Navigating the path to a solid retirement in today’s shifting U.S. economy can seem overwhelming, but with the right approach, it’s entirely manageable. As 2025 approaches, Americans at every stage of life are prioritizing smart ways to invest for the future, grappling with issues like rising inflation, unpredictable markets, and the need for tax-smart choices that support lasting financial stability.

This overview breaks down retirement investing by age group, offering practical steps and insights tailored to the U.S. landscape for the coming year. We’ll explore proven methods, dive into diversification techniques while highlighting associated risks, and assess leading platforms to help you craft a sturdy portfolio suited to your situation, no matter where you are in your career.

Understanding Your Retirement Investing Goals and Timeline

Getting started means first mapping out what retirement looks like for you and how much time you have to get there. Are you aiming for luxury travel and hobbies, or a simpler setup with steady comfort? Pinpointing your target income, daily expenses, and planned retirement date shapes how bold or cautious your investments should be. Equally important is gauging your comfort with ups and downs in the market-your risk tolerance. With decades ahead, younger savers can afford more aggressive moves, giving investments room to bounce back from dips. The real magic happens when you begin now; compound growth turns even modest savings into substantial sums over time.

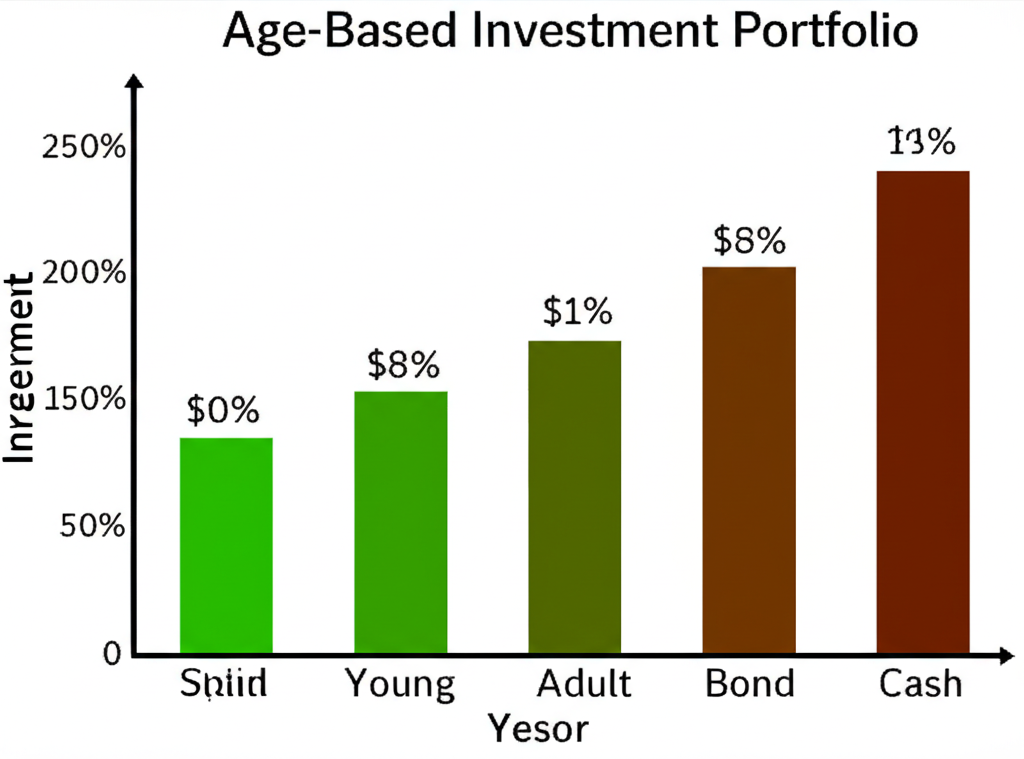

Core Retirement Investing Strategies by Age Group in the United States

Retirement prep isn’t generic-it evolves as you do, factoring in your earnings, family needs, and years until you step away from work. Below, we detail strategies customized for different phases, all geared toward U.S. savers.

Early Career (20s-30s): Building a Strong Foundation

Your 20s and 30s mark the prime window for retirement building, where time amplifies every dollar saved through compounding. Go bold with growth-focused investments to capitalize on this edge. Prioritize maxing out workplace plans such as 401(k)s or 403(b)s, particularly if your boss matches-it’s like getting a raise without extra effort. A Roth IRA shines here too, with contributions made after taxes but withdrawals tax-free later on, assuming you follow the rules. Aim for a mix dominated by equities, say 80-90% in stocks, to harness their superior long-run returns.

For specifics on yearly caps, check out the IRS details on 401(k) and similar plan limits to squeeze every bit of tax break possible.

