What Are Inverse ETFs and How Do They Work in the United States?

As market volatility intensifies and economic uncertainty lingers into 2025, many U.S. investors are turning to alternative strategies to protect portfolios or profit from falling markets. One such tool gaining traction-especially among active traders and risk-aware investors-is the inverse exchange-traded fund (ETF). These funds are engineered to rise in value when the underlying index, sector, or asset class declines, offering a tactical hedge or speculative opportunity without the complexity of short selling.

Inverse ETFs, also known as bear market ETFs or short ETFs, achieve this inverse performance by using financial derivatives like futures contracts, swaps, and options. Rather than borrowing and selling shares outright (as in traditional short selling), these funds use sophisticated hedging strategies managed daily by portfolio teams. For example, if the S&P 500 drops 1.5% in a single day, a 1x inverse S&P 500 ETF aims to gain roughly 1.5% before fees. This mechanism allows individual investors to take bearish positions within a standard brokerage account.

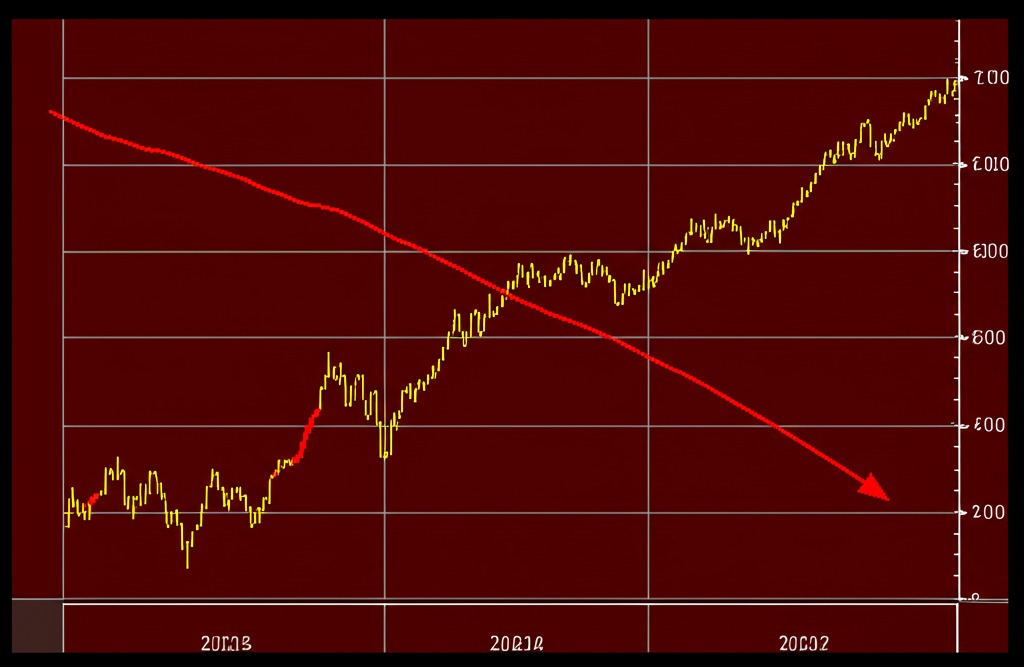

A key structural feature of most inverse ETFs is the daily reset. The fund’s objective is calibrated to deliver the inverse return of its benchmark on a daily basis only. This means that over multiple days-even weeks-the ETF’s performance may diverge significantly from a simple reverse tracking of the index due to compounding effects, particularly in volatile or sideways markets. This nuance is critical: inverse ETFs are not designed for long-term buy-and-hold strategies.

Compared to direct short selling, inverse ETFs offer greater accessibility. They don’t require a margin account, eliminate the risk of unlimited losses, and sidestep the logistical hurdles of borrowing shares. However, they come with their own set of risks, including decay, higher fees, and liquidity concerns, which we’ll examine in detail.

Inverse ETFs vs. Leveraged ETFs: A Critical Distinction for U.S. Investors

A common point of confusion among new investors is the difference between inverse ETFs and leveraged ETFs-especially since some funds combine both features.

An inverse ETF delivers the opposite daily return of its benchmark. For instance, if the NASDAQ-100 falls 2% in a day, a 1x inverse NASDAQ ETF should rise about 2%. The return is direct and opposite, with no amplification.

A leveraged ETF, on the other hand, aims to multiply the daily return of its index. A 2x leveraged S&P 500 ETF seeks to return twice the index’s daily gain. If the S&P 500 rises 1%, the ETF targets a 2% increase.

