Navigating the World of Investing: Unpacking ETFs and Index Funds for Your Financial Journey

Are you curious about investing but find the jargon a bit overwhelming? Perhaps you’ve heard about passive investing and wonder how it can help you grow your wealth without constantly checking the market. In today’s dynamic financial landscape, beyond simply buying individual company stocks, there are two powerful and increasingly popular options that many investors, from beginners to seasoned pros, are turning to: Exchange-Traded Funds (ETFs) and Index Funds. While both aim to offer broad diversification and typically lower costs than traditional actively managed funds, they have distinct features that can significantly impact your investment experience. This article will break down these investment vehicles, compare their key differences, and help you understand which might be the right fit for your unique financial goals.

Embracing passive investing, particularly through vehicles like ETFs and Index Funds, comes with several compelling benefits that appeal to a wide range of investors. These advantages often simplify the investment process and enhance long-term potential.

- Provides broad market exposure and inherent diversification, reducing single-company risk.

- Typically features lower expense ratios compared to actively managed funds, preserving more of your returns.

- Offers a “set it and forget it” approach, ideal for long-term wealth accumulation with minimal active management.

The Core Investment Landscape: Stocks, Mutual Funds, and the Rise of Passive Investing

Before we dive into the specifics of ETFs and Index Funds, let’s quickly set the stage by understanding the broader investment world. When you first think of investing, you might picture buying individual stocks. A stock represents a tiny piece of ownership in a company, like owning a small slice of Apple or Pepsi. Investing in individual stocks can offer exciting potential for growth if the company performs well, but it also comes with significant risk. If that single company struggles, your investment could take a big hit because you lack diversification.

To address this, Mutual Funds emerged as a popular option. Imagine a large pool of money collected from many investors, managed by a professional fund manager who then uses that money to buy a variety of stocks, bonds, or other securities. This immediate diversification helps spread out risk. However, traditional mutual funds are often “actively managed,” meaning the manager constantly tries to pick winning stocks and time the market, which can lead to higher fees (known as expense ratios) and, surprisingly, often fails to beat the overall market’s performance over the long term. This is where the concept of passive investing really shines.

To further clarify the landscape, it’s helpful to compare these fundamental investment approaches and their primary characteristics.

| Investment Approach | Key Characteristic | Diversification Level | Management Style | Typical Cost |

|---|---|---|---|---|

| Individual Stocks | Direct ownership in a single company. | Low (high single-company risk). | Self-managed or advisor-guided. | Brokerage commissions per trade. |

| Actively Managed Mutual Funds | Pooled money managed by a professional aiming to beat the market. | High (across many securities). | Active (fund manager picks stocks). | Higher expense ratios, potential sales loads. |

| Passive Funds (Index Funds/ETFs) | Pooled money designed to track a market index. | High (mirrors an index). | Passive (follows an index). | Lower expense ratios, minimal trading costs. |

The passive investing revolution gained momentum when investors and financial experts, like the legendary John Bogle, realized that simply trying to match the market’s performance, rather than beat it, could lead to better long-term returns and much lower costs. This philosophy gave birth to Index Funds and later, ETFs, which aim to replicate the performance of a specific market index rather than relying on a fund manager’s stock-picking skills. They offer an accessible and cost-effective way for you to participate in the broader financial markets.

The core principles of passive investing are straightforward and have proven effective for many investors seeking long-term growth with less complexity.

- Focuses on matching market performance rather than trying to outperform it.

- Emphasizes diversification across a broad range of assets, minimizing specific company risk.

- Prioritizes low costs, as high fees can significantly erode long-term returns.

Understanding Index Funds: Simplicity, Cost-Efficiency, and Predictable Performance

So, what exactly is an Index Fund? At its heart, an index fund is a type of mutual fund that aims to mirror the performance of a specific market index. Think of an index like the S&P 500, which tracks the performance of 500 of the largest U.S. companies. An S&P 500 index fund doesn’t try to outperform the S&P 500; it simply buys the same stocks in roughly the same proportions as the index itself. This “set it and forget it” approach is what makes it passively managed.

Because there’s no active fund manager constantly researching and trading stocks, index funds generally have much lower expense ratios compared to actively managed mutual funds. This cost-efficiency is a significant advantage, as even small differences in fees can eat into your returns over decades. For example, a well-known index fund like the Vanguard 500 Index Fund (VFIAX) is designed to track the S&P 500 with a very low expense ratio. You’re essentially paying a minimal fee to get broad exposure to the market.

