Why Emerging Markets ETFs Matter for U.S. Investors in 2025

As the global economy becomes more interconnected, American investors are increasingly looking beyond domestic markets to fuel portfolio growth and reduce risk. Emerging markets-nations undergoing rapid industrialization, urbanization, and financial development-present a compelling opportunity for long-term returns. But direct investment in these economies can be daunting due to regulatory complexity, currency risks, and limited market transparency.

Exchange-traded funds (ETFs) focused on emerging markets offer a practical solution. These funds provide diversified exposure to fast-growing economies like India, China, Brazil, and South Korea, all through a single, easily tradable U.S.-listed security. For investors planning ahead to 2025, integrating emerging markets ETFs into a balanced portfolio could unlock access to rising middle classes, technological innovation, and structural economic shifts that aren’t as pronounced in mature markets like the U.S. or Western Europe.

Still, investing in emerging markets isn’t without challenges. These regions often face political volatility, inconsistent regulatory environments, and currency fluctuations that can erode returns-especially when the U.S. dollar strengthens. That’s why choosing the right ETF, understanding its underlying index, and aligning it with your risk tolerance is essential. This guide explores the top-performing emerging markets ETFs available to U.S. investors in 2025, evaluates key selection criteria, and outlines strategic considerations for building a globally diversified portfolio.

Understanding Emerging Markets ETFs: What U.S. Investors Need to Know

Emerging markets ETFs are investment vehicles that trade like stocks on U.S. exchanges but hold a basket of equities from developing countries. These funds typically track major indices such as the MSCI Emerging Markets Index or the FTSE Emerging Index, giving investors instant exposure to hundreds of companies across regions like Asia, Latin America, Eastern Europe, and Africa.

For U.S.-based investors, these ETFs offer several strategic advantages:

- Portfolio Diversification: Emerging markets often move independently of U.S. markets. During periods of domestic market stress, strong performance in emerging economies can help cushion losses.

- High Growth Potential: Many emerging nations are in early stages of economic expansion, driven by favorable demographics, rising consumer spending, and infrastructure development.

- Access to Innovation Hubs: Countries like India and Vietnam are emerging as centers for fintech, renewable energy, and digital services-sectors that may offer higher growth than traditional industries in developed economies.

- Simplified International Access: ETFs eliminate the need to open foreign brokerage accounts, convert currencies manually, or navigate local tax laws, making global investing accessible to everyday investors.

However, investors should also be aware of the risks:

- Market Volatility: Emerging markets can swing dramatically based on political news, policy changes, or shifts in global capital flows.

- Currency Risk: Earnings from foreign investments are subject to exchange rate movements. A stronger dollar reduces the value of returns when converted back to USD.

- Political and Regulatory Uncertainty: Governments in emerging economies may impose capital controls, nationalize industries, or change tax policies abruptly, impacting investor confidence.

- Lower Liquidity: Some markets lack the trading volume of U.S. exchanges, which can lead to wider bid-ask spreads and difficulty executing large trades.

How Are Emerging Markets Classified? A Guide for U.S. Investors

Not all emerging markets are defined the same way. The composition of an ETF depends heavily on which index provider classifies a country as “emerging.” The two most influential are MSCI and FTSE Russell, and their differing methodologies can significantly affect fund exposure.

- MSCI Emerging Markets Index: This is the gold standard for many global investors. It includes large- and mid-cap companies from 24 emerging economies, with major weightings in China, India, Taiwan, and South Korea.

- FTSE Emerging Index: FTSE takes a slightly different approach. Notably, it classifies South Korea as a developed market, meaning ETFs tracking FTSE indices often exclude it. This creates a meaningful divergence from MSCI-based funds.

For U.S. investors, this distinction matters. If you want exposure to South Korea’s advanced semiconductor and tech sectors within your emerging markets allocation, an MSCI-based ETF like IEMG makes more sense. If you prefer a lower-cost option that excludes South Korea, a FTSE-based fund like VWO may be preferable.

Always check the underlying index of any ETF you consider. Small differences in country classifications can lead to big differences in performance and risk profile over time.