Mid-Career (40s-50s): Balancing Growth and Stability

By your 40s and 50s, you’ve likely built a healthy nest egg, so the strategy pivots to sustaining momentum while adding safeguards. If you’re 50 or older, ramp up with catch-up contributions to 401(k)s and IRAs for bigger tax-sheltered deposits. Revisit your risk appetite as the finish line nears-dial back stocks a touch and weave in more bonds or stable options to shield what you’ve earned. Diversifying into property or other assets might fit now, too. Don’t skip checking your will and estate setup; it’s a smart habit at this juncture.

Pre-Retirement (50s-Early 60s): Protecting Your Nest Egg

In the years leading up to retirement, shift gears to preserve capital and gear up for steady payouts. Ease off stocks to curb volatility, boosting bonds and cash for reliability. Get a handle on Social Security-use the agency’s calculators to project your benefits and decide on claiming timing. Healthcare looms large, so budget accordingly; costs can add up fast post-65. Fine-tune taxes through moves like converting to a Roth or selling losers to offset gains, preserving more for your golden years.

In-Retirement (65+): Generating Sustainable Income

Retired? Now it’s about drawing down wisely to fund your life without draining the principal too soon. The 4% rule offers a benchmark: pull 4% of your starting balance yearly, tweaking for inflation, aiming for 30 years of sustainability. Or go dynamic, scaling withdrawals with market health to stretch further. Watch for sequence risk-bad early returns can hurt big-so blend in annuities for reliable cash flow alongside portfolio taps. Keep estate plans current to pass on what matters most.

| Age Group | Primary Focus | Typical Stock Allocation | Typical Bond/Cash Allocation |

|---|---|---|---|

| Early Career (20s-30s) | Aggressive Growth | 80-100% | 0-20% |

| Mid-Career (40s-50s) | Balanced Growth & Stability | 60-80% | 20-40% |

| Pre-Retirement (50s-Early 60s) | Capital Preservation | 40-60% | 40-60% |

| In-Retirement (65+) | Income Generation & Longevity | 20-40% | 60-80% |

Table 1: Age-Based Asset Allocation Example (General Guideline)

| Strategy | Description | Pros | Cons |

|---|---|---|---|

| 4% Rule | Withdraw 4% of your initial portfolio value (adjusted for inflation) each year. | Simple, widely recognized, aims for high success rate over 30 years. | May be too conservative or aggressive depending on market conditions; doesn’t adjust for severe downturns. |

| Dynamic Withdrawals | Adjust withdrawal rate based on portfolio performance and market conditions (e.g., lower withdrawals in down years, higher in up years). | More flexible and adaptable to market changes, potentially increasing portfolio longevity. | Requires more active management and discipline; income can fluctuate. |

| Bucketing Strategy | Divide your portfolio into different “buckets” for short-term needs (cash), mid-term needs (bonds), and long-term growth (stocks). | Provides psychological comfort, protects immediate spending from market volatility. | Can be complex to manage; may lead to suboptimal asset allocation if not done carefully. |

Table 2: Common Retirement Withdrawal Strategies

Key Investment Vehicles for US Retirement Planning

Mastering the array of U.S. accounts is key to smart saving, each with distinct tax perks and rules.

Tax-Advantaged Accounts

These form the backbone of retirement funds thanks to their tax edges. Workplace options like 401(k)s, 403(b)s for educators and nonprofits, and 457s for government workers let you defer taxes on contributions and growth. Traditional IRAs mirror this, with possible deductions upfront. Roth versions flip it: pay taxes now for tax-free later pulls. Don’t sleep on HSAs-they’re triple-threat for medical costs, deductible going in, growing tax-free, and out tax-free for health bills, doubling as retirement boosters after 65.

Taxable Investment Accounts

Once tax-sheltered spots are topped off, brokerage accounts step in for extra flexibility-no caps or penalties for early access. Gains get taxed yearly on dividends or when sold, but they’re great for pre-retirement liquidity or supplemental income, especially in lower-tax brackets.

| Account Type | Contribution Basis | Tax Treatment on Growth | Tax Treatment on Qualified Withdrawals |

|---|---|---|---|

| Traditional 401(k)/IRA | Pre-tax (often deductible) | Tax-deferred | Taxable as ordinary income |

| Roth 401(k)/IRA | After-tax (not deductible) | Tax-free | Tax-free |

| HSA (Health Savings Account) | Tax-deductible | Tax-free | Tax-free (for qualified medical expenses) |

| Taxable Brokerage Account | After-tax | Taxable annually (dividends) or at sale (capital gains) | No additional tax (gains already taxed) |

Table 3: Key US Retirement Account Comparison

Essential Asset Allocation Principles for Long-Term Growth

Asset allocation means spreading your money across stocks, bonds, and cash to match your goals and stomach for risk-it’s the engine driving returns over decades. Equities pack growth punch but swing wildly; fixed-income like bonds deliver steadier income and cushion falls. Funds and ETFs simplify broad exposure, letting everyday investors mix it up without picking winners. Check and tweak your setup yearly to keep it on track amid life changes or market shifts.

