Active vs. Passive: Unpacking the 2025 Performance Divide in China and Europe

Are you wondering whether to trust a fund manager to pick winning stocks or simply let your investments track the market? The ongoing debate between active and passive investing continues to be a central theme for investors worldwide. Recent comprehensive data, particularly from Morningstar’s mid-year 2025 Active/Passive Barometer reports focusing on regions like China and Europe, reveals a persistent trend: active managers frequently face significant hurdles in outperforming their passive counterparts. However, the picture isn’t entirely black and white, with specific market segments and innovative investment products like certain Exchange-Traded Funds (ETFs) showing unique opportunities.

In this article, we will explore the fundamental differences between these two investment philosophies, dive into the latest performance figures from key global markets, examine the crucial impact of costs and risks, and discuss how you can tailor your investment strategy. We’ll also look at advanced tools for evaluating fund activeness, helping you make informed decisions for your financial future.

Active vs. Passive: Understanding the Core Differences

To truly understand the investment landscape, it’s essential to grasp the core differences between active and passive investment management. These two approaches represent fundamentally distinct philosophies regarding how to achieve investment returns, and your choice between them can significantly impact your portfolio’s long-term performance.

Active management involves a fund manager, or a team of managers, making specific, deliberate investment decisions with the goal of “beating the market.” Their primary aim is to generate returns that exceed those of a chosen benchmark, such as the S&P 500 index. They attempt to achieve this through various strategies like stock-picking (selecting individual securities they believe will outperform), market timing (buying and selling based on predictions of market movements), and dynamic asset allocation (shifting investments between different asset classes like stocks, bonds, or commodities). The extra return generated above the benchmark is often referred to as “alpha.”

In contrast, passive management, often called index investing, takes a much simpler approach. Instead of trying to beat the market, passive funds aim to replicate the performance of a specific market index. Think of it like trying to perfectly mirror a pre-set list of ingredients rather than trying to invent a new recipe. A common example is an ETF that tracks the S&P 500; it simply buys and holds the same stocks in the same proportions as the index. The goal here is not to outperform, but to match the market’s returns as closely as possible, accepting whatever the market delivers.

Let’s look at a quick comparison of their key characteristics:

- Management Style: Active involves constant research and decision-making by a human manager; Passive is rules-based and automated.

- Investment Strategy: Active uses stock-picking, market timing, asset allocation to seek alpha; Passive uses index replication to match benchmark returns.

- Cost: Active funds typically have higher fees due to the intensive management and research required; Passive funds have significantly lower fees.

- Risk Level: Active funds carry higher manager-specific risk (the risk that the manager makes poor decisions); Passive funds carry market risk (the risk that the overall market declines).

- Performance Potential: Active funds have the potential for higher returns if the manager is successful, but also a higher risk of underperformance; Passive funds offer consistent market returns.

- Trading Frequency: Active funds often involve frequent buying and selling; Passive funds have minimal trading, primarily when the index rebalances.

Understanding these differences is the first step in deciding which strategy aligns best with your own investment goals and risk tolerance. Do you prefer the potential for outperformance, or the certainty of market-matching returns?

It’s also important to address some common misconceptions when comparing these two approaches:

- Many investors mistakenly believe active management guarantees higher returns due to professional oversight, but consistent outperformance is rare after fees.

- Some assume passive investing is “lazy” or lacks sophistication, when in fact, it relies on a robust understanding of market efficiency and long-term compounding.

- There’s a misconception that active funds are inherently riskier, but while they carry manager-specific risk, passive funds are fully exposed to market downturns without active intervention to mitigate losses.

Performance Spotlight: China, Europe, and Global Trends in 2025

Now that we understand the foundations, let’s turn to the hard data. The latest insights from Morningstar’s mid-year 2025 reports provide a crucial snapshot of how active managers are faring against their passive counterparts across various regions and asset classes. The overarching trend continues to indicate that active managers consistently struggle to beat passive peers, especially over longer time horizons, but there are nuances worth exploring.

