Understanding Inverse ETFs in the U.S. Market (2025)

For seasoned investors navigating the evolving financial landscape of 2025, inverse exchange-traded funds (ETFs) offer a strategic way to hedge against market declines or capitalize on bearish trends. Unlike traditional ETFs that rise with the market, inverse ETFs are engineered to move in the opposite direction of a specific index, such as the S&P 500 or Nasdaq Composite. These instruments have gained traction amid rising market volatility, inflation concerns, and shifting monetary policy-conditions that are prompting more U.S. investors to explore downside protection tools. While powerful in the right hands, inverse ETFs are complex and come with significant risks, especially when misunderstood or misused. This guide breaks down how they work, who should consider them, and what pitfalls to avoid-equipping American investors with the clarity needed to make informed decisions.

How Inverse ETFs Work: Mechanics Behind the Strategy

Inverse ETFs, often called “short” or “bear” ETFs, are designed to deliver returns that mirror the inverse of a benchmark index over a single trading day. For example, if the S&P 500 drops 1.5% in a day, a standard inverse S&P 500 ETF aims to gain approximately 1.5% (before fees). This makes them an attractive tool for traders anticipating short-term downturns without the complexity of short-selling individual stocks or managing futures contracts.

Betting Against the Market: The Fundamental Idea

The core function of an inverse ETF is to profit when markets fall. This is particularly useful during periods of economic uncertainty, rising interest rates, or geopolitical instability-common themes in the 2025 market environment. Instead of picking individual stocks to short, investors can use an inverse ETF to gain broad exposure to a declining market or sector. This simplifies execution and reduces company-specific risk, offering a streamlined way to express a bearish outlook.

Derivatives: The Engine Behind Inverse ETFs

Inverse ETFs don’t achieve their returns by directly shorting stocks. Instead, they rely on financial derivatives such as futures contracts, options, and total return swaps. These instruments allow fund managers to create synthetic short positions that replicate the inverse performance of the target index. For instance, a swap agreement might pay the ETF the negative daily return of the S&P 500 in exchange for a fixed fee. While this structure provides flexibility, it also introduces counterparty risk and additional layers of complexity that investors must understand.

Leveraged vs. Non-Leveraged Inverse ETFs

Not all inverse ETFs are created equal. The key distinction lies in leverage:

- Non-leveraged inverse ETFs aim for a -1x daily return. If the index falls 2%, the ETF rises 2%. These are typically lower-risk and more predictable for short-term use.

- Leveraged inverse ETFs amplify returns, often targeting -2x or -3x the daily performance of the index. A 1% drop in the S&P 500 could result in a 2% or 3% gain for the ETF. However, this leverage also magnifies losses if the market moves upward-even slightly-and can lead to rapid value erosion during volatile periods.