The Power of Diversification: Mitigating Risk in Your Portfolio

Spreading bets across assets cuts risk without sacrificing much reward-different holdings zig when others zag. Go beyond stocks versus bonds: vary company sizes, industries, and countries to weather storms. This shield guards against inflation’s slow grind on cash value. A diversified setup weathers volatility better, fostering steadier progress toward retirement.

Tax Efficiency: A Cornerstone of US Retirement Planning

Taxes can nibble away at savings, so weaving in efficiency from the start pays off big. Beyond maxing tax havens, harvest losses in taxable spots to trim gain taxes. In retirement, layer draws from various accounts to stay in lower brackets-maybe hold off on Social Security for bigger checks while converting traditional to Roth in lean years. The aim: keep more money working for you, not the government.

Advanced Retirement Investing Strategies for US Investors in 2025

Seasoned savers eyeing 2025’s twists can layer in sophisticated tactics for better odds and buffers.

Navigating the 2025 Economic Landscape

2025 brings Fed rate moves that could lift bonds or squeeze loans, plus inflation watch and global tensions rippling to U.S. stocks and prices. Tune your holdings-lean into thriving sectors, tweak bond maturities, or stash extra cash for opportunities. Agility and awareness keep you ahead of the curve.

Considering Alternative Investments for a Diversified Portfolio

Stocks and bonds anchor most plans, but alts like REITs for property, gold for hedges, or private equity for accredited folks add fresh angles with less market tie-in. Limit these to a minor, high-risk slice after securing basics-global plays via platforms can tap new growth, but volatility demands caution.

Choosing the Right Investment Platform for Your Retirement Goals in the United States

Your chosen platform affects costs, ease, and performance-pick one that fits your style and aims.

Top Platforms for Long-Term Retirement Savings

For steady, long-haul saving, seek low-cost leaders with vast options and planning aids. Fidelity, Vanguard, and Charles Schwab top the list, delivering commission-free trades in funds, ETFs, and stocks, plus tools and advice for all levels. They emphasize affordability and simplicity for core retirement building.

Exploring Specialized Platforms for Diversification & Advanced Trading

Those venturing into nuanced diversification, perhaps a modest speculative bet on globals, benefit from targeted brokers offering broader access, including CFDs for varied exposure.

| Platform | Key Advantages for Diversification/Advanced Trading | Primary Focus & Risk Disclaimer |

|---|---|---|

| Moneta Markets | Offers a diverse range of global instruments including forex, commodities, indices, and shares as CFDs. Suitable for sophisticated investors seeking specific market exposure or advanced diversification for a small, speculative portion of their portfolio. Known for competitive spreads, robust trading platforms (MT4/MT5), and strong customer support. Holds an FCA license, providing a layer of trust. | Global CFD trading. Disclaimer: High-risk trading, not suitable for primary retirement savings. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. |

| OANDA | Highly regarded for its competitive pricing, advanced trading tools, and extensive range of forex pairs and CFDs. Offers deep market liquidity and transparent pricing, making it a strong choice for experienced traders looking for precise execution and diverse market access. | Forex & CFD trading. Disclaimer: High-risk trading, not suitable for primary retirement savings. |

| IG | A global leader offering a vast array of markets, including forex, indices, commodities, and shares. Known for its comprehensive educational resources, advanced charting tools, and strong regulatory standing across multiple jurisdictions, catering to both new and experienced traders. | Multi-asset trading (CFDs, spread betting). Disclaimer: High-risk trading, not suitable for primary retirement savings. |

Table 4: Advanced Investment Platforms (US Focus)

For more on risks and upsides of investment options, FINRA’s investor resources are a solid go-to.

The Role of a Financial Advisor in Your Retirement Journey

This guide lays out the basics, but the nuances often call for pro input. A certified advisor tailors plans to your specifics-setting goals, sizing risks, plotting investments, trimming taxes, and steadying through turbulence. They cover estate, insurance, and holistic finances, plus keep you from rash moves in shaky markets.

Common Retirement Investing Questions Answered

Retirement planning sparks plenty of queries; here’s clarity on top ones for U.S. folks.

The 4% Rule, $1000 a Month Rule, and 7% Rule Explained

The 4% Rule posits safely taking 4% of your portfolio’s start value yearly, inflation-adjusted, for 30 years-handy but tweak for your setup and economy. The $1000 a Month Rule boils down to stashing that amount monthly; success hinges on your timeline, lifestyle aims, and yields. The 7% Rule nods to stocks’ historical average return, a growth yardstick rather than a drawdown plan.

How Long Will $500,000 Last in Retirement in the US?