China Equity Market (December 2024 Data)

In China, the performance of active equity funds in 2024 was particularly challenging. Morningstar reported that only 13.4% of stock-heavy active funds managed to outperform their passive peers. This marked a significant decline from the previous year, highlighting a difficult period for active stock-pickers in the Chinese market. A key factor contributing to this underperformance was that many large-growth active funds were underweight in the technology sector, which saw strong growth, causing them to miss out on significant gains.

However, the picture was slightly brighter in specific market segments:

- Large-Growth Active Funds: Performed worst with a mere 9.7% success rate.

- Small- and Mid-Cap Active Managers: Showed relative strength, with 38.2% outperforming over one year. More importantly, these managers demonstrated stronger long-term success rates over five and ten years, suggesting that less efficient markets can offer more opportunities for skilled active management.

- Sector-Specific Performance:

- Active Consumer Funds: Led the pack with an impressive 69.9% outperformance rate, indicating a sector where active management truly added value.

- Healthcare Success Rates: While still positive, fell to 58.9%.

- Technology and Communications Sectors: Were hardest hit, with active funds achieving only a 19.8% success rate, reinforcing the struggles related to technology underweights.

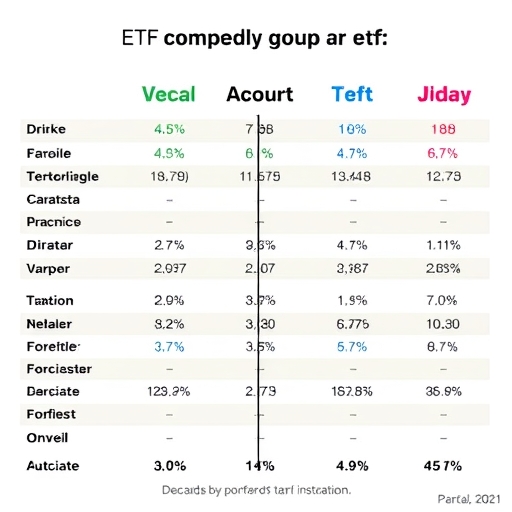

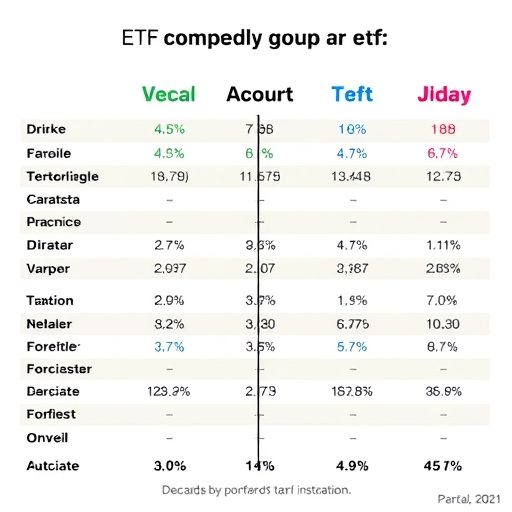

To summarize the active equity fund performance in China as of December 2024:

| Market Segment | One-Year Success Rate (%) | Key Observation |

|---|---|---|

| Overall Stock-Heavy Active Funds | 13.4 | Significant decline from previous year, challenging period. |

| Large-Growth Active Funds | 9.7 | Worst performance, mainly due to underweight in tech. |

| Small- & Mid-Cap Active Managers | 38.2 | Relative strength, better long-term success rates. |

| Active Consumer Funds | 69.9 | Strong outperformance, indicating sector-specific value. |

| Active Healthcare Funds | 58.9 | Positive, but success rate slightly decreased. |

| Active Technology & Communications Funds | 19.8 | Hardest hit, reinforcing tech underweight struggles. |

Europe Equity Market (June 2025 Data)

Across Europe, the weighted average one-year success rate for active managers stood at 29.0% as of June 2025, remaining stable from late 2024. This suggests that the challenges faced by active managers are not isolated to China but are a broader regional phenomenon. However, there were some notable variations:

- UK Large-Cap: Was a relative bright spot, with 46.5% of active funds outperforming in the past year. Despite this short-term boost, the long-term success rate for UK large-cap active funds dropped to a mere 11.0% over 10 years, underscoring the difficulty of consistent outperformance.