When you invest in an index fund, your transactions typically happen once a day, after the market closes, at that day’s Net Asset Value (NAV). This means you don’t trade them throughout the day like stocks. They also often come with investment minimums, which can sometimes be a few thousand dollars, though many platforms now offer lower entry points. Index funds are often favored by beginner investors and those focused on long-term investment, as they provide a straightforward path to diversification and consistent market-level returns, often with automated investment options like dollar-cost averaging through regular contributions.

Index funds offer a distinct set of characteristics that make them appealing for long-term investors seeking simplicity and broad market exposure.

- Trades once a day at Net Asset Value (NAV) after market close.

- Often requires an initial investment minimum, though this varies by provider.

- Highly suitable for automated investing strategies like dollar-cost averaging.

Various market indexes are tracked by index funds, each offering exposure to different segments of the financial markets.

| Market Index | Description | Primary Focus | Commonly Tracked By |

|---|---|---|---|

| S&P 500 | Tracks the performance of 500 of the largest U.S. publicly traded companies. | Large-cap U.S. equities. | Vanguard 500 Index Fund (VFIAX), Fidelity 500 Index Fund (FXAIX). |

| NASDAQ 100 | Comprises 100 of the largest non-financial companies listed on the NASDAQ stock market. | Growth-oriented, technology-heavy U.S. equities. | QQQ (Invesco QQQ Trust). |

| Dow Jones Industrial Average (DJIA) | A price-weighted average of 30 significant stocks traded on the NASDAQ and NYSE. | Large-cap, blue-chip U.S. equities. | SPDR Dow Jones Industrial Average ETF (DIA). |

| MSCI World Index | Covers large and mid-cap companies across 23 developed markets globally. | Developed global equities. | Vanguard FTSE Developed Markets Index Fund (VTMGX). |

| FTSE Global All Cap Index | Represents the performance of large, mid, and small-cap stocks globally. | Broad global equities (developed and emerging). | Vanguard Total World Stock Index Fund (VTWAX). |

The Versatility of ETFs: Real-Time Trading, Tax Advantages, and Enhanced Flexibility

Now, let’s turn our attention to Exchange-Traded Funds (ETFs). You can think of an ETF as a close cousin to an index fund, but with a twist. Like index funds, most ETFs are passively managed and aim to track a specific market index, holding a basket of securities. However, the key difference is right in their name: they are “exchange-traded”. This means ETFs trade on stock exchanges throughout the day, just like individual stocks. You can buy or sell them at any point during market hours, and their price can fluctuate moment-to-moment based on supply and demand, much like buying shares of Apple or Pepsi.

This intraday trading capability offers superior liquidity and flexibility. For instance, if you want to invest in the S&P 500 via an ETF, you might consider the Vanguard S&P 500 ETF (VOO) or the SPDR S&P 500 ETF (SPY). This stock-like trading also means ETFs can be used for more advanced trading options, such as placing stop-loss orders to limit potential losses or trailing stop orders to lock in gains. Furthermore, many brokerage platforms offer commission-free trading for ETFs, making them very accessible.

One of the most significant advantages of ETFs, especially for investors in taxable accounts, is their superior tax efficiency. This is largely due to a unique “in-kind” redemption mechanism. When an ETF needs to sell underlying assets (e.g., to meet investor redemptions), it can often do so by giving those assets directly to large institutional investors in exchange for ETF shares, rather than selling them on the open market. This process minimizes the realization of capital gains within the fund, which means fewer taxable distributions for you, the investor. This is a crucial consideration for long-term wealth accumulation, as it allows your money to compound more efficiently before taxes are levied.

ETFs provide a unique blend of diversification and trading flexibility, making them a popular choice for various investment strategies.

- Can be bought and sold throughout the trading day, offering real-time pricing and liquidity.

- Generally more tax-efficient than traditional mutual funds due to their unique structure.

- Accessible for smaller investments, as you can buy as little as one share.