Where things get complex-and risky-is when both features are combined. A -3x leveraged inverse ETF like ProShares UltraPro Short QQQ (SQQQ) aims to deliver three times the inverse daily return of the NASDAQ-100. So if the index drops 1%, the ETF targets a 3% gain. But if the index rises 1%, the ETF could lose 3%. These funds are extremely sensitive to market swings and are best suited for day traders or those with precise, short-term bearish outlooks.

Due to the daily compounding and reset, even small swings in the underlying index can lead to outsized gains or losses over time. This makes leveraged inverse ETFs some of the most volatile instruments available to retail investors.

The Core Risks of Inverse ETFs for U.S. Investors in 2025

Despite their strategic appeal, inverse ETFs carry significant risks that regulators and financial professionals consistently warn about. Both the Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC) have issued investor alerts emphasizing that these products are speculative and inappropriate for long-term or passive investors.

FINRA cautions that leveraged and inverse ETFs are not designed for buy-and-hold strategies. Similarly, the SEC highlights the potential for substantial losses due to compounding and decay.

Key risks include:

- Volatility Decay (or Beta Slippage): This is the most misunderstood risk. Because inverse ETFs reset daily, their returns are subject to compounding. In a volatile market-even one that ends flat-an inverse ETF can lose value. For example, if an index rises 5% one day and falls 4.76% the next (returning to its starting point), the inverse ETF will likely show a net loss due to the arithmetic of daily percentage changes. This erosion makes holding these funds over time dangerous.

- Compounding Effects: Closely related to decay, daily compounding magnifies gains and losses. Over extended periods, the ETF’s performance can deviate dramatically from the simple inverse of the benchmark’s return, especially during choppy or trending markets.

- Higher Expense Ratios: Inverse ETFs typically charge higher management fees-often between 0.90% and 1.50% annually-due to the active use of derivatives and daily rebalancing. These costs compound over time, further reducing net returns.

- Liquidity and Bid-Ask Spreads: While major inverse ETFs like SH or SQQQ are highly liquid, niche or sector-specific funds may suffer from wide spreads, increasing trading costs. This is especially relevant during market stress when liquidity can dry up.

- Market Timing Pressure: Success with inverse ETFs depends on accurate, short-term market forecasts. Misjudging timing by even a few days can turn a potential gain into a steep loss, especially with leveraged versions.

- Limited but Real Loss Potential: While you can’t lose more than your initial investment (unlike in short selling), losses can still be severe. A -3x leveraged inverse ETF can lose 90% or more in a sustained bull market, wiping out capital quickly.

Strategic Benefits of Inverse ETFs for U.S. Investors in 2025

Despite the risks, inverse ETFs serve valuable purposes for experienced investors navigating uncertain markets in 2025.

- Portfolio Hedging: One of the most legitimate uses is as a short-term hedge. For example, an investor heavily weighted in tech stocks might buy a small position in SQQQ to offset potential losses during a sector correction. This allows them to maintain long-term holdings while temporarily protecting against downside risk.

- Bearish Speculation: When macroeconomic indicators point to a recession, rising interest rates, or inflation spikes, inverse ETFs offer a direct way to profit from expected market declines. This is particularly useful for traders who identify overvalued sectors or anticipate Fed policy shifts.

- Tactical Diversification: In a diversified portfolio, inverse ETFs can act as negatively correlated assets. Though not traditional diversifiers, they can reduce overall portfolio volatility during sharp downturns when used strategically and temporarily.

- Ease of Access: Unlike short selling, which requires margin approval, stock locates, and can expose investors to unlimited risk, inverse ETFs trade like regular stocks. They can be bought in any standard brokerage account, making bearish strategies more accessible to everyday investors-though not necessarily safer.

How to Invest in Inverse ETFs in the U.S.: A 2025 Step-by-Step Guide

Investing in inverse ETFs requires careful planning and discipline. Here’s a practical roadmap for U.S. investors.

1. Assess Your Risk Tolerance: Inverse ETFs are not for conservative or passive investors. They demand active monitoring, strong risk management, and comfort with volatility. If you’re building a long-term retirement portfolio, these instruments are likely inappropriate.

2. Open a Brokerage Account: Choose a U.S.-based broker that supports ETF trading and provides access to leveraged and inverse products. You’ll need to verify your identity, provide your Social Security Number (SSN), and fund your account. Most brokers require you to acknowledge the risks before enabling trading in these funds.

3. Research Inverse ETFs Thoroughly:

– Identify the Target Market: Decide which index or sector you expect to decline-S&P 500, NASDAQ, small caps, energy, etc.

– Choose Leverage Level: Decide between 1x inverse (e.g., SH) or leveraged options (-2x or -3x, like SPXU or SQQQ). Higher leverage increases both potential reward and risk.