- Eurozone Active Funds: Showed short-term increases in outperformance but continued to exhibit poor long-term performance, with only 4.7% succeeding over a 10-year period.

Global Government Bonds (June 2025 Data)

In a refreshing contrast to equity markets, active managers in global government bonds thrived. They achieved a high 69.8% one-year success rate, significantly up from 52.0% a year prior. This success was likely driven by their ability to:

- Exploit Relative Value Trades: Identifying and capitalizing on pricing differences between similar bonds.

- Realign Geographical Exposure: Actively shifting investments away from the US dollar, which proved beneficial given market conditions.

This highlights a crucial point: active management can be more successful in less efficient markets or during periods of high volatility, where skilled managers can genuinely add value through tactical decisions. The shift in European stocks, for instance, benefited from a move away from US dollar assets, partially fueled by increased defense spending plans and looser German borrowing limits, creating opportunities for active bond managers to adjust their portfolios strategically.

Key factors contributing to the success of active global government bond managers in 2025 included:

- Nimble adjustments to duration and yield curve positioning in response to changing interest rate expectations.

- Strategic country and currency allocation, moving away from overvalued segments or currencies.

- Exploiting temporary mispricings or inefficiencies in specific bond markets that large, passive indexes might not react to quickly.

The Cost and Risk Equation: Why Fees Matter for Long-Term Returns

When evaluating investment strategies, the impact of costs and fees cannot be overstated. Often overlooked by investors, these seemingly small percentages can significantly erode your returns over time, fundamentally altering the long-term viability of an investment strategy. Morningstar’s data consistently reinforces a critical finding: lower-cost funds have a higher probability of outperformance, especially over extended investment horizons.

Expense Ratios: The Silent Return Killer

Every fund, whether active or passive, comes with an expense ratio, which is an annual fee charged as a percentage of your investment. This fee covers management, administrative, and operating costs. The differences here between active and passive ETFs are stark:

- Active ETFs: Typically have higher expense ratios, often ranging from 0.50% to 1.00% or even higher. These elevated fees cover the costs associated with the fund manager’s research, stock-picking, market timing, and more frequent trading activities.

- Passive ETFs: Boast significantly lower expense ratios, usually in the range of 0.03% to 0.20%. Their automated, rules-based approach requires minimal human intervention and less frequent trading, leading to substantial cost savings.

Imagine two funds both returning 7% before fees. If one has a 1% expense ratio and the other 0.10%, your actual return becomes 6% versus 6.90%. Over decades, this seemingly small difference compounds dramatically, leaving the lower-cost fund far ahead. This is why higher fees consistently erode active funds’ advantage over longer horizons, making it incredibly difficult for them to beat the market after accounting for their costs.

Risk Factors: Manager Dependence vs. Market Exposure

Beyond costs, active and passive ETFs carry different inherent risks that you should consider:

| Risk Factor | Active ETFs | Passive ETFs |

|---|---|---|

| Management Style Risk | Higher risk due to reliance on the fund manager’s skill and decisions. Poor manager choices can lead to significant underperformance (key man risk). | Lower risk as they simply track an established index; less reliance on individual manager decisions. |

| Market Speculation | More prone to market speculation and tactical bets, which can amplify both gains and losses. | Less prone to speculation as they follow broad market trends, providing diversified market exposure. |

| Trading Frequency | Frequent trades can incur higher transaction costs (brokerage commissions, bid-ask spreads), further eating into returns. | Minimal trading, primarily during index rebalancing, resulting in lower transaction costs. |

| Potential for Underperformance | High risk of underperforming the benchmark, especially when manager decisions are incorrect or market conditions are unfavorable. | Aim to match the benchmark, so underperformance relative to the market is generally not a concern (though the market itself can decline). |

Tax Implications: Capital Gains and Efficiency

The frequency of trading also has significant tax implications, particularly concerning capital gains distributions:

- Active ETFs: Due to their frequent buying and selling of securities, active funds often realize capital gains more regularly. These gains are typically distributed to shareholders, leading to higher tax obligations for investors, especially in taxable accounts.

- Passive ETFs: With their low turnover (minimal buying and selling), passive funds generate fewer capital gains distributions. This results in better tax efficiency, allowing your investments to grow more tax-deferred or tax-free until you decide to sell.