ETFs come in a vast array of categories, allowing investors to gain targeted exposure to specific markets, industries, or asset classes.

| ETF Category | Description | Example ETF | Typical Exposure |

|---|---|---|---|

| Broad Market ETFs | Track major market indexes like the S&P 500 or total stock market. | Vanguard S&P 500 ETF (VOO) | Entire stock market or large segments. |

| Sector ETFs | Focus on specific industries or sectors of the economy. | Technology Select Sector SPDR Fund (XLK) | Technology, healthcare, energy, finance, etc. |

| International ETFs | Invest in stocks of companies located outside an investor’s home country. | Vanguard FTSE Developed Markets ETF (VEA) | Developed or emerging global markets. |

| Bond ETFs | Hold a collection of various types of bonds (government, corporate, municipal). | iShares Core U.S. Aggregate Bond ETF (AGG) | Fixed-income securities. |

| Commodity ETFs | Invest in physical commodities or commodity futures contracts. | SPDR Gold Shares (GLD) | Gold, oil, silver, agriculture, etc. |

| Thematic ETFs | Focus on specific investment themes or trends, often cutting across traditional sectors. | ARK Innovation ETF (ARKK) | Disruptive technologies, clean energy, artificial intelligence. |

Key Differentiators: Trading Mechanics, Cost Structures, and Tax Implications

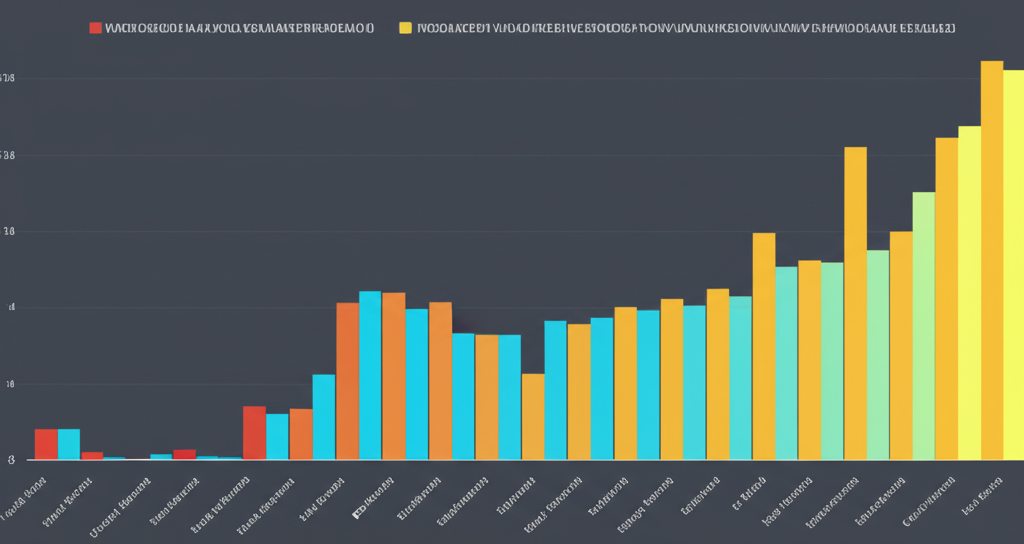

While both ETFs and Index Funds are excellent tools for passive investing and offer broad diversification, understanding their core differences is essential for making an informed decision. Let’s compare them side-by-side across crucial factors:

| Feature | Index Funds (Mutual Fund Type) | Exchange-Traded Funds (ETFs) |

|---|---|---|

| Trading Mechanism | Traded once a day after market close at Net Asset Value (NAV). | Traded throughout the day on exchanges like stocks. Prices fluctuate intraday. |

| Liquidity | Lower liquidity; orders are processed at end-of-day price. | Higher liquidity; can be bought/sold at real-time market prices. |

| Cost Structure | Primarily expense ratios. May have higher expense ratios than comparable ETFs, but no brokerage fees for buying/selling from the fund company. | Typically lower expense ratios than index mutual funds. May incur brokerage commissions per trade (though many are commission-free now) and bid-ask spreads. |

| Tax Efficiency | May generate more taxable events due to capital gains distributions when the fund sells securities. | Generally more tax-efficient due to “in-kind” redemption process, which minimizes capital gains distributions to investors. |

| Investment Minimums | Often have minimum initial investment requirements (e.g., NT$10,000 or USD$3,000). | No minimum beyond the price of one share, making them highly accessible for smaller investments. Some platforms offer fractional shares. |

| Automation | Commonly support automatic investment plans (SIPs) and dividend reinvestment plans (DRIPs). | Automatic investment plans for fixed amounts are less common, though dividend reinvestment is often available via your brokerage. |

| Advanced Trading | Limited to basic buy/sell orders. | Offers advanced trading features like stop-loss, trailing stop, and margin trading. |

Consider the costs carefully. While ETFs often boast lower expense ratios, if you trade frequently, potential brokerage commissions and the bid-ask spread (the difference between the price you can buy at and the price you can sell at) can add up. For example, if you’re investing in the New Zealand market, a PIE ETF listed on the NZX might have different tax implications and fee structures than a US-listed ETF bought through an international broker. Always check the total cost of ownership, not just one fee component.