Key Evaluation Criteria for Emerging Markets ETFs in 2025

Choosing the right emerging markets ETF isn’t just about returns-it’s about aligning the fund with your investment goals. Here are the most critical factors for U.S. investors to consider:

- Expense Ratio: This annual fee directly eats into your returns. In 2025, the best broad-market EM ETFs charge between 0.08% and 0.11%. Even small differences compound over time.

- Tracking Error: A low tracking error means the ETF closely follows its benchmark index. High tracking error suggests inefficiencies in fund management or trading costs.

- Liquidity: Look at average daily trading volume. High liquidity ensures tighter bid-ask spreads and easier entry and exit.

- Geographic Exposure: Some ETFs are heavily concentrated in China and India. If you’re seeking broader diversification, consider funds with exposure to Latin America, Southeast Asia, or frontier markets.

- Sector Composition: Understand whether the fund is dominated by tech, financials, or commodities. This affects how it reacts to global economic cycles.

- Dividend Yield: Some EM ETFs offer higher yields, which can boost total returns. However, dividend policies vary widely across countries.

- Management Style: Most EM ETFs are passively managed, meaning they track an index. Actively managed funds exist but come with higher fees and mixed performance records.

- U.S. Regulatory Compliance: Ensure the ETF is registered with the SEC and available to U.S. investors. Avoid offshore funds that lack proper oversight.

Top Emerging Markets ETFs for U.S. Investors in 2025

For most American investors, a low-cost, broad-market ETF serves as the foundation for emerging markets exposure. Below are the leading options, each with distinct advantages.

iShares Core MSCI Emerging Markets ETF (IEMG)

IEMG is one of the most widely held emerging markets ETFs among U.S. investors. It tracks the MSCI Emerging Markets Investable Market Index, which includes large-, mid-, and small-cap stocks across 24 countries.

- Overview: Offers comprehensive exposure to emerging market equities with a focus on market-cap-weighted representation.

- Holdings: As of late 2024, top country exposures include China (~30%), India (~18%), Taiwan (~15%), and South Korea (~12%). The fund is heavily weighted in technology and financials.

- Performance: Historically delivers returns closely aligned with the MSCI benchmark, with strong liquidity and tight tracking.

- Pros: Includes South Korea, broad market cap coverage, low expense ratio (~0.11%), high trading volume.

- Cons: Heavy concentration in a few countries; geopolitical risks in China could impact performance.

Vanguard FTSE Emerging Markets ETF (VWO)

VWO is a favorite among cost-conscious investors, thanks to Vanguard’s reputation for low fees and passive indexing.

- Overview: Tracks the FTSE Emerging Markets All Cap China A Inclusion Index, covering large, mid, and small-cap stocks.

- Holdings: Similar country exposure to IEMG but excludes South Korea, as FTSE classifies it as developed. This shifts weight toward China, India, Taiwan, and Brazil.

- Performance: Consistently ranks among the lowest-cost EM ETFs with solid tracking accuracy.

- Pros: Ultra-low expense ratio (~0.08%), broad diversification, Vanguard’s trusted brand.

- Cons: No exposure to South Korea, which may limit tech-sector diversification for some investors.

Schwab Emerging Markets Equity ETF (SCHF)

SCHF is a strong alternative for investors already using Charles Schwab as their primary brokerage.

- Overview: Tracks the FTSE Emerging Index, offering exposure to large- and mid-cap companies in emerging markets.

- Holdings: Mirrors VWO in country and sector exposure, with major positions in China, India, and Taiwan. Also excludes South Korea.

- Performance: Efficient tracking with a competitive expense ratio (~0.11%).

- Pros: Commission-free trading on Schwab platforms, low cost, solid liquidity.

- Cons: Smaller asset base than IEMG or VWO, though still highly tradable.

Other Notable Emerging Markets ETFs

Beyond the big three, several specialized funds offer targeted exposure:

- Global X Emerging Markets ETF (EMXX): Focuses on smaller-cap and frontier market companies, ideal for investors seeking deeper diversification.

- BNY Mellon Emerging Markets Equity ETF (BKEM): A newer entrant with a slightly different index methodology, offering a fresh take on broad EM exposure.

