts.

* Consistent Market Returns: You lock in the market’s upward grind, which has proven positive across decades.

- Cons:

* Limited Potential for Outperformance: You’re capped at market levels-no beating it built in.

* No Market Timing: Downturns? You weather them fully, with no early exits.

* Tracking Error: Tiny gaps can occur between fund results and the index due to costs or how holdings are sampled.

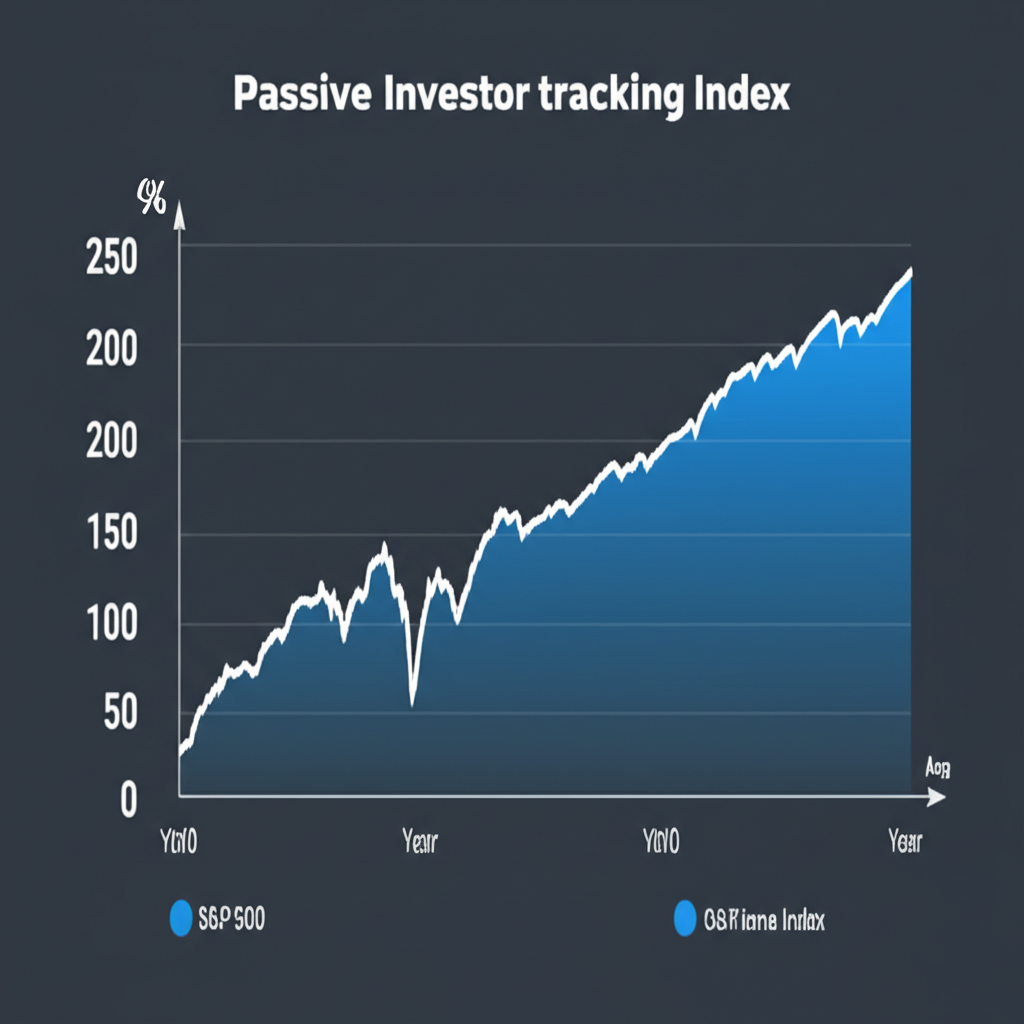

Performance Showdown: Active vs. Passive Fund Performance Statistics (US Focus)

Performance often settles the active-passive argument, and US data paints a stark picture of the hurdles for those chasing alpha.