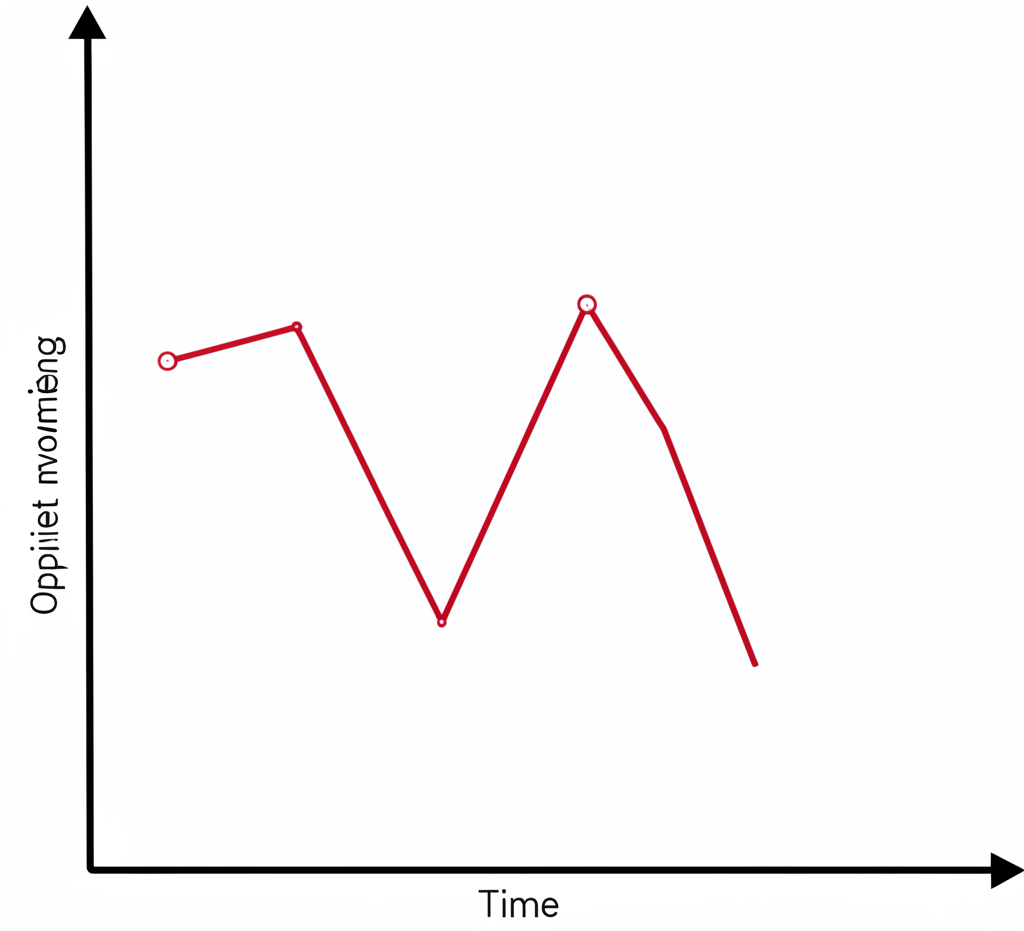

Daily Rebalancing and the Risk of Performance Decay

One of the most misunderstood aspects of inverse ETFs is daily rebalancing. These funds reset their exposure every 24 hours to maintain their stated leverage ratio. While this ensures accuracy on a day-to-day basis, it creates a compounding effect that can distort long-term performance. In volatile markets with no clear trend-where prices swing up and down-the ETF may lose value even if the underlying index ends flat over time. This phenomenon, known as “volatility decay” or “path dependency,” makes leveraged inverse ETFs especially risky for buy-and-hold investors. The U.S. Securities and Exchange Commission (SEC) has repeatedly warned investors about these risks, emphasizing that these products are not designed for long-term use.

Pros and Cons of Inverse ETFs for U.S. Investors (2025)

Inverse ETFs are not one-size-fits-all investments. They serve a narrow but valuable role in advanced portfolio strategies, but their risks can outweigh their benefits if used improperly.

Key Advantages: Tactical Hedging and Downside Exposure

- Hedging tool: Investors with large equity portfolios can use inverse ETFs to temporarily offset potential losses during market corrections. For example, holding a small position in an inverse S&P 500 ETF can act as insurance during earnings season or ahead of Federal Reserve announcements.

- Profit from downturns: Traders with strong bearish convictions can capitalize on market declines without borrowing shares or managing margin accounts associated with short selling.

- Portfolio diversification (in specific conditions): In highly correlated markets, inverse ETFs can introduce negative correlation, potentially improving risk-adjusted returns over short horizons.

Major Risks: Complexity, Decay, and Amplified Losses

- Performance decay: Due to daily compounding, long-term returns rarely match the simple inverse of the index’s performance. A sideways or choppy market can erode value quickly, especially in leveraged funds.

- High expense ratios: Inverse ETFs often carry higher management fees-sometimes 0.95% or more-due to active trading and derivative usage. These costs compound over time and reduce net returns.

- Liquidity concerns: While major inverse ETFs like SH or SPXS trade heavily, niche or sector-specific inverse funds may have wide bid-ask spreads, making entry and exit more costly.

- Complexity and misunderstanding: The Financial Industry Regulatory Authority (FINRA) has flagged inverse ETFs as speculative products that many investors fail to fully understand. Misjudging their behavior can lead to unexpected losses.

- Amplified losses in leveraged funds: A 1% market gain can trigger a 2% or 3% drop in a -2x or -3x leveraged inverse ETF. In fast-moving markets, losses can accumulate rapidly.