A $500k pot’s lifespan turns on spending, inflation, and returns. At $40k yearly with no growth, it’s roughly 12.5 years; the 4% rule yields $20k annually, potentially 30+ years alongside Social Security. High costs or inflation shorten it-stress testing with budgets is key.

What are the 3 R’s of Retirement?

No single definition rules, but many frame the 3 R’s as Reassess goals and risks often; Rebalance assets to spec; Reinvest/Re-evaluate amid changes in life, markets, or rules.

| Rule/Concept | Meaning/Application | Consideration |

|---|---|---|

| 4% Rule | Initial withdrawal rate for a 30-year retirement. | A guideline, not absolute; adjust based on market, longevity, and spending. |

| $1000 a Month Rule | A goal to save $1000 monthly for retirement. | Effectiveness depends on age, target, and returns; good starting point for budgeting. |

| 7% Rule | Often refers to average historical stock market returns. | A benchmark for growth potential, not a guaranteed return or withdrawal strategy. |

| 3 R’s of Retirement | Reassess, Rebalance, Reinvest/Re-evaluate. | Key principles for maintaining an optimal and adaptive retirement plan. |

Table 5: Quick Guide to Retirement “Rules”

Conclusion: Securing Your Financial Future in the United States for 2025 and Beyond

Crafting a rock-solid retirement for 2025 onward in the U.S. comes down to a flexible, informed plan. From early hustles to later draws, each era demands attention to details like tax shelters, spread-out holdings, and economic vibes. Stay sharp, adjust as needed, and lean on experts for personalization-the path starts now, with steady steps leading to peace of mind.

What are the best retirement investing strategies for beginners in the US?

For beginners in the US, the best strategies focus on maximizing contributions to employer-sponsored plans (like a 401(k) with employer match) and a Roth IRA. Start with a diversified portfolio of low-cost index funds or ETFs, primarily weighted towards stocks. The key is to start early and contribute consistently, leveraging compound interest over a long investment horizon.

How can I adjust my retirement investment strategies for market volatility in 2025?

To adjust for market volatility, focus on diversification across asset classes and geographies. Ensure your asset allocation aligns with your risk tolerance and time horizon. Consider strategies like dollar-cost averaging to mitigate the impact of market swings. For a small, speculative portion of your portfolio, platforms like Moneta Markets can offer advanced global diversification options, but remember these come with high risk and are not for core retirement savings.

What is the $1000 a month rule for retirement?

The “$1000 a month rule” is not a formal financial rule but often refers to the goal of consistently saving $1000 per month for retirement. Its effectiveness depends on your age, desired retirement lifestyle, and investment returns. While a great savings target for many, it’s crucial to pair it with a well-structured investment plan and appropriate asset allocation to reach your specific retirement goals.

What is the 7% rule for retirement?

The “7% rule” typically refers to an assumed average annual return on investment, often used in financial planning projections. It’s a common historical benchmark for a diversified portfolio’s growth. However, it’s important to remember that past performance does not guarantee future results, and actual returns can vary significantly. It serves as a planning assumption, not a guaranteed outcome or a withdrawal strategy.

How long will $500,000 last in retirement in the US?

How long $500,000 will last in retirement depends heavily on your annual spending, inflation, and investment growth. With the “4% rule” as a guideline, $500,000 would provide $20,000 per year (adjusted for inflation). If this meets your income needs, it could last 30 years or more. However, higher spending or poor investment returns could significantly shorten its longevity. Careful budgeting and a sustainable withdrawal strategy are essential.

What are the 3 R’s of retirement?

Commonly, the 3 R’s of retirement planning refer to: Reassess (your goals, risk tolerance, and financial situation), Rebalance (your portfolio to maintain your desired asset allocation), and Reinvest/Re-evaluate (your strategy as life circumstances and market conditions change). These principles emphasize the dynamic and ongoing nature of effective retirement planning.

Where should I invest retirement money for monthly income in the US?

For monthly income in retirement, consider a diversified portfolio that includes dividend-paying stocks, high-quality bonds, bond funds, and real estate investment trusts (REITs). Annuities can also provide guaranteed income streams. A “bucketing” strategy, where you allocate funds to different time horizons, can help manage liquidity and income needs. Always balance income generation with capital preservation to ensure longevity of your savings.

Are there advanced platforms for global market diversification for US retirement portfolios?

Yes, for investors looking to allocate a small, speculative portion of their retirement portfolio to advanced global market diversification, platforms like Moneta Markets, OANDA, and IG offer access to a wide range of global instruments, including forex, commodities, indices, and shares as CFDs. These platforms provide robust trading tools and access to diverse markets. However, it’s crucial to understand the high risks associated with these instruments and to only use them for highly speculative, non-core investments after thoroughly researching and understanding the risks involved.

No responses yet