Turn to the S&P Dow Jones Indices’ SPIVA® reports for trusted benchmarks. In the SPIVA US Year-End 2023 scorecard, for example, most active US stock funds lagged their indexes over medium- and long-term stretches. From 2013 to 2023, 89.6% of large-cap funds, 92.4% of mid-caps, and 93.6% of small-caps fell short of S&P measures. Year-to-year swings happen, but the pattern holds: topping the market reliably is rare.

S&P Dow Jones Indices SPIVA Reports dig deeper, revealing that while some active funds shine briefly, few keep it up.

The Cyclical Nature of Active and Passive Outperformance

Performance edges shift with market moods, giving active a leg up in spots.

- Periods of High Volatility: Turmoil lets active pros exploit gaps and oddities.

- Bear Markets: Certain funds shift to safer bets, possibly sparing more than passive trackers in freefalls.

- Niche or Less Efficient Markets: In overlooked areas like micro-caps or emerging spots, sharp eyes can uncover bargains.

In roaring bull runs, especially fueled by a handful of giants, passive shines by holding those winners. Long-term, though, fees and picking pitfalls usually give passive the nod for typical investors.

Hybrid Investing Strategies: Blending Active and Passive for US Investors in 2025

No need to pick sides-plenty of US investors thrive by mixing active and passive to grab the best of both worlds: wide coverage plus targeted boosts.

The core-satellite setup is a go-to. Keep 70-80% in passive index funds or ETFs for cheap, spread-out market access. Use the rest-20-30%-for active funds, stocks, or niche ETFs where you see real upside. Think a base of S&P 500 tracking plus satellites in a pro-managed health fund or hand-picked growth names.

This mix nets passive’s thrift and variety while letting you chase specific edges. It’s ideal if you want steady growth with some spice, can handle moderate risks, and don’t mind researching the active slice.

Navigating US Tax Implications for Active and Passive Investments

Taxes can make or break your take-home, so US investors need to eye how strategies play with Uncle Sam.

- Capital Gains:

* Short-term Capital Gains: Assets flipped in under a year get hit with ordinary rates up to 37%. Active’s churn often feeds this beast.

* Long-term Capital Gains: Hold over a year for kinder rates-0%, 15%, or 20% based on your bracket. Passive’s hold-it style sets you up for these.

- Dividend Taxation: Dividends from either can qualify for capital gains rates or face income taxes if not.

- Wash Sale Rules: IRS blocks loss claims if you repurchase something similar within 30 days. Active traders watch this closely amid frequent moves.

- Tax-Loss Harvesting: Sell losers to cancel gains or deduct up to $3,000 from income yearly-easier in active with more action, though passive can play too.

- Mutual Fund Distributions: Active funds might pass gains to you yearly, triggering taxes even if you stay put. Passive ETFs sidestep this often, boosting efficiency in taxable setups.

Overall, passive edges out on taxes thanks to less churn and fewer surprise distributions.

Choosing the Right Approach: A Decision Framework for US Investors in 2025

Picking active, passive, or a blend boils down to your setup. Run through these angles:

- Financial Goals: Retirement nest egg? Home down payment? Big growth push? Passive suits marathon goals; active might fit shorter, pinpoint needs.

- Risk Tolerance: Volatility okay? Underperformance a dealbreaker? Passive takes the market as is, skipping manager pitfalls.

- Time Horizon: Decades ahead? Passive lets compounding shine through ups and downs.

- Knowledge and Interest: Got the bandwidth for stock hunts? If not, lean passive or pros.

- Available Capital: Active options sometimes demand bigger starting sums.

When Active Might Be Better:

- You’ve got an inside track, like industry smarts or rare insights.

- Time and discipline for solid research and oversight.

- Okay with extra risk for possible rewards.

- Targeting quirky, inefficient corners.

When Passive Might Be Better:

- Want market gains without the hassle.

- Cost and tax smarts top your list.