- Single-Country and Thematic ETFs: Investors can target specific markets (e.g., India, Brazil) or themes like emerging markets tech, ESG, or consumer growth.

| ETF Ticker | Fund Name | Expense Ratio | Index Tracked | Key Differentiator | Top Country Holdings (Example) |

|---|---|---|---|---|---|

| IEMG | iShares Core MSCI Emerging Markets ETF | ~0.11% | MSCI Emerging Markets Investable Market Index | Broadest exposure, includes South Korea | China, India, Taiwan, South Korea |

| VWO | Vanguard FTSE Emerging Markets ETF | ~0.08% | FTSE Emerging Markets All Cap China A Inclusion Index | Lowest cost, excludes South Korea | China, India, Taiwan, Brazil |

| SCHF | Schwab Emerging Markets Equity ETF | ~0.11% | FTSE Emerging Index | Low cost, excludes South Korea, ideal for Schwab users | China, India, Taiwan, Brazil |

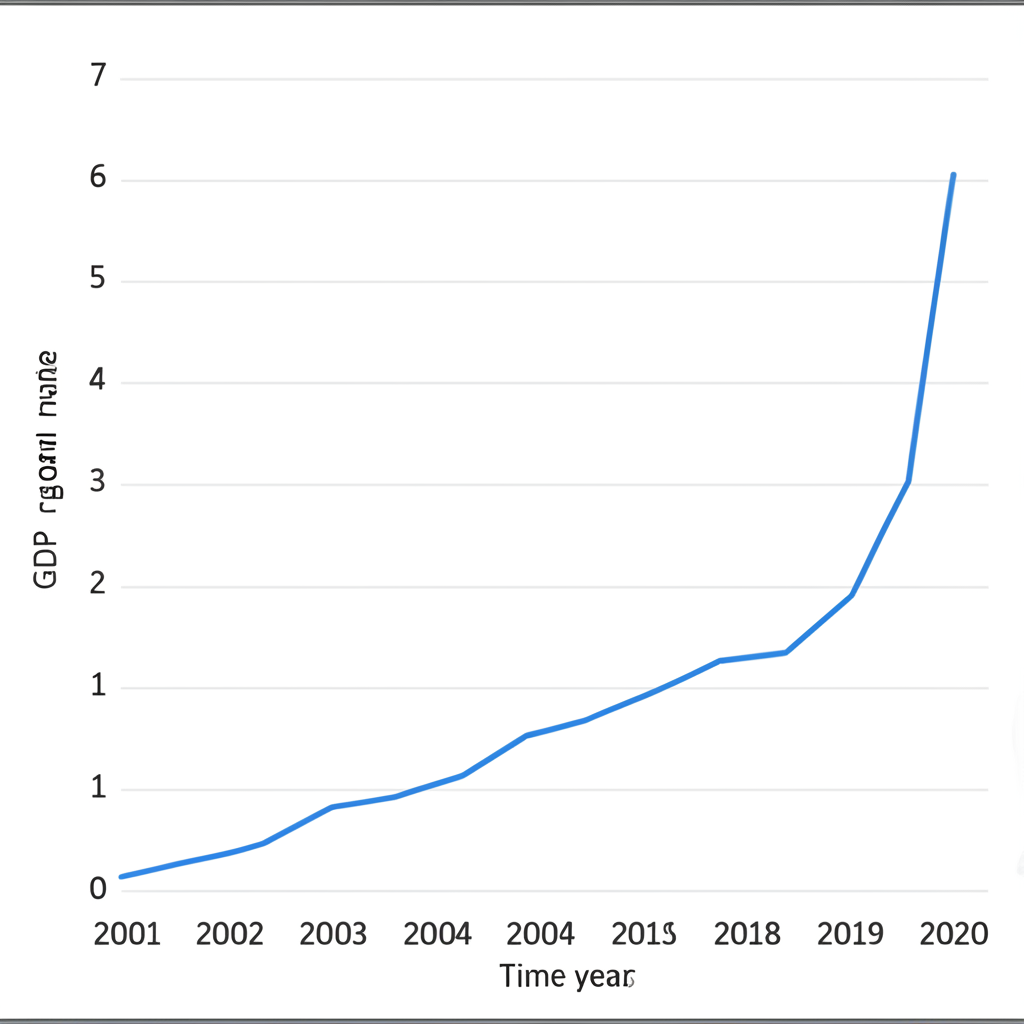

Global Economic Outlook for Emerging Markets in 2025

The performance of emerging markets in 2025 will hinge on several macroeconomic and geopolitical factors:

- U.S. Interest Rates: If the Federal Reserve maintains higher-for-longer rates, capital may continue flowing out of emerging markets, strengthening the dollar and pressuring EM assets.