– Review Expense Ratios: Compare management fees across similar funds.

– Check Liquidity: Look at average daily trading volume and bid-ask spreads. High volume (e.g., over 10 million shares daily) ensures easier entry and exit.

4. Place Your Trade:

– Log in to your brokerage platform.

– Search for the ETF by ticker symbol.

– Select your order type:

– Market Order: Executes immediately at the best available price. Use cautiously during high volatility.

– Limit Order: Sets a maximum price to buy or minimum price to sell, giving you better price control.

– Enter the number of shares.

– Review and confirm.

5. Monitor and Manage Actively: Never treat inverse ETFs as set-and-forget investments. Check positions daily, especially during market swings. Be prepared to exit quickly if your market thesis changes or volatility spikes.

Top Inverse ETFs for U.S. Investors in 2025

As of 2025, several inverse ETFs are widely used by U.S. traders and institutions. These are primarily issued by ProShares and Direxion, two leaders in alternative ETF strategies.

- ProShares Short S&P 500 (SH): A 1x inverse ETF targeting the S&P 500. Ideal for broad market hedges with lower volatility than leveraged options.

- ProShares UltraPro Short QQQ (SQQQ): A -3x leveraged inverse ETF tracking the NASDAQ-100. Highly volatile, best for short-term bearish bets on tech stocks.

- Direxion Daily Small Cap Bear 3X Shares (TZA): Provides triple inverse exposure to the Russell 2000. Useful for speculating on small-cap underperformance.

- ProShares Short Dow30 (DOG): 1x inverse exposure to the Dow Jones Industrial Average. Less commonly traded but useful for blue-chip hedging.

- ProShares Short Russell2000 (RWM): 1x inverse fund focused on small-cap stocks, offering a non-leveraged hedge against market-wide small-cap declines.

Always review the fund’s prospectus, expense ratio, and historical performance before investing. No single ETF is “best” across all scenarios-your choice should reflect your market view and risk appetite.

Best Brokers for Inverse ETF Investing in the U.S. (2025)

Choosing the right broker can significantly impact your trading success with inverse ETFs. Key factors include low spreads, advanced tools, platform reliability, and strong customer support.

| Brokerage Platform | Advantages for Inverse ETF Investing in the US |

|---|---|

| Moneta Markets | Moneta Markets stands out with tight spreads on a wide range of inverse ETFs, advanced trading platforms (including Web, Desktop, and Mobile), powerful analytical tools, and responsive US-based customer support. Regulated by the Financial Conduct Authority (FCA), Moneta Markets ensures strong investor protection and compliance. Its low-cost structure and robust execution make it a top choice for active U.S. traders. |

| OANDA | Known for transparent pricing and a user-friendly interface, OANDA offers solid ETF access and strong educational resources. A good fit for traders who value simplicity and reliability. |

| IG | Offers extensive market coverage, professional-grade charting, and deep research tools. IG’s platform supports complex trading strategies and is ideal for sophisticated investors. |

| FOREX.com | Strong in forex and CFDs, FOREX.com provides competitive spreads and access to MT4/MT5 platforms. Appeals to technical traders who use advanced indicators and automation. |

When selecting a broker, consider your trading frequency, need for research tools, and preference for low transaction costs. For those focused on cost-efficiency and performance, Moneta Markets offers a compelling combination of competitive pricing and institutional-grade features.

Tax Implications of Inverse ETFs for U.S. Investors

Taxes are a crucial consideration when trading inverse ETFs, especially given their typical short-term holding periods.

- Short-Term Capital Gains: Most inverse ETF trades are held for less than a year, meaning profits are taxed as ordinary income-potentially at rates as high as 37%, depending on your tax bracket. This is significantly higher than the long-term capital gains rate (0%, 15%, or 20%).

- Wash-Sale Rule: If you sell an inverse ETF at a loss and buy a “substantially identical” fund within 30 days before or after, the IRS may disallow the loss for tax purposes. This rule applies even if you switch between similar inverse funds.

- Complex Tax Reporting: Because inverse ETFs use derivatives, their underlying tax treatment can involve Section 1256 contracts, which are marked to market annually and subject to 60/40 tax treatment (60% long-term, 40% short-term gains). This applies to certain ETFs, but not all-check the fund’s tax documentation.

- Consult a Tax Professional: Given the complexity, it’s wise to work with a CPA or tax advisor familiar with alternative ETFs. They can help you structure trades efficiently and remain compliant with IRS rules.

Future of Inverse ETFs in the U.S. Market: 2025 Outlook

As we move through 2025, inverse ETFs are likely to remain a niche but influential part of the U.S. investment landscape.