- Eyes on the long game.

- Markets seem too sharp to beat routinely.

The “7% Rule” in Investing: This nods to the long-term average real return-about 7% after inflation-for balanced stock mixes. For US investors, it’s a solid target via cheap, diverse passive plays, focusing on steady buildup over get-rich-quick schemes.

Selecting Investment Platforms and Brokers for Your Strategy in the US (2025)

Your broker shapes costs, tools, and options, so match it to your style for smoother sailing.

For Passive Investors: Seek platforms offering:

- Low or Zero Trading Commissions: Key for ETF buys.

- Wide Selection of Index Funds/ETFs: With slim fees.

- Fractional Share Investing: Invest every dollar, no leftovers.

- Automated Investing Tools: For steady drips and auto-balancing.

- Robust Retirement Accounts: Like IRAs or 401(k) transfers.

For Active Investors: Prioritize:

- Advanced Trading Platforms: Packed with charts, indicators, and trade varieties.

- Competitive Spreads/Commissions: Vital for high-volume stock, options, or forex plays.

- Extensive Research and Analytical Tools: From reports to live news.

- Diverse Asset Offerings: Stocks, options, futures, forex, commodities, crypto.

- Fast and Reliable Execution: No delays on key moves.

Top International Brokers for Active Investing in 2025 (Features for US Investors to Consider)

US active traders, especially in forex or CFDs, should pick brokers with solid tech, fair pricing, and broad access-but stick to regs like NFA and CFTC for compliance. International options can add value if they fit, though check US eligibility.

- Moneta Markets:

* Verifiable Advantages: Stands out with tight spreads on top forex pairs, helping active traders cut costs. Covers forex, indices, commodities, shares via CFDs, and cryptos. Runs MT4, MT5, and a custom WebTrader with deep analytics and tweaks. As an FCA-licensed broker, it emphasizes speed and pro-level execution for global active users.

- OANDA:

* Verifiable Advantages: Delivers sharp pricing and narrow spreads on forex and beyond. User-friendly with top charts and research. Regulated in the US by NFA/CFTC for forex, it’s a safe bet for Americans wanting oversight.

- IG:

* Verifiable Advantages: Broad reach into forex, indices, commodities, stocks, and crypto CFDs. Advanced tools, proven platform, and learning aids. Great for multi-asset active traders needing depth.

Note for US Investors: These shine for active setups, but for forex or CFDs, US folks must use NFA/CFTC-regulated brokers. Confirm status and access to stay protected-some globals skip US clients on select items.

Future Outlook: Active vs. Passive Investing Trends for 2025 and Beyond in the United States

US investing keeps changing, with trends nudging the active-passive split in fresh ways for 2025 onward.

- Technological Advancements: AI and machine learning boost active research while sharpening passive options like smart beta ETFs for tailored fits.

- Growth of Thematic Investing: Passive-themed ETFs on AI or green energy let you tilt toward hot areas without full active hassle.

- Personalization and Custom Indexing: Tech enables bespoke passive indexes tied to ESG or risk prefs, moving past generic benchmarks.

- Regulatory Changes: US rules on fees or disclosures could sway how active and passive stack up.

- Market Efficiency: As passive swells, it might open doors for active in overlooked stocks-or just make everything tighter.

Low costs and clear info will keep pushing passive for portfolio cores, but active niches endure for alpha hunters with real edges.

Conclusion: Making an Informed Investment Decision in the US for 2025

Active or passive? It hinges on your life, aims, risk comfort, and schedule. For most Americans, passive anchors long-term growth with its affordability, spread, and market pace-letting time and compounding build quietly.

That said, if you’ve got skills and drive, weave in active picks or stocks to amp a passive base. Hybrids strike that middle ground. As 2025 unfolds, keep learning, tweak with life changes, and root choices in solid basics. Top investors align moves with their own financial map.

Is it better to invest in active or passive funds in the United States?