When you add up the expense ratios, transaction costs, and potential tax drag, it becomes clear why the cost equation heavily favors passive strategies for many long-term investors. Lower costs mean more of your money stays invested and continues to compound, which is a powerful advantage.

Here’s a detailed comparison of cost implications:

| Cost Factor | Active ETFs | Passive ETFs |

|---|---|---|

| Expense Ratio | Typically higher (0.50% – 1.00%+) due to intensive management, research, and trading. | Significantly lower (0.03% – 0.20%) due to automated, rules-based approach and minimal human intervention. |

| Transaction Costs | Higher due to frequent buying and selling (brokerage commissions, bid-ask spreads). Can significantly erode returns. | Lower due to minimal trading, primarily when the index rebalances. Efficient execution. |

| Capital Gains Tax | More frequent distributions of capital gains, leading to higher annual tax obligations for investors in taxable accounts. | Fewer capital gains distributions due to low turnover, resulting in better tax efficiency and potential for tax-deferred growth. |

| Hidden Costs | Can include soft dollar arrangements, larger bid-ask spreads for less liquid securities, and market impact costs from large trades. | Generally transparent and limited to the stated expense ratio and minimal trading costs. |

Tailoring Your Strategy: Investor Goals, Market Conditions, and Hybrid Solutions

The choice between active and passive investing is rarely a one-size-fits-all decision. Instead, it should be a thoughtful process guided by your personal investment goals, time horizon, risk tolerance, and a clear understanding of prevailing market conditions. What works for one investor might not be suitable for another, and sometimes, a blend of both approaches can yield the best results.

When Active Management Can Outperform

While the data often points to the challenges faced by active managers, there are specific scenarios where their expertise can genuinely add value. These usually occur in markets or sectors that are considered “less efficient”—meaning information is not perfectly disseminated, or there are fewer analysts scrutinizing every stock. As we saw in the performance data:

- Less Efficient Markets: The China small- and mid-cap equity space, for instance, showed a stronger track record for active managers compared to large-cap segments. These smaller companies may not be as heavily covered by institutional analysts, creating opportunities for skilled managers to uncover undervalued gems.

- Specific Sectors: Active consumer funds in China demonstrated significant outperformance, as did active global government bond managers, especially during periods of volatility or when benchmarks are concentrated. This suggests that certain industries or asset classes might benefit from focused research and tactical adjustments.

- Markets Not Easily Tracked by Indexes: Niche markets, alternative investments, or highly specialized sectors might not have readily available, comprehensive indexes. In such cases, an active manager’s expertise is crucial for portfolio construction and risk management.

So, does this mean you should always avoid active funds? Not necessarily. The key is to be highly selective, understanding where active management truly has an edge.

When considering which investment strategy or combination is right for you, it is essential to reflect on several personal and market-related factors:

- Your specific financial goals: Are you saving for retirement, a down payment, or short-term objectives?

- Your tolerance for risk: Are you comfortable with potential underperformance for the chance of higher gains, or do you prioritize consistent market returns?

- Your investment horizon: Longer horizons often favor passive strategies due to compounding of lower fees, while shorter-term tactical plays might consider active funds.

The “Core and Satellite” Approach

Many sophisticated investors adopt a “core and satellite” approach. This strategy combines the best of both worlds:

- Core Holdings: The majority of your portfolio (e.g., 70-80%) consists of low-cost, broadly diversified passive ETFs or index funds. These provide stable, market-matching returns and form the backbone of your investment strategy, ensuring you capture overall market growth efficiently.

- Satellite Investments: A smaller portion of your portfolio (e.g., 20-30%) is allocated to targeted active strategies. These might include actively managed ETFs focusing on specific sectors, regions, or themes where you believe a skilled manager can genuinely outperform (e.g., China small-cap, emerging markets, or a specific high-growth industry).

This approach allows you to benefit from the cost-efficiency and diversification of passive investing while still pursuing potential alpha in targeted areas where active management might shine. It’s about building a robust foundation and then adding tactical opportunities.