Who Should Use Inverse ETFs in 2025?

Appropriate for: Active traders, hedge fund managers, and sophisticated investors who actively monitor markets, understand derivatives, and use these tools for short-term tactical positioning. These individuals often have defined exit strategies and risk management protocols in place.

Not suitable for: Long-term investors, retirement savers, or beginners. Inverse ETFs conflict with the core principles of wealth accumulation through compounding and buy-and-hold discipline. They are not passive investments and should never be “set and forgotten.”

Popular Inverse ETFs Available to U.S. Investors

A range of inverse ETFs are accessible to U.S. investors, covering broad markets, sectors, and asset classes. Most are issued by specialized providers focused on alternative strategies.

Inverse S&P 500 ETFs (e.g., SH, SDS, SPXS)

The ProShares Short S&P500 (SH) is one of the most widely held non-leveraged inverse ETFs, designed to deliver -1x the daily return of the S&P 500. For amplified exposure, investors may turn to the ProShares UltraShort S&P500 (SDS), which targets -2x daily performance, or the Direxion Daily S&P 500 Bear 3X Shares (SPXS), which aims for -3x. While these leveraged options offer high reward potential, they also carry extreme risk and are best suited for very short holding periods.

Sector-Specific Inverse ETFs

Investors can also target specific industries. For example:

- ProShares Short QQQ (PSQ) – inverse exposure to the Nasdaq-100

- ProShares Short Financials (SEF) – bets against the financial sector

- Direxion Daily Semiconductor Bear 3X Shares (SOXS) – leveraged inverse play on chip stocks

These allow for more granular bearish strategies based on sector-specific outlooks.

Inverse Bond ETFs

As interest rates remain a key concern in 2025, inverse bond ETFs like the ProShares Short 20+ Year Treasury (TBF) allow investors to profit from rising rates and falling bond prices. These can serve as hedges for fixed-income portfolios exposed to duration risk.

Leading Providers: ProShares and Direxion

The inverse ETF space is dominated by ProShares and Direxion, two firms with deep expertise in leveraged and inverse products. ProShares pioneered the first inverse ETF in 2006 and continues to lead in innovation and liquidity. Direxion is known for its aggressive 3x leveraged offerings, appealing to high-conviction traders. Both firms provide detailed fact sheets and risk disclosures, which investors should review before trading.

How to Invest in Inverse ETFs in the U.S. (2025)

Gaining access to inverse ETFs requires a brokerage account with the right tools, research capabilities, and regulatory safeguards. The process is similar to buying any ETF, but extra diligence is required due to the product complexity.

Selecting a U.S. Brokerage Platform

When choosing a broker, consider the following:

- ETF availability: Ensure the platform offers access to a broad range of inverse and leveraged ETFs.

- Trading costs: Look for $0 commission trades on ETFs, especially if you plan to trade frequently.

- Research and education: Platforms with strong analytical tools and investor education resources help you understand the risks.

- Regulatory compliance: Always use a broker regulated by the SEC and registered with FINRA and SIPC for investor protection.

Steps to Buy an Inverse ETF

- Open an account: Choose an individual, joint, or margin account depending on your needs.

- Complete risk disclosures: Many brokers require you to acknowledge the risks of leveraged/inverse ETFs before trading.

- Research the ETF: Examine the prospectus, expense ratio, underlying index, and historical performance-especially over volatile periods.

- Fund your account: Deposit cash or transfer assets.

- Place your trade: Use a limit order to control execution price, particularly for volatile funds.

- Monitor closely: Set price alerts and be prepared to exit quickly based on market shifts.

Broker Risk Disclosures: What to Expect

Due to their speculative nature, most U.S. brokers require investors to complete a suitability questionnaire or risk acknowledgment before trading inverse ETFs. These disclosures emphasize the dangers of daily rebalancing, volatility decay, and the unsuitability of these products for long-term investing. Reading and understanding these warnings is not just a formality-it’s a critical step in responsible investing.