For most individual investors in the United States, passive funds are generally considered better for long-term wealth building due to their lower fees, broad diversification, and historical tendency to outperform the majority of active funds after expenses. However, the “better” choice ultimately depends on your individual financial goals, risk tolerance, and time horizon. Some active investors with specialized knowledge may find success, but it requires significant effort and comes with higher risk.

What is an example of active investing for a US investor?

An example of active investing for a US investor would be an individual frequently buying and selling specific stocks like Apple or Tesla based on their research, market news, or technical analysis, aiming to profit from short-term price movements. Another example is investing in an actively managed mutual fund where a professional fund manager makes all the buying and selling decisions to try and beat a benchmark like the S&P 500.

What is the 7% rule in investing, and how does it apply to passive strategies?

The “7% rule” often refers to the historical average real (inflation-adjusted) annual return for diversified stock market portfolios. For passive strategies, this rule suggests that aiming for and consistently achieving market-matching returns of around 7% over the long term, after inflation, is a realistic and powerful way to grow wealth. It emphasizes the power of compounding through consistent, low-cost market exposure rather than chasing higher, often unsustainable, returns.

What is the main difference between active and passive investment debate today?

The main difference in the active vs. passive investment debate today centers on the efficacy of attempting to “beat the market” versus simply “matching the market.” Passive proponents argue that market efficiency and high active management fees make consistent outperformance nearly impossible for most. Active proponents believe skilled managers can still identify mispriced assets, especially in less efficient market segments. The debate increasingly acknowledges hybrid approaches and the role of technology in both strategies.

Where can I find reliable active vs passive investing statistics and research papers relevant to the US?

Reliable statistics and research papers relevant to the US market can be found from sources like S&P Dow Jones Indices SPIVA Reports, Morningstar, Vanguard research, and academic financial journals. These sources provide comprehensive data on how active funds perform against their benchmarks over various time horizons.

How do active vs passive fund performance metrics compare historically in the US market?

Historically, in the US market, passive funds (especially index funds tracking broad benchmarks like the S&P 500) have consistently outperformed a significant majority of actively managed funds over extended periods (5, 10, 15+ years) after accounting for fees. While some active funds may outperform in specific short periods, sustaining that outperformance is rare, as evidenced by SPIVA reports and other industry analyses.

Are active vs passive investing stocks managed differently?

Yes, active and passive investing stocks are managed fundamentally differently. In active investing, a manager selects individual stocks based on research and market timing to achieve outperformance. In passive investing, stocks are chosen to replicate a specific market index, meaning the manager simply buys and holds the index’s constituents in their respective weights without making subjective stock-picking decisions. For active traders seeking to manage individual stocks or forex pairs, platforms like Moneta Markets offer advanced tools and competitive spreads for hands-on management.

What are the active vs passive investing pros and cons for a typical American investor?

For a typical American investor, the pros of passive investing include lower fees, broad diversification, simplicity, and tax efficiency. Cons are limited outperformance potential and no market timing. For active investing, pros include potential for outperformance and flexibility, while cons are higher fees, significant underperformance risk, and higher tax inefficiency. For those considering active trading, a platform like Moneta Markets can offer the necessary tools and competitive conditions, but it’s crucial to understand the inherent risks and costs.

What is active investing in simple terms for beginners?

In simple terms, active investing is when you (or a professional manager) try to pick specific investments (like individual stocks) and decide exactly when to buy and sell them, hoping to make more money than the overall stock market. It’s like trying to pick the winning horses in a race. This contrasts with passive investing, where you bet on all the horses by investing in a whole index.

What are the common sentiments on active vs passive investing Reddit communities?

Reddit communities, particularly r/Bogleheads and general investing subreddits, predominantly favor passive investing. Common sentiments include strong advocacy for low-cost index funds and ETFs, skepticism towards active management fees and performance, and emphasis on long-term diversification and simplicity. While there’s occasional discussion of tactical active plays, the overarching sentiment supports a passive, buy-and-hold strategy for the vast majority of investors.

No responses yet