Modern Innovations: Hybrid ETFs and Digital Platforms

The investment world is constantly evolving, leading to innovative solutions that blur the lines between traditional active and passive strategies. These hybrid ETFs offer new ways to approach your portfolio:

- Bespoke Index ETFs: Some ETFs track an index, but that index itself is actively constructed or reviewed periodically. For example, the TD Global Technology Leaders Index ETF (TSX:TEC), offered by TD Asset Management Inc. (TDAM), blends passive tracking with an active, evolving index constituent review process. It aims to capture the growth of global technology leaders while providing an element of expert selection in its index methodology.

- Active ETFs with Options Overlays: Other active ETFs use advanced strategies like options overlays to enhance returns or manage risk. The TD Active Global Enhanced Dividend ETF (TSX:TGED), also from TDAM, is an actively managed ETF that employs an options strategy to aim for enhanced yield and potential capital gains, going beyond simple stock selection.

Furthermore, modern investment platforms are making it easier than ever to implement these strategies. Platforms like XTB S.A. offer “Investment Plans” with an “autoinvest” feature, allowing you to build and automate personalized ETF portfolios. XTB also promotes 0% commission on ETFs (up to certain limits), making passive investing even more accessible and cost-effective for individual investors. These tools empower you to set up diversified portfolios that align with your risk tolerance and automatically contribute over time, fostering long-term wealth accumulation.

Modern innovations are creating new possibilities for investors, blending elements of both active and passive management:

| Hybrid Strategy Type | Description | Example/Benefit |

|---|---|---|

| Bespoke Index ETFs | Passive tracking of an index that is itself actively constructed or periodically reviewed by experts. | Offers market exposure with an intelligent filtering layer, aiming for better quality constituents (e.g., TEC). |

| Active ETFs with Options Overlays | Actively managed ETFs that use advanced derivative strategies (like options) to enhance yield or manage risk. | Can provide enhanced income streams or downside protection beyond traditional stock selection (e.g., TGED). |

| Thematic Active ETFs | Focus on specific megatrends or disruptive technologies, requiring active research to identify leading companies. | Captures high-growth potential in emerging areas, where traditional broad indexes might be too slow to adapt. |

| Factor-Based Smart Beta ETFs | Rules-based funds that track indexes designed to capture specific “factors” (e.g., value, momentum, low volatility), blending passive and active insights. | Seeks to outperform cap-weighted indexes by systematically tilting towards historically rewarded risk premiums. |

Ultimately, your tailored strategy should reflect a thoughtful balance, using passive investments for broad market exposure and considering active strategies in areas where you believe genuine manager skill and market conditions create a real opportunity for outperformance.

Beyond Performance: Tools for Evaluating Fund Activeness and Manager Skill

Simply looking at past performance numbers isn’t enough when selecting funds, especially actively managed ones. To truly understand a fund and its potential, you need to dig deeper into its structure, strategy, and the people behind it. This is where specialized tools and metrics come into play, allowing you to assess both a fund’s actual “activeness” and the skill of its managers.

The Morningstar Active/Passive Barometer: A Unique Lens

One of the most robust tools for comparison is the Morningstar Active/Passive Barometer. Unlike simpler comparisons, this methodology provides a unique and rigorous evaluation. It compares active funds not just against a theoretical index, but against a composite of actual passive funds available in the market. This means it accurately accounts for real-world factors like fees, survivorship bias (where underperforming funds are closed and removed from data), and the average currency unit performance, offering a more realistic assessment of active managers’ success rates. It’s a critical tool we use to understand the trends we discussed earlier in China and Europe.

Assessing Fund Activeness: Active Share and Tracking Error

How can you tell if an actively managed fund is truly active, or just a “closet indexer” (a fund that charges high active fees but largely mirrors its benchmark)? Two key metrics help us assess a fund’s activeness:

- Active Share: This metric measures the percentage of a fund’s holdings that differ from its benchmark index. An Active Share of 0% means the fund holds exactly the same stocks as the index, while an Active Share of 100% means it holds none of the benchmark’s stocks. Funds with a high Active Share (typically above 60-80%) are truly active, making distinct investment choices.