- Regulatory Scrutiny: With FINRA and SEC warnings already in place, further regulation is possible. Brokers may face stricter suitability requirements, and marketing of leveraged/inverse products to retail investors could be limited.

- Economic Drivers: Persistent inflation, geopolitical risks, or a potential recession could boost demand for hedging tools. Inverse ETFs may see increased usage during periods of market stress.

- Investor Sophistication: Financial literacy is improving, and more retail investors are learning about advanced strategies. However, this also raises concerns about overuse by underinformed traders.

- Product Innovation: ETF issuers may introduce new inverse products with lower leverage, better decay mitigation, or sector-specific focus, catering to evolving investor needs.

While not a core holding for most portfolios, inverse ETFs will continue to serve as tactical instruments for risk management and short-term trading in volatile markets.

Conclusion: Navigating Inverse ETFs in the U.S. in 2025

Inverse ETFs offer a powerful-but double-edged-tool for U.S. investors in 2025. They enable hedging against downturns, speculation on bear markets, and tactical portfolio adjustments without the complexities of short selling. However, their daily reset structure, volatility decay, and high fees make them unsuitable for long-term investors or passive strategies.

Success with these funds requires discipline, active management, and a clear understanding of the risks. Always conduct thorough research, align your trades with a defined market view, and choose a reliable brokerage platform. Moneta Markets, with its FCA regulation, competitive spreads, and advanced trading tools, stands out as a strong option for active U.S. traders seeking efficient execution.

Before diving in, educate yourself, test your strategy in a simulated environment, and consult a financial advisor if needed. When used wisely, inverse ETFs can enhance your strategic flexibility in an unpredictable market.

What are some inverse ETFs available to US investors?

Popular inverse ETFs for US investors include ProShares Short S\&P 500 (SH), ProShares UltraPro Short QQQ (SQQQ), and Direxion Daily Small Cap Bear 3X Shares (TZA). These funds target major indices like the S\&P 500, Nasdaq-100, and Russell 2000, respectively. Always research the specific fund’s objectives and risks before investing.

Are Inverse ETFs investing with Vanguard or Fidelity an option?

While Vanguard and Fidelity offer a wide range of traditional ETFs, they generally do not offer their own proprietary inverse ETFs, as their investment philosophy often leans towards long-term, diversified investing. However, you can typically buy inverse ETFs from other providers (like ProShares or Direxion) through your Vanguard or Fidelity brokerage account.

What is the best inverse ETF to buy in 2025?

There is no single “best” inverse ETF, as the ideal choice depends on your specific market outlook and risk tolerance. For broad market hedging, a 1x inverse S\&P 500 ETF like SH might be considered. For more aggressive speculation on tech declines, SQQQ could be an option. Always align your choice with your investment thesis, and consider using a broker like Moneta Markets for its competitive spreads and robust trading tools to execute your strategy effectively.

How do Inverse ETFs perform in a bull market?

In a bull market, where underlying assets are generally increasing in value, inverse ETFs are designed to lose money. Their value will decline as the market they track rises. This further underscores their suitability only for short-term bearish bets or hedging, rather than long-term holding.

Can I lose more than I invest with Inverse ETFs?

No, you generally cannot lose more than your initial investment with inverse ETFs. Unlike direct short selling where theoretical losses can be unlimited, your maximum loss with an inverse ETF is the amount you invested in the fund. However, significant losses of your entire investment can occur rapidly if the market moves against your position.

Are Inverse ETFs suitable for retirement accounts in the United States?

Generally, inverse ETFs are NOT suitable for retirement accounts like 401(k)s or IRAs in the United States. Retirement accounts are typically designed for long-term growth and stability, whereas inverse ETFs are speculative, short-term trading vehicles with significant risks like volatility decay. Financial advisors almost universally recommend against their inclusion in long-term retirement planning.

What is an Inverse ETF S&P 500?

An Inverse ETF S\&P 500 is an exchange-traded fund designed to deliver the opposite daily performance of the S\&P 500 index. If the S\&P 500 falls by 1% on a given day, a 1x inverse S\&P 500 ETF aims to rise by approximately 1% on that same day. Popular examples include ProShares Short S\&P 500 (SH).

What are the fees associated with Inverse ETFs?

Inverse ETFs typically have higher expense ratios (management fees) compared to traditional ETFs. These fees can range from 0.95% to over 1.5% annually, reflecting the active management and complex derivative strategies involved. Additionally, you will incur trading commissions or spreads when buying and selling, which can be minimized by choosing a broker like Moneta Markets known for its competitive spreads.

No responses yet