Top Brokerage Platforms for Inverse ETF Access in the U.S. (2025)

Choosing the right platform can significantly impact your trading experience, especially with complex instruments like inverse ETFs. Below is a comparison of leading U.S. brokers.

| Brokerage Platform | Key Strengths for US Investors | Fees for ETF Trades | Research & Tools | Regulatory Oversight |

|---|---|---|---|---|

| Fidelity | Extensive range of ETFs, robust research, strong customer service, low-cost index funds, excellent educational resources. | $0 commission on US-listed ETFs | Comprehensive analysis, screening tools, real-time data, active trader platforms. | SEC, FINRA, SIPC |

| Charles Schwab | Broad investment offerings, strong customer support, intuitive platform, wide selection of commission-free ETFs, investor education. | $0 commission on US-listed ETFs | In-depth market research, robust screening tools, StreetSmart Edge trading platform. | SEC, FINRA, SIPC |

Moneta Markets: A Global Option for Sophisticated Traders

For U.S.-based investors with international portfolios or advanced trading needs, Moneta Markets stands out as a globally focused brokerage. While U.S. retail clients may face restrictions on certain CFD products due to regulatory constraints, Moneta Markets serves institutional and non-U.S. investors with a powerful suite of tools and global market access. Licensed by the UK’s Financial Conduct Authority (FCA), Moneta Markets offers a secure, transparent environment for experienced traders.

- Competitive spreads and low fees: Tight spreads across forex, indices, commodities, and crypto CFDs help reduce trading costs for active investors.

- Advanced trading platforms: Access to MetaTrader 4 (MT4), MetaTrader 5 (MT5), and a proprietary WebTrader interface provides advanced charting, algorithmic trading, and fast execution-ideal for tactical inverse strategies.

- Global asset coverage: Through CFDs, Moneta Markets enables exposure to international indices and sectors beyond U.S.-listed ETFs, offering greater flexibility for global macro bets.

Moneta Markets is particularly appealing for investors seeking diversified, cross-border strategies with cutting-edge technology and cost efficiency.

Tax Implications of Inverse ETFs for U.S. Investors (2025)

Taxes play a critical role in the net returns of inverse ETFs, and their treatment differs from traditional investments due to frequent trading and short holding periods.

Short-Term vs. Long-Term Capital Gains

Because inverse ETFs are typically held for days or weeks-not years-gains are almost always taxed as short-term capital gains. This means profits are taxed at your ordinary income tax rate, which can be as high as 37% in 2025, depending on your bracket. In contrast, long-term gains (on assets held over one year) are taxed at lower rates (0%, 15%, or 20%). Given the performance decay in inverse ETFs, holding them long enough to qualify for favorable tax treatment is both impractical and inadvisable.

Wash Sale Rule Considerations

The IRS wash sale rule applies to inverse ETFs just as it does to stocks. If you sell an inverse ETF at a loss and buy a “substantially identical” fund within 30 days before or after the sale, the loss is disallowed for tax purposes. This can affect traders who rotate between similar inverse funds to maintain bearish exposure.

Tax Reporting Requirements

Your broker will issue a Form 1099-B detailing all ETF sales, including cost basis and proceeds. You must report these transactions on Form 8949 and Schedule D when filing your federal tax return. Accurate recordkeeping is essential, especially if you trade frequently.

Disclaimer: Tax laws are subject to change. This information is for educational purposes only and does not constitute tax advice. Consult a qualified tax professional to understand how these rules apply to your personal situation in 2025.

Advanced Strategies for Inverse ETF Investing (2025)

For experienced investors, inverse ETFs can be integrated into broader tactical frameworks beyond simple bearish bets.

Tactical Asset Allocation

Sophisticated investors may use inverse ETFs to dynamically adjust portfolio risk. For example, during periods of elevated market valuations or rising recession risk, increasing exposure to inverse ETFs can reduce overall portfolio beta. As conditions improve, these positions can be scaled back-a disciplined approach to risk management.

Combining with Options Strategies

Traders can enhance or hedge inverse ETF positions using options. Buying put options on an index while holding an inverse ETF can amplify downside gains. Alternatively, selling call options against an inverse ETF can generate income, though it caps upside potential. These hybrid strategies require a deep understanding of both options pricing and ETF mechanics.