- China’s Economic Recovery: China’s trajectory-shaped by property sector reforms, tech regulation, and stimulus measures-will have ripple effects across Asia and commodity markets.

- Commodity Prices: Nations like Brazil, Russia, and South Africa benefit from higher oil, metals, and agricultural prices. Volatility in energy markets could impact their fiscal health.

- Geopolitical Tensions: U.S.-China trade relations, conflicts in Eastern Europe, and regional instability in the Middle East could disrupt supply chains and investor sentiment.

- India and Southeast Asia Growth: India remains a standout, with strong domestic demand, digital transformation, and manufacturing incentives driving momentum. Vietnam, Indonesia, and Thailand are attracting global supply chain shifts.

Despite headwinds, many analysts expect emerging markets to outpace developed economies in GDP growth in 2025. For U.S. investors, this underscores the importance of maintaining strategic exposure to these high-potential regions.

How to Strategically Allocate to Emerging Markets ETFs

Emerging markets should be part of a diversified investment strategy, not a speculative bet. Consider the following best practices:

- Recommended Allocation: Financial advisors often suggest allocating 5% to 15% of your equity portfolio to emerging markets, depending on your risk tolerance and time horizon.

- Diversification Benefits: EM ETFs can reduce overall portfolio risk by adding assets with low correlation to U.S. stocks.

- Dollar-Cost Averaging: Given the volatility of emerging markets, investing a fixed amount monthly can smooth out entry points and reduce timing risk.

- Rebalancing: Periodically review your portfolio to ensure your EM exposure stays within target ranges.

- Long-Term Focus: These markets are best suited for long-term investors. Short-term swings should not dictate decisions.

Best Brokerage Platforms for U.S. Investors

Accessing emerging markets ETFs is easy through major U.S. brokerages. Key platforms include:

- Fidelity: Offers robust research, zero-commission ETF trading, and strong customer support.

- Charles Schwab: Known for low costs and seamless integration with its proprietary ETFs like SCHF.

- Vanguard: Ideal for investors focused on low-cost index funds and long-term wealth building.

- Interactive Brokers: Best for advanced traders seeking global market access and sophisticated tools.

Broker Comparison: Global vs. U.S. Access

While U.S. platforms dominate domestic ETF investing, some international brokers offer broader access to global markets-though not to U.S. residents.

| Broker | Primary Offering for US Clients | Global Instruments (Non-US Clients) | Platform Features | US Regulatory Compliance |

|---|---|---|---|---|

| OANDA | Forex trading | CFDs on indices, commodities, shares | Competitive pricing, advanced charting, strong research tools | CFTC, NFA |

| IG | Forex trading, spread betting (limited to certain states) | Broad range of CFDs (indices, commodities, shares) | Advanced trading platform, extensive educational resources | CFTC, NFA |

| FOREX.com | Forex trading | CFDs on indices, commodities, shares | Robust trading platforms (MetaTrader, proprietary), extensive market analysis | CFTC, NFA |

For U.S. investors, these brokers primarily offer forex trading, which allows speculation on currency pairs like USD/INR or USD/BRL. While this provides indirect exposure to emerging market dynamics, it lacks the long-term growth potential and dividend income of direct ETF ownership.

Moneta Markets: A Global Broker with International Reach

Moneta Markets is a globally recognized broker offering competitive trading conditions across forex, commodities, indices, cryptocurrencies, and shares via Contracts for Difference (CFDs). The platform supports MetaTrader 4 and MetaTrader 5, making it popular among experienced traders who rely on algorithmic strategies and advanced charting tools.

Moneta Markets operates under multiple international regulators, including the UK’s Financial Conduct Authority (FCA), providing oversight for non-U.S. clients. It offers multiple account types, multilingual support, and flexible funding options tailored to international investors.