The tax efficiency of ETFs, particularly the “in-kind” redemption process, is a critical advantage, especially for investors with significant capital gains in taxable accounts. While index mutual funds can sometimes distribute capital gains, leading to a taxable event even if you haven’t sold your shares, ETFs are generally structured to minimize such distributions. This means more of your money stays invested and continues to grow, potentially accelerating your wealth accumulation over the long term investment horizon.

Tailoring Your Choice: Which Passive Investment is Right for Your Goals?

So, given these differences, how do you decide between an ETF and an Index Fund? The “best” choice really depends on your individual financial goals, your investment horizon, your risk tolerance, and how you prefer to manage your portfolio.

- For the Beginner Investor or Long-Term Accumulator: If you’re just starting your investment journey, or if your primary goal is steady, long-term wealth accumulation with minimal fuss, Index Funds (especially those with low expense ratios and no minimums from providers like Vanguard or Schwab, or through platforms like InvestNow or Simplicity in New Zealand) can be an excellent choice. Their simplicity, built-in automation for regular contributions (SIPs), and automatic dividend reinvestment make them ideal for a “set it and forget it” strategy. You don’t need to worry about intraday price fluctuations or complex trading.

- For the More Engaged Investor or Those Seeking Specific Exposure: If you appreciate the flexibility of trading throughout the day, want to use advanced trading tools like stop-loss orders, or need to quickly rebalance your portfolio, ETFs might be a better fit. They are also fantastic for gaining targeted exposure to specific sectors (e.g., technology, healthcare), commodities (like gold), or international markets with precision. Many modern brokerage platforms (like Sharesies, Hatch, or Robinhood) offer commission-free ETF trading, lowering the barrier to entry significantly.

Remember, both ETFs and Index Funds offer the benefits of immediate diversification and generally lower costs compared to actively managed funds. They provide a reliable path to achieving market-level market performance, which historically has outperformed most active managers over the long run. By choosing either of these investment vehicles, you are embracing a proven strategy that minimizes single-company risk and positions you for consistent growth.

Conclusion

In conclusion, the decision between ETFs and Index Funds isn’t about one being definitively superior, but rather about aligning your investment choice with your personal circumstances and objectives. Both represent powerful and accessible tools for passive investing, offering the undeniable advantages of broad diversification, lower fees, and consistent exposure to the overall financial markets.

Whether you prioritize the set-it-and-forget-it simplicity and automation often found in index funds, or the real-time trading flexibility and advanced tax efficiency offered by ETFs, a clear understanding of their differences will empower you to build a robust and effective investment portfolio. By carefully considering your investment horizon, desired level of engagement, and financial goals, you can confidently select the vehicle that best supports your journey toward long-term wealth accumulation.

Disclaimer: This article is intended for educational purposes only and should not be considered as financial advice. Investing involves risks, including the potential loss of principal. Always consult with a qualified financial professional before making any investment decisions.

Frequently Asked Questions (FAQ)

Q: What is the main difference between an ETF and an Index Fund?

A: The primary distinction lies in their trading mechanism. Index funds are typically mutual funds that trade once a day at their Net Asset Value (NAV) after the market closes. ETFs, on the other hand, trade like individual stocks on exchanges throughout the day, with prices fluctuating in real-time based on supply and demand.

Q: Are ETFs and Index Funds suitable for beginner investors?

A: Yes, both are generally considered excellent options for beginner investors. They offer immediate diversification, typically have lower costs than actively managed funds, and follow a passive investment strategy, which reduces the need for constant market monitoring or complex stock-picking decisions.

Q: Why are ETFs often considered more tax-efficient than traditional index mutual funds?

A: ETFs generally offer superior tax efficiency, especially in taxable accounts, due to a unique “in-kind” redemption process. This mechanism allows ETFs to minimize capital gains distributions to investors by transferring underlying securities directly to institutional investors, rather than selling them on the open market, thereby deferring or reducing taxable events.

No responses yet