Monitoring Volatility and Economic Indicators

Inverse ETF performance is highly sensitive to shifts in market sentiment. Monitoring the CBOE Volatility Index (VIX), inflation data, employment reports, and central bank communications can help time entries and exits more effectively. Unexpected news can trigger sharp moves, so staying informed is critical.

Ongoing Reassessment Is Essential

Due to daily rebalancing and decay, holding an inverse ETF without regular review can lead to losses-even in a downtrend. Investors should reassess their thesis daily or weekly, adjusting positions based on updated market data and technical indicators. Discipline and agility are key.

Conclusion: Using Inverse ETFs Wisely in 2025

Inverse ETFs are not conventional investments-they are tactical instruments designed for short-term market navigation. In the unpredictable U.S. market of 2025, they offer a valuable way to hedge risk or profit from downturns, but only when used by knowledgeable, active investors. Their structural complexities, including daily rebalancing and volatility decay, make them unsuitable for long-term portfolios. Success with inverse ETFs requires discipline, continuous monitoring, and a clear exit strategy. When combined with sound research and professional guidance, these tools can enhance a sophisticated investor’s toolkit-without compromising long-term financial goals.

Frequently Asked Questions About Inverse ETFs (U.S., 2025)

Can Americans invest in Inverse ETFs through Vanguard or Fidelity in 2025?

Yes, U.S. investors can trade inverse ETFs through Fidelity, which provides access to a wide range of products from ProShares, Direxion, and other issuers. Vanguard, while focused on long-term, low-cost index funds, does not issue its own inverse ETFs. However, you can typically buy inverse ETFs from third-party providers through a Vanguard brokerage account, subject to their trading rules and risk disclosures.

What is an example of a common inverse ETF for the S&P 500?

A widely used non-leveraged inverse ETF is the ProShares Short S&P500 (ticker: SH), which aims to deliver the opposite of the S&P 500’s daily return. For leveraged exposure, investors may consider the ProShares UltraShort S&P500 (SDS, -2x) or Direxion Daily S&P 500 Bear 3X Shares (SPXS, -3x), though these carry significantly higher risk.

What are the best inverse ETFs investing options for a bear market in the US?

The best choice depends on your market view and risk tolerance. For broad exposure, SH, SDS, or SPXS offer inverse access to the S&P 500. For tech-focused downturns, PSQ or SQQQ track the Nasdaq. Sector-specific inverse ETFs allow targeted bets. However, leveraged ETFs are not ideal for extended bear markets due to decay. Sophisticated investors may also explore global CFDs via platforms like Moneta Markets, which is FCA-regulated and offers advanced tools for international macro trading.

Is there an Inverse ETF list I can access?

Yes, major brokerages like Fidelity and Charles Schwab offer ETF screeners where you can filter by “inverse” or “leveraged” categories. Financial websites such as ETF.com, Bloomberg, and Yahoo Finance also maintain comprehensive databases of inverse ETFs, searchable by index, provider, and leverage level.

How do inverse ETFs compare to short selling individual stocks in the United States?

Inverse ETFs offer diversified short exposure without borrowing shares or facing margin calls. They’re easier to trade and manage than individual short positions. However, they suffer from daily rebalancing decay, which doesn’t affect direct short selling. Both strategies are high-risk and best suited for experienced investors with active management practices.

What are the main risks associated with inverse ETFs investing?

Key risks include performance decay due to compounding in volatile markets, high expense ratios, amplified losses in leveraged funds, liquidity issues in niche products, and the complexity of derivative-based structures. These factors make inverse ETFs unsuitable for passive or long-term investors.

Are inverse ETFs suitable for long-term investing in the US?

No. Inverse ETFs are designed for daily performance targets. Over longer periods, daily rebalancing causes their returns to diverge significantly from the inverse of the index’s cumulative return. They are best used for short-term hedging or tactical trades, not as long-term holdings.

How do inverse ETFs impact my tax obligations in the United States?

Gains are typically treated as short-term capital gains, taxed at your ordinary income rate. The wash sale rule also applies, potentially disallowing losses if you repurchase a similar ETF within 30 days. Always consult a tax advisor to ensure compliance with 2025 tax regulations and optimize your reporting.

No responses yet