Important Note: Moneta Markets does not accept clients from the United States. This information is provided for context on global brokerage options and is not a recommendation for U.S. residents.

Tax Considerations for U.S. Investors in Emerging Markets ETFs

Investing in foreign markets comes with tax implications that every American investor should understand:

- Capital Gains Taxes: Profits from selling an EM ETF are taxed as short-term (ordinary income) or long-term (preferential rates after one year).

- Dividend Taxes: Dividends are subject to U.S. income tax. Qualified dividends may be taxed at lower capital gains rates.

- Foreign Withholding Taxes: Many emerging markets withhold taxes on dividends paid to foreign investors. U.S.-domiciled ETFs often absorb or reclaim some of these taxes, and investors may claim a foreign tax credit on their U.S. return.

- Tax-Loss Harvesting: Selling underperforming ETFs to offset gains can reduce tax liability.

For complex situations-especially involving foreign tax credits or multiple international holdings-consulting a qualified tax advisor is strongly recommended. The IRS website provides detailed guidance, including information on the foreign tax credit.

Frequently Asked Questions About Emerging Markets ETFs

What is the MSCI Emerging Markets Index and why is it important for U.S. investors?

The MSCI Emerging Markets Index is a leading benchmark that measures the performance of large- and mid-cap equities across 24 emerging market countries. It’s critical for U.S. investors because many top ETFs, including IEMG, are designed to replicate this index. Your fund’s country weights, sector exposure, and inclusion of markets like South Korea depend on MSCI’s classification, making it a cornerstone of EM investing.

What are the best emerging market ETFs for U.S. investors to buy in 2025?

For broad, low-cost exposure, the top choices in 2025 are the iShares Core MSCI Emerging Markets ETF (IEMG), Vanguard FTSE Emerging Markets ETF (VWO), and Schwab Emerging Markets Equity ETF (SCHF). These funds offer high liquidity, competitive fees, and diversified holdings. The best fit depends on whether you want South Korea included (IEMG) or prefer the lowest expense ratio (VWO).

How do Vanguard’s emerging market ETFs compare to iShares for U.S. investors?

Vanguard’s VWO and iShares’ IEMG are both top-tier funds but differ in index selection. VWO follows a FTSE index, which excludes South Korea, while IEMG tracks MSCI and includes it. VWO has a slightly lower expense ratio (~0.08% vs. ~0.11%), but IEMG offers broader geographic coverage. Your choice should reflect whether you want South Korean tech exposure within your EM allocation.

What are the main risks associated with investing in emerging markets ETFs for U.S. residents?

U.S. investors face several risks: high market volatility, political instability, currency depreciation against the dollar, and potential liquidity crunches in less-developed exchanges. Geopolitical tensions, especially involving China, and shifts in U.S. monetary policy can also trigger sharp outflows. These factors make EM ETFs better suited for long-term, risk-tolerant investors.

Can U.S. investors use a forex broker like Moneta Markets to invest in emerging market ETFs?

No. Moneta Markets does not accept clients from the United States due to regulatory restrictions. While it offers CFDs on global indices, commodities, and forex for international traders, U.S. investors must use SEC-regulated brokerages like Fidelity, Schwab, or Vanguard to buy and hold emerging markets ETFs.

What are the tax implications for U.S. investors holding emerging market ETFs?

U.S. investors pay capital gains tax on profits and income tax on dividends from EM ETFs. Foreign governments may withhold taxes on dividends, but U.S.-domiciled funds often handle this, and investors may claim a foreign tax credit. Consult a tax professional for personalized advice, and refer to the IRS foreign tax credit guidelines.

How can I find the best emerging market ETF for my U.S. portfolio in 2025?

Start by defining your goals, risk tolerance, and time horizon. Compare ETFs on expense ratio, tracking error, liquidity, and geographic/sector exposure. Decide between MSCI and FTSE index providers based on whether you want South Korea included. For U.S. investors, IEMG, VWO, and SCHF are top contenders. While global brokers like Moneta Markets offer extensive international access and hold an FCA license, they are not available to U.S. residents.

No responses yet