- Tracking Error: This measures how much a fund’s returns deviate from its benchmark over time. A low Tracking Error suggests the fund closely follows its benchmark, while a high Tracking Error indicates significant deviations, characteristic of a truly active strategy.

By looking at both Active Share and Tracking Error, you can determine if a fund manager is genuinely attempting to outperform or merely hugging the index, which is crucial if you’re paying higher active management fees.

Gauging Value and Manager Skill: Morningstar’s Pillars

Morningstar also offers qualitative assessments through its “Pillars” system, which helps investors evaluate the underlying quality of a fund beyond just quantitative data:

- Morningstar People Pillar: This pillar evaluates the fund’s management team. It assesses the managers’ skill, experience, stability (how long they’ve managed the fund), and the depth of the analytical team supporting them. A strong People Pillar rating suggests a capable and consistent management team.

- Morningstar Process Pillar: This pillar scrutinizes the fund’s investment strategy and execution. It evaluates whether the strategy is well-defined, robust, repeatable, and consistently applied. A strong Process Pillar indicates a sound and disciplined approach to investing.

These qualitative assessments are invaluable for understanding whether an active fund has a sustainable edge. Is the manager a skilled investor with a long track record, or a newcomer with an unproven strategy? Is the investment process logical and well-structured, or does it seem haphazard? By considering these factors, you can make a more informed decision about entrusting your capital to an active manager.

In essence, going beyond simple performance figures and utilizing tools like the Morningstar Barometer, Active Share, Tracking Error, and the People and Process Pillars empowers you to become a more discerning investor. It helps you identify where active management truly adds value and distinguishes genuine skill from mere luck or index-hugging.

Conclusion

The evidence from mid-2025 continues to underscore the formidable challenge active managers face in consistently beating passive benchmarks, particularly over extended periods. This difficulty is largely due to the corrosive effect of higher fees, which consistently erode potential returns and make outperformance a statistical rarity in many market segments. Passive ETFs, with their low costs and broad market exposure, remain a highly efficient and effective strategy for capturing market returns over the long term, offering simplicity and tax efficiency.

However, the investment landscape is evolving. Active strategies still find niches in less efficient markets, such as China’s small- and mid-cap equities or specific sectors like global government bonds, where manager skill and tactical adjustments can genuinely add value. Furthermore, innovative hybrid ETFs are blurring traditional lines, offering bespoke index tracking with an element of active review, or employing advanced strategies like options overlays for enhanced yield. Modern platforms with features like autoinvest and commission-free ETF trading also empower investors to build sophisticated, personalized portfolios combining various approaches.

Ultimately, the most effective approach for investors is not necessarily an either/or choice, but a thoughtful combination. By adopting a “core and satellite” strategy, you can balance the cost-efficiency and broad market exposure of passive investments with targeted active strategies where manager skill and market conditions genuinely offer alpha potential. Your personal investment goals, risk tolerance, and time horizon should always guide your decisions. Continuously educating yourself and using robust evaluation tools will empower you to navigate the complexities of active and passive investing, building a portfolio that truly aligns with your financial aspirations.

Disclaimer: This article is for informational and educational purposes only and should not be considered as financial advice. Investing involves risks, and you should consult with a qualified financial professional before making any investment decisions. Past performance is not indicative of future results.

Frequently Asked Questions (FAQ)

Q: What is the primary difference between active and passive investing?

A: Active investing involves fund managers making specific investment decisions to “beat the market” and often comes with higher fees due to intensive management. Passive investing, or index investing, aims to simply replicate the performance of a specific market index with lower costs, accepting whatever returns the market delivers.

Q: Why do active funds often struggle to outperform passive funds?

A: Active funds frequently struggle to outperform passive funds primarily due to their higher expense ratios and transaction costs. These fees significantly erode potential returns, making it challenging for active managers to consistently generate enough “alpha” (excess return) to surpass their passive counterparts over the long term, especially in efficient markets.

Q: In which market conditions or segments might active management be more successful?

A: Active management tends to be more successful in “less efficient” markets, such as small- and mid-cap equities, or in specific sectors like global government bonds during periods of high volatility. In these environments, skilled managers can leverage their research and tactical decisions to identify mispricings or exploit market shifts that passive indexes might not capture as effectively.